The Malaysian Ringgit and Thai Baht face persistent depreciatory pressures

The USD/MYR pair is trading above 4.80, marking a 4.5% decline year-to-date for the Malaysian ringgit against the US dollar.

Bank Negara Malaysia (BNM) appears relatively unconcerned about this weakness, potentially signalling a continuation of the downward trend for the ringgit. BNM has attributed the ringgit's decline to the strengthening of the US dollar and uncertainties in China's economy rather than domestic indicators.

However, the ongoing reduction in Malaysia's trade surplus adds to the MYR's challenges, given persistent external pressures and fragile demand from China.

While the weak ringgit benefits exporters in Malaysia's trade-dependent economy, stubbornly high global inflation has dampened product demand, suggesting a between a rock and a hard place dynamic for the currency.

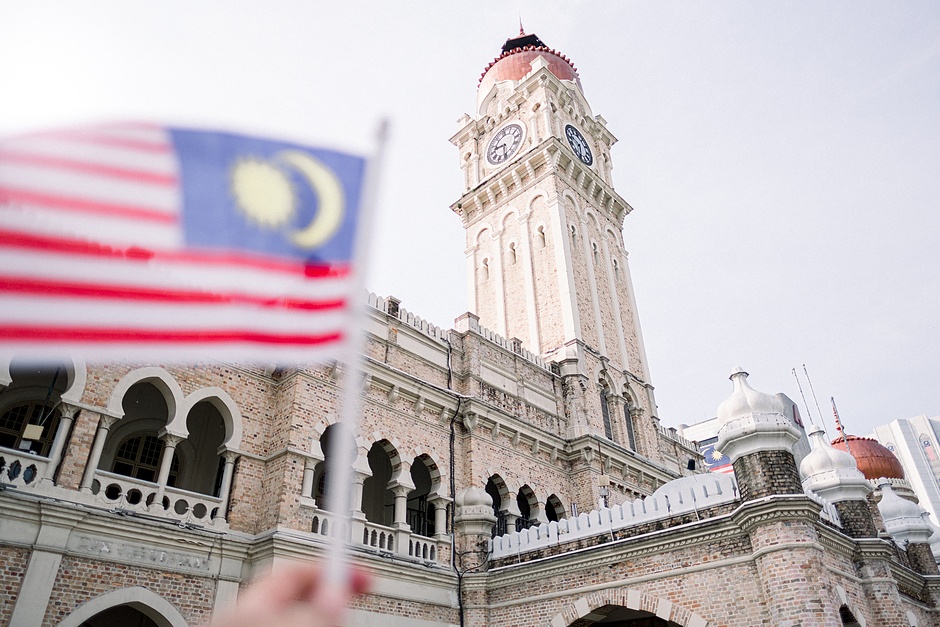

However, the weaker MYR could ostensibly benefit the travel industry in Malaysia in the short term. Hence, we continue to think 4.80 is an overshoot, especially with expectations of a rate cut by the Federal Reserve in the year's second half.

Meanwhile, the USD/THB pair has surged above the 36-handle, indicating a 5.5% decline year-to-date for the Thai baht against the US dollar.

Thai Prime Minister Srettha has pressured the Bank of Thailand (BoT) to reduce policy rates following disappointing Q4 GDP figures, which showed a 0.6% quarter-on-quarter decline (1.7% year-on-year).

PM Srettha has called for an off-cycle policy meeting to implement an emergency rate cut despite the next official BoT policy meeting scheduled for April 10. The discussion of rate cuts has intensified following the release of the GDP figures, so traders have been buying USD/THB recently.

Author

Stephen Innes

SPI Asset Management

With more than 25 years of experience, Stephen has a deep-seated knowledge of G10 and Asian currency markets as well as precious metal and oil markets.