The Monetary Sentinel: Bank Indonesia seen resuming its easing stance

A light calendar in the central bank’s universe will only feature the decision of the Bank Indonesia (BI), which is seen reducing its benchmark rate after the steady hand observed in the last couple of gatherings.

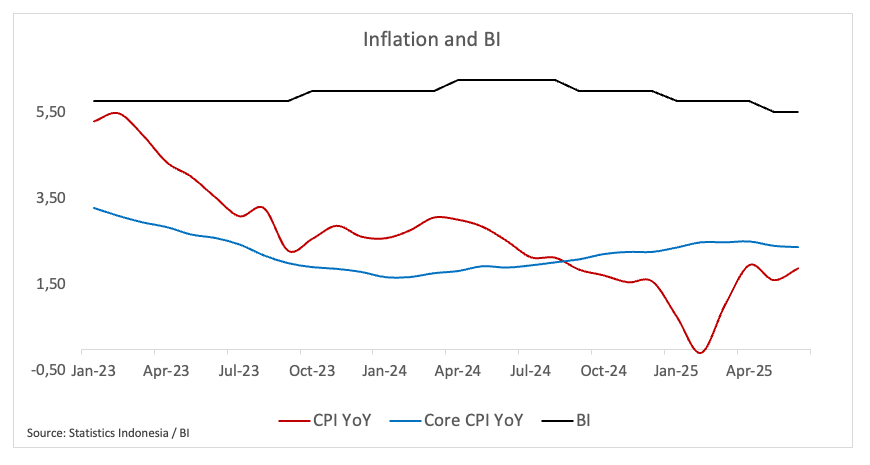

Bank Indonesia (BI) – 5.50%

At its policy meeting on July 16, Bank Indonesia is largely anticipated to lower its benchmark interest rate by 25 basis points to 5.25%. The decision would be justified by unabated uncertainty surrounding US tariffs as well as geopolitical effervescence.

If the move happens, it would come after a two-month pause and show the central bank’s willingness to resume its easing cycle started earlier in the year.

Even though the economic growth rate in the first quarter decreased to 4.87% YoY, the worst since late 2021, the BI kept its full-year growth forecast for 2025 at 4.6% to 5.4%, expecting the economic activity to pick up pace in the latter part of the year.

Back to inflation, consumer prices rose from 1.03% in March to a little under 2.0% in April, although they have since dropped a little, giving BI more flexibility to support growth.

Since early May, the rupiah (IDR) has remained below 16,600 per US dollar in the FX market, indicating that capital flight concerns have eased. This situation has allowed Governor Perry Warjiyo to concentrate on domestic issues without jeopardising the currency.

Overall, market participants will be paying close attention to BI's forward guidance to see how quickly cuts may come in the future. Now that the pressures on the currency rate are under control, the bank is poised to continue cautiously with its easing cycle to let the economy pick up speed.

Upcoming Decision: July 16

Consensus: 25 basis point cut

FX Outlook: Since the start of the month, the Indonesian Rupiah (IDR) has been stuck in a range against the Greenback. The USD/IDR has been around the 16,200 mark, which is where its important 200-day SMA is. In the meanwhile, investors expect that IDR will continue to be watched closely because of the growing unpredictability in global trade developments.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.