The Monetary Sentinel: The BoE’s loose hand

This week, the central bank landscape is leaning broadly toward easing, with rate cuts on the cards from both the Bank of England (BoE) and Banxico, while the Reserve Bank of India (RBI) faces a more finely balanced decision. What they all share, though, is a lingering sense of unease over the White House’s trade policy—a common thread keeping policymakers on edge.

Bank of England (BoE) – 4.25%

The BoE is widely expected to lower its benchmark interest rate by 25 basis points to 4.00% on August 7—a move that would bring borrowing costs to their lowest level in two and a half years. After standing out as one of the more cautious central banks when it came to loosening policy, the BoE now looks set to take a more dovish turn than both the Federal Reserve (Fed) and the European Central Bank (ECB) in the months ahead, according to money market pricing.

The bank’s shift comes as the UK economy loses momentum. After a solid start to the year, growth has started to slip, with GDP shrinking in both April and May—dragged down in part by a slowdown in manufacturing. A string of recent data has only added to the sense that the domestic outlook is weakening, fuelling expectations that the BoE may have to cut rates more quickly than previously thought.

Although inflation edged up to 3.6% in June—largely because of rising food and transport costs—falling mortgage rates and the prospect of further cuts are offering households a bit of breathing room. Still, there’s unease about inflation proving more persistent than hoped. BoE policymaker Catherine Mann noted in July that despite cooling wage growth, price dynamics remain a challenge and require vigilance from monetary policy.

With the labour market cooling and output slipping, the focus at this week’s meeting will not just be on the rate cut itself but on the tone of the guidance—particularly how far and how fast policymakers expect to ease from here.

Upcoming Decision: August 7

Consensus: 25 basis point cut

FX Outlook: The British Pound (GBP) seems to have met some contention in the area of four-month lows near 1.3140 vs. the US Dollar (USD), with GBP/USD managing to partially reverse its intense sell-off in place since July. While above its key 200-day SMA near 1.2979, Cable’s outlook is expected to maintain its constructive stance.

Reserve Bank of India (RBI) – 5.50%

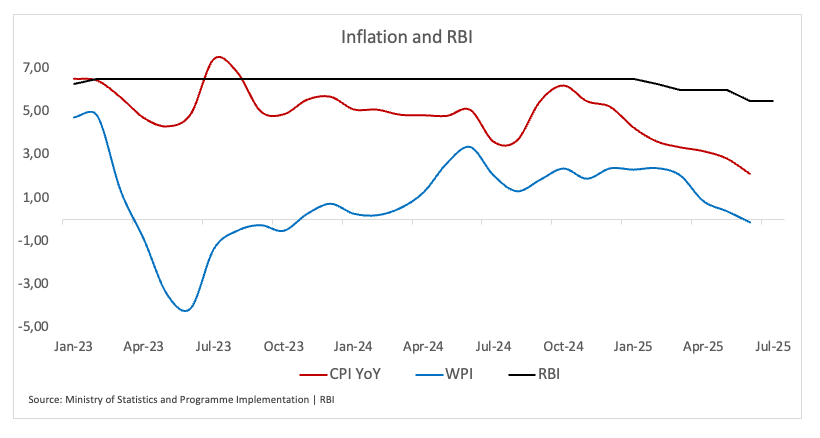

The RBI is widely expected to keep interest rates on hold at its upcoming policy meeting on August 7, following a surprise 50 basis point cut in June and a shift to a neutral policy stance.

Given the subdued inflation and relatively strong growth, the central bank seems hesitant to implement what the markets perceive as the final rate cut of this easing cycle.

Retail inflation fell to a six-year low in June, fuelling initial speculation that another cut could come as early as August. However, expectations have since cooled after RBI Governor Sanjay Malhotra signalled a more cautious tone, stating that the bar for further easing is now higher with a neutral stance.

Even though inflation continues to drift lower, the RBI might still revise its FY26 inflation forecast down—likely trimming it from the 3.7% they projected back in June—as price pressures on food and energy lose momentum. That said, the growth outlook is looking a bit murkier.

The Indian economy started off strong this year, growing at an annualised 7.4% in the first quarter. But more recent signs point to a loss of impulse, particularly as the fog surrounding the White House’s trade policy remains well in place. It is worth noting that new US tariffs will kick in on August 7.

Back to trade, it is worth noting that India has refused to bend on important areas, including agriculture, dairy, and genetically modified crops.

Upcoming Decision: August 6

Consensus: Hold

FX Outlook: The Indian Rupee (INR) has regained some momentum following last week’s multi-month lows vs. the Greenback, with USD/INR easing to the low 87.00s. The pair’s pullback, however, appears to have been exclusively motivated by renewed weakness around the US Dollar (USD), while the INR is expected to remain under scrutiny amid ongoing trade negotiations.

Banxico – 8.00%

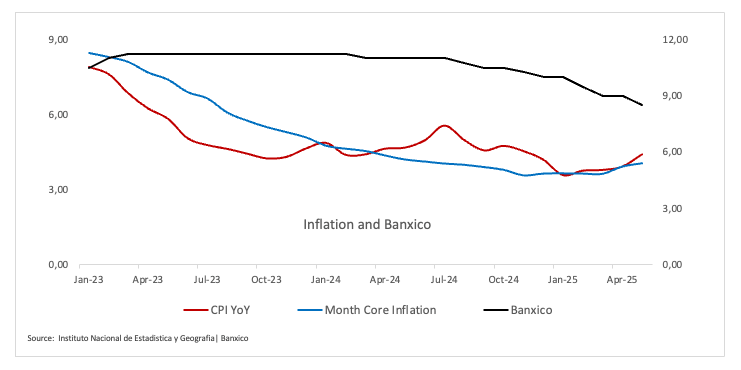

Mexico’s central bank is expected to take a more cautious approach at its August 7 meeting, following a 50-basis-point rate cut in June.

According to the latest Minutes, while inflation remains above the bank’s target, four of the five board members backed the June decision, arguing that the window for aggressive easing may be closing. Those same members signalled a preference for smaller, more measured adjustments going forward—suggesting that any future moves are likely to come in smaller increments.

The rate cut came against a backdrop of lingering trade uncertainty. Although President Trump announced a delay in planned tariffs on Mexico, the move appears more like a pause than a pivot. Talks between Washington and Mexico City are ongoing, and while Trump described his latest call with President Claudia Sheinbaum as "very successful".

Against this backdrop, Banxico finds itself balancing multiple pressures: still-elevated inflation, a slowing global economy, and trade tensions that could flare up again at any moment. All signs point to a more deliberate pace of easing from here—one that reflects both caution and an increasingly complex external landscape.

In its most recent quarterly report, Banxico largely maintained its inflation forecasts while sharply downgrading its growth outlook. The GDP is expected to grow by just 0.1% in 2025 and 0.9% in 2026. Core inflation is predicted to be 3.4% in Q4 2025 and 3.0% in Q4 2026, while headline inflation is expected to average 3.3% in Q4 2025 and ease to 3.0% in Q4 2026. Last but not least, by Q3 2026, headline inflation should converge to the 3% target, following the timeline of the earlier forecast.

Upcoming Decision: August 7

Consensus: 25 basis points rate cut

FX Outlook: The Mexican Peso (MXN) has appreciated to levels last seen around a year ago near 18.5000 vs. the US Dollar (USD) in late July. Since then, USD/MXN has managed to regain some pace on the back of renewed upside bias in the Greenback, always amid steady trade jitters, flirting with the 19.0000 barrier during last week. Looking at the broader picture, MXN’s price action is expected to closely follow trade developments, while the bearish bias in spot should prevail as long as it navigates below its 200-day SMA around 19.8500.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.