The latest ECB meeting creates a problem for the SNB

At the last ECB (European Central Bank) meeting last week the ECB revised their growth projections higher this week for 2020 to -8.0% and inflation expectations for 2021 were revised upwards to 1.0%. The EUR received a lift. Although going into the last ECB meeting last week ECB’s Lane had expressed concerns about a strong euro President Lagarde also seems relatively unfazed by the recent euro strength. However, a strong euro does hurt the European export market and the ECB will not want to see it strengthen.

The SNB (Swiss National Bank), on the other hand, does want a strong euro. Or at least it is part of their mandate to buy euros to try and alleviate some of the pressure on the Swiss franc (CHF). A strong CHF hurts the Swiss export economy, so they too want (and do intervene) to weaken the CHF. The SNB does this by buying euros. You can see that on their latest sigh deposit report this week where they reached high levels for the year. The total sight deposits were CHF 704.1 billion. Take a look at the chart below to see the sight deposit levels:

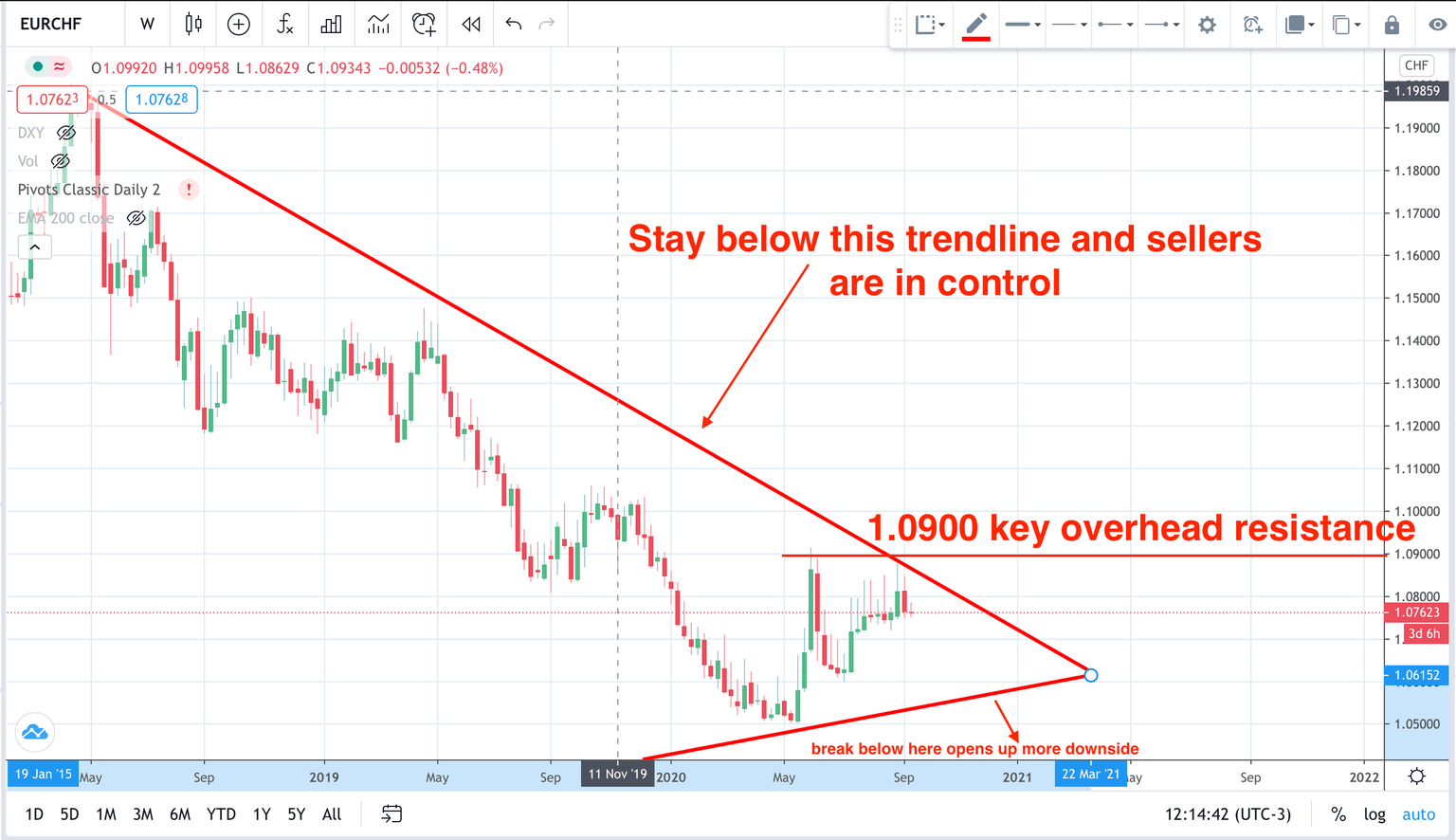

So this now creates a tension in the EURCHF currency pair where we could have two central banks actively fighting each other. This can create opportunities for nimble investors if either the SNB or the ECB steps up the battle to protect their currency and their export markets. Here is a look at the EURCHF pair with some of the key levels to watch out for. If the ECB starts to talk down the euro watch out for retaliatory verbal interventions on the EURCHF pair.

Author

Giles Coghlan LLB, Lth, MA

Financial Source

Giles is the chief market analyst for Financial Source. His goal is to help you find simple, high-conviction fundamental trade opportunities. He has regular media presentations being featured in National and International Press.