The long wait for relevant US data

The US government shutdown proved a nightmare across the FX board, firstly by the lack of major releases and secondly, by the lack of volatility that brought about by the lack of releases. USD gradually ground higher but based off little other than a cautious sense of “wait and see”. None of this was very exciting, until the shutdown officially ended last week and US data could flow again on the 13th of this month.

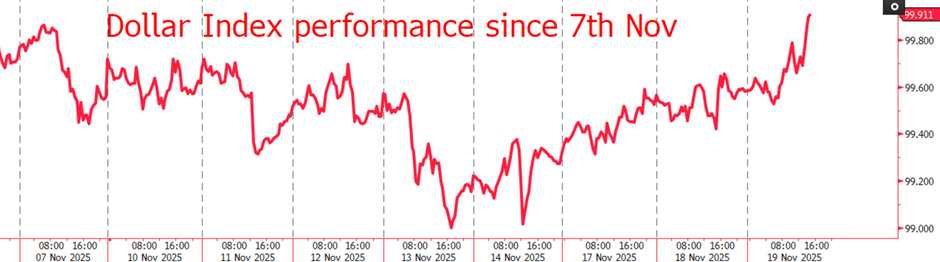

Since then however, the Dollar has followed a steady path upwards, despite inherent concern over how the backlogged data will hold up. Traders may even look through the September data, given that the figures are two months stale and simply wait for the November number.

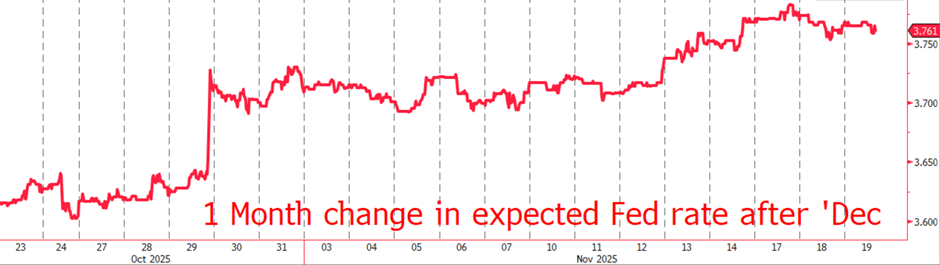

The interesting suggestion is that traders were more confident of a cut when data wasn’t releasing, even though the Fed doesn’t have a history of cutting during Government shutdowns, owing to the uncertainty over data. But since the reopening, the Dollar has clawed back its losses as traders dialed back their expectations of a cut, from 58% sure last Wednesday, to 47% this Wednesday.

What has caused this? Powell did give a tough speech following the October 29th meeting, assuring that “nothing is guaranteed”, but the mood of the market cannot have changed so deeply with such a dearth of data. US inflation does continue to rise, but with 2 Non-Farm payroll figures to read before the December 10th decision, I would have expected traders to feel slightly more certain of a cut to come.

The reaction to tomorrow's data will be fascinating to watch, whether traders do react at all to data two months stale, or simply continue their present cautious waiting for the November employment data.

Tomorrow’s reaction will, if nothing else, provide an interesting litmus test as to how traders are really feeling regarding the Dollar going into the end of the year.

Author

David Stritch

Caxton

Working as an FX Analyst at London-based payments provider Caxton since 2022, David has deftly guided clients through the immediate post-Liz Truss volatility, the 2020 and 2024 US elections and innumerable other crises and events.