The Monetary Sentinel: Further easing by Banxico remains on the cards

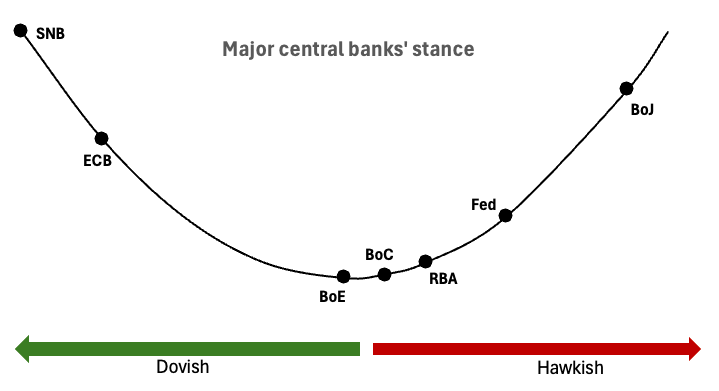

This week is expected to be relatively quiet, with few central bank decisions on the agenda. Amid ongoing uncertainty regarding trade dynamics and escalating concerns related to the Middle East crisis, central banks are anticipated to convey a prudent stance. Concurrently, they are likely to assess strategies aimed at bolstering their economies in the face of the current global trade volatility.

Banxico – 8.50%

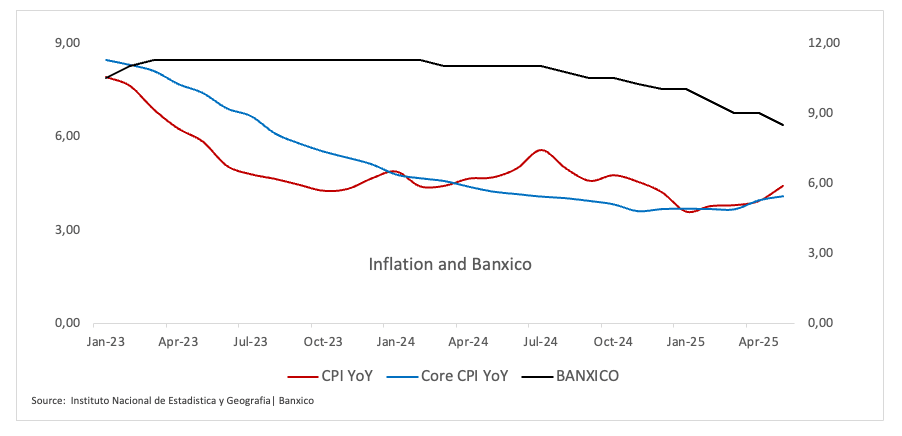

At its May 15 policy meeting, Banxico lowered its interest rate by half percentage point to 8.50% in a unanimous vote, at the same time leaving the door open to further rate cuts depending on the progress around inflation.

In its most recent quarterly report, Banxico largely maintained its inflation forecasts while sharply downgrading its growth outlook. The GDP is expected to grow by just 0.1% in 2025 and 0.9% in 2026. Core inflation is predicted to be 3.4% in Q4 2025 and 3.0% in Q4 2026, while headline inflation is expected to average 3.3% in Q4 2025 and ease to 3.0% in Q4 2026. Last but not least, by Q3 2026, headline inflation should converge to the 3% target, following the timeline of the earlier forecast.

In his latest comments, Deputy Governor Jonathan Heath said that he is in the minority on the central bank's five-member board and is against another 50 basis point rate cut until there is unmistakable proof of declining inflation. However, he anticipates that the bank will approve a fourth consecutive 50 basis point reduction this week. Heath emphasised the institution's difficulty in containing inflation while bolstering a weak economy and argued for a pause to evaluate incoming data.

Upcoming Decision: June 26

Consensus: 50 basis points rate cut

FX Outlook: After bottoming out in levels last seen in the last summer near 18.8000, USD/MXN has embarked on a marked rebound, reclaiming the 19.0000 barrier and beyond during last week. In the meantime, the bearish bias remains likely as long as the pair trades below its 200-day SMA just below the 20.0000 barrier. Looking at the broader picture, the Mexican Peso (MXN) is expected to stay sensitive to the ongoing back-and-forth over the US tariff narrative.

Bank of Thailand (BoT) – 1.75%

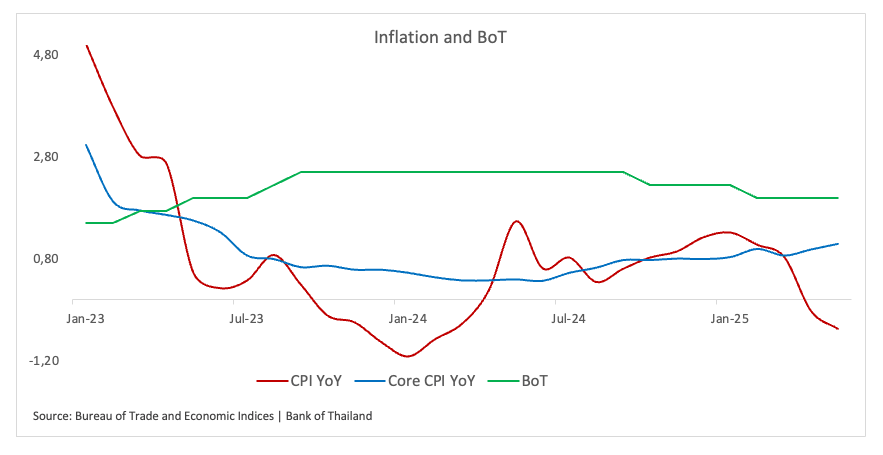

The Monetary Policy Committee of the BoT voted 5–2 on April 30 to lower the one-day repurchase rate by 25 basis points to 1.75%, the lowest level since April 2023. This move, which comes after a similar cut in February, shows that the bank is serious about helping an economy that is facing global challenges.

In its latest outlook, the BoT revised down its 2025 GDP projection to around 2.0%, reflecting heightened concerns over spillovers from the US–China trade war and the threat of steep US reciprocal tariffs. However, should US duties escalate to half the proposed 36% level, domestic economic growth could slow sharply to around 1.3% this year.

Thailand is among the Southeast Asian economies most exposed to US reciprocal tariffs. Without a negotiated reduction before the July moratorium expires, Thai exporters risk facing a 36% levy on key goods, an impact most likely to materialize in the second half of the current year.

Deputy Governor Paiboon “Piti” Kittisriprasert expects the cumulative 50 basis points of easing so far should help cushion the economy against tariff shocks, assuming a deal is struck before mid-summer.

Upcoming Decision: June 24

Consensus: Hold

FX Outlook: The Thai Baht (THB) has lost value in the last six days, moving USD/THB away from nine-month lows near 32.30 (June 13). The US Dollar (USD) has been becoming stronger slowly, which is mostly what has caused this bounce. However, the THB is still at risk of trade-related uncertainties in the future weeks. As long as the pair stays below its critical 200-day SMA of around 33.70, the bearish view should stay the same.

Hungarian Central Bank (MNB) – 6.50%

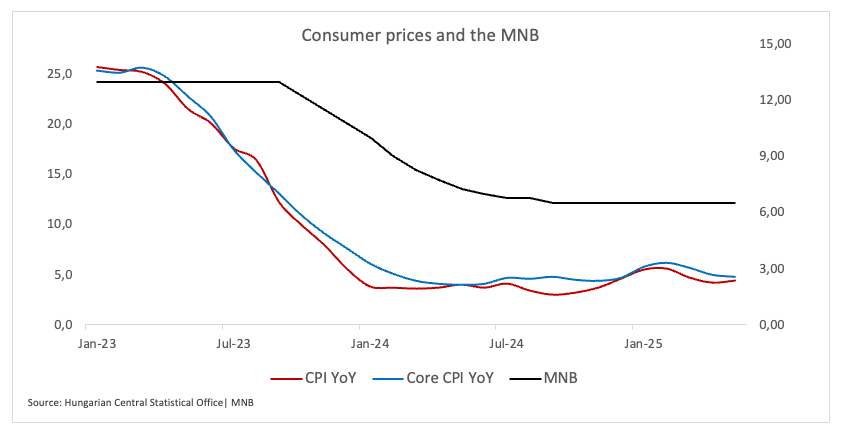

The central bank of Hungary is broadly anticipated to keep its interest rate at 6.50% at its monetary policy gathering on Tuesday.

Th expected decision on rates appears still justified by the sluggish economic growth, budgetary pressures, and steady uncertainty surrounding international trade tariffs.

Governor Mihály Varga stressed the need to keep the 3.0% inflation goal and keep inflation expectations in check.

Daniel Palotai, who is going to be the next deputy governor, has asked for a careful monetary policy even when the economy is underperforming. He enphasised that the multi-month pause in the monetary policy stance came in response to the dangers of tariffs and growing service expenses.

Back to inflation, May’s CPI ticked higher at 4.4% from a year earlier, showing that the bank needs a framework that is careful, prudent, and focused on stability. The MNB will also publish an update of its quarterly forecast.

Upcoming Decision: June 24

Consensus: Hold

FX Outlook: The Hungarian Forint (HUF) gave way part of its monthly gains vs. the European currency, prompting EUR/HUF to rebound from multi-week troughs near 398.60 to levels well past the 403.00 barrier. So far, the cross navigates below its key 200-day SMA near 404.20, which should be indicative that extra weakness remains well on the cards in the short-term horizon.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.