The ES is settling between 2650 and 2425

In early 2020 the market was in complete denial of peripheral risks to the economy. That all changed in February as the exuberance shifted to panic. Now, it feels like we are moving into the acceptance stage.

The markets have accepted the new reality and we appear to be seeing volatility normalize. Although still elevated, the VIX has fallen below 50.00 and price discovery is becoming less hectic. Last year we would have considered a 225 point trading range in the S&P highly volatile but in a coronavirus world it is a welcomed change of pace.

Crude oil jumped over 25% today on hopes of OPEC production cuts to the tune of 10 million barrels per day. If this cut materializes, this is a potential game-changer for financial market stability (support stocks and put pressure on Treasuries). IF (this is a big if) OPEC complies with the cuts and oil starts to move higher, it takes away some of the crippling effects of potential default risk in the junk bond market.

Treasury Futures Markets

30-year Treasury Bond Futures

Portfolio allocations have probably run their course

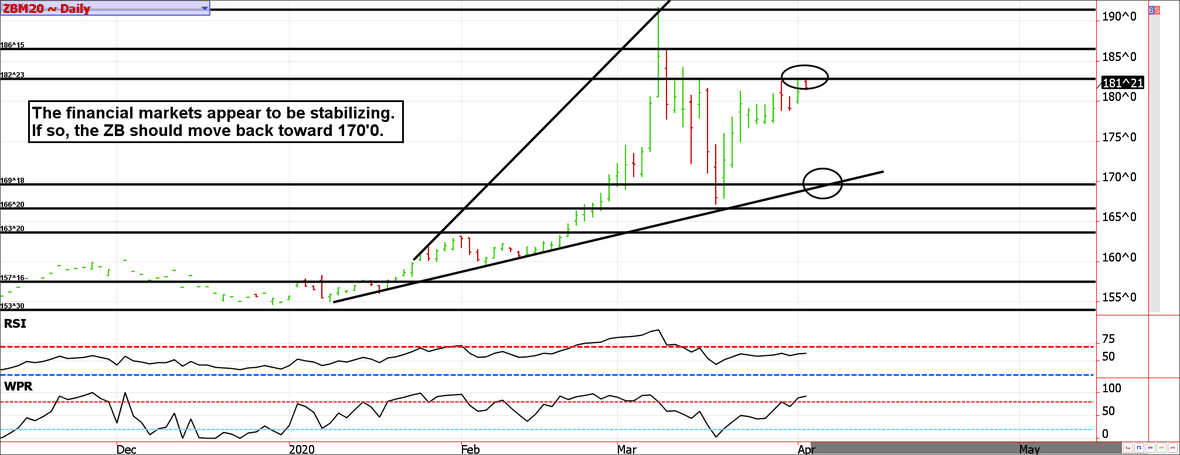

Mom and pop investors have likely completed the transfer of funds between risk assets (stocks) to risk-off assets (Treasuries). If this is the case, the buying will likely dry up in Treasuries. Without fear pushing money into low-yielding safety assets, there is little reason to be putting money to work there. The odds are, the 183'0 area in the ZB will hold and prices should see 170' again in the coming weeks.

Treasury futures market consensus:

The bond market rally has probably run its course. We are looking for the 30-year bond to make its way back to 170ish.

Technical Support: ZB: 178'13, 169'18, 166'20, 163'20, 157'16, and 153'30 ZN: 137'10, 134'03, 132'23, 130'29, and 128'0

Technical Resistance: ZB: 182'23, 186'15, 191'11 ZN: 139'27, and 140'23.

Stock Index Futures

If 2425ish can hold, the bulls have an edge in the ES.

There are plenty of reasons to be bearish in the stock market. Everywhere we look we are reminded of the demand destruction of goods and services and overall lack of confidence permeating through the economy.

The question remains, was mid-March selling enough or is there more to come? We can't see into the future, but we have noticed the consensus opinion is for a retest of the lows before the market turns around. When everyone is looking for the same thing, the market generally does the opposite. Thus, either we've seen the lows and the ES makes a miraculous recovery or if it does suffer another leg of liquidation dramatically new lows will be made. From a technical standpoint, a break of 2425/2400 support would leave us open to the latter but until then we'll be looking for a test of 2700 resistance. A break above that level could see impressive follow through.

It is difficult to imagine now, but the year is young. Even if the lows haven't been seen yet, Washington is throwing enough money at the markets that 3400 to 3500 by December 31st isn't out of the question. If we've managed to flatten the Covid-19 curve and resume a somewhat normal existence in May, the pent up demand and excess cash will likely buoy asset prices.

Stock index futures market consensus:

As long as 2425/2400 holds, the bulls have an edge but a break below could see 2100 to 2000. A break above 2700 would likely see a large short squeeze.

Technical Support: 2425/2400, 2370, 2250, 2100, 2000 and 1800

Technical Resistance:2661, 2700, 2764, 2897, and 3130

E-mini S&P Futures Day Trading Ideas

These are counter-trend entry ideas, the more distant the level the more reliable but the less likely to get filled

ES Day Trade Sell Levels: 2506, 2650, 2697

ES Day Trade Buy Levels: 2460(minor),2426, 2367, 2254, 2165, 2100, 2000, and 1800

In other commodity futures and options markets...

January 3 - Go long mini natural gas futures near $2.10.

January 16 - Go long May corn, hedge the position by purchasing a May 3.70 puy and paying for it with the sale of a May 4.10 call.

February 25 - Sell June ZN 134 call and buy the April 136 call as insurance.

February 27 - Offset short corn 4.00 call and long 3.70 put to lock in moderate gain on those legs. Buy the April 3.60 put to keep a floor under risk.

March 2 - Roll BCI into June.

March 4 - Go short the September eurodollar near 99.37 and buy the 99.50 call option. Total risk is roughly $600 depending on fills (prior to transaction costs).

March 25 - Roll April corn 3.60 put into a May 3.30 put.

March 25 - Roll April 10-year note 136 call into a May 137.50 call.

March 26 - Roll mini natural gas from April to May.

March 27 - Roll long April 136 call into May 137.50 call in the 10-year note.

Due to time constraints and our fiduciary duty to put clients first, the charts provided in this newsletter may not reflect the current session data.

Seasonality is already factored into current prices, any references to such does not indicate future market action.

There is substantial risk of loss in trading futures and options

** These recommendations are a solicitation for entering into derivatives transactions. All known news and events have already been factored into the price of the underlying derivatives discussed. From time to time persons affiliated with Zaner, or its associated companies, may have positions in recommended and other derivatives. Past performance is not indicative of future results. The information and data in this report were obtained from sources considered reliable. Their accuracy or completeness is not guaranteed. Any decision to purchase or sell as a result of the opinions expressed in this report will be the full responsibility of the person authorizing such transaction. Seasonal tendencies are a composite of some of the more consistent commodity futures seasonals that have occurred over the past 15 or more years. There are usually underlying, fundamental circumstances that occur annually that tend to cause the futures markets to react in similar directional manner during a certain calendar year. While seasonal trends may potentially impact supply and demand in certain commodities, seasonal aspects of supply and demand have been factored into futures & options market pricing. Even if a seasonal tendency occurs in the future, it may not result in a profitable transaction as fees and the timing of the entry and liquidation may impact on the results. No representation is being made that any account has in the past, or will in the future, achieve profits using these recommendations. No representation is being made that price patterns will recur in the future.

Author

Carley Garner

DeCarley Trading

Carley Garner is an experienced commodity broker with DeCarley Trading, a division of Zaner, in Las Vegas, Nevada. She is also the author of multiple books including, “Higher Probability Commodity Trading” and “A Trader's First Book on Commodities”.