The economy explained

S2N spotlight

I often like to take an idea and explore it through all its rabbit holes back to its first principles. Stay with me; you might find this enlightening. We are about to enter the weekend; it is summer in the northern hemisphere, so let us picture a warm tropical island somewhere in paradise.

Imagine a hundred shipwrecked souls starting life from scratch on a remote island. Their first mission is simple: survive. They gather native fruits and berries but soon realise they need protein. So they sharpen sticks into spears and carve makeshift fishing poles. Every able-bodied islander spends nearly every waking hour catching enough fish to keep everyone alive. It’s exhausting, but it works.

One day, a curious mind on the island imagines a better way: a fishing net. Building it isn’t free—the innovator and a handful of helpers have to forgo fishing for a few days, enduring rumbling stomachs while they weave their invention. But their gamble pays off. With the new net, they haul in 100 fish in one swoop—far more than any individual could catch with a pole.

Now the innovator sits on a mountain of fresh fish and, with so much free time, starts to notice how unpleasant it is to sleep on sand, covered in mosquito bites. He strikes a deal: he trades fish to other islanders in exchange for a fine hut, complete with a spa.

I think I am enjoying writing this island paradise story too much. I was about to write about his love interest, the fit blonde with blue eyes. Michael, focus and get to the point.

At this point, we see the birth of an economy: productivity frees up time, trade allows specialisation, and surplus fish become the island’s first currency. Prosperity follows—more huts, sturdier boats, even simple pleasures like music and storytelling.

So when does this utopian island economy stop growing? It stops when people have enough fish, enough huts, enough boats—when there are no new wants or new people to serve, or when resources run out. In theory, if everyone is content and nature’s bounty is stable, the economy plateaus.

But here’s the catch: humans are rarely content. Islanders want bigger huts, fancier spas, and boats that reach distant reefs. There aren’t enough trees, fish, or working hands to satisfy all these dreams today. Enter a clever islander who becomes the local banker. “Relax,” he says. “Build now, pay later. Promise to repay with the fish you’ll surely catch tomorrow.” And just like that, debt is born: a way to borrow from the future to satisfy today’s wants.

For a while, this works beautifully. The economy hums along on borrowed time. But eventually, the fishing teams notice their nets bring in fewer fish—they’ve overfished the local waters. Now, all the promises of future repayment look shaky.

Sound familiar? This is exactly the stress point of our modern debt-fuelled world.

But our island has one more twist. One restless visionary takes his boat far offshore, exploring distant waters, and while the others sleep, he invents a massive trawling net, powered by a clever sail design—catching a thousand times more fish with only a handful of helpers. Let’s call this our stand-in for artificial intelligence: a leap in productivity that replaces most fishermen overnight.

Suddenly, fish are abundant—but the power to catch them is concentrated in the innovator’s hands. As long as he shares, everyone eats. But if he hoards his surplus, he shifts from benefactor to dictator. Utopia flips to dystopia.

This is the paradox we now face: AI promises superhuman productivity but risks concentrating wealth and hollowing out jobs.

While I am not writing off the economy or society, I am suggesting that markets have not yet fully embraced the coming losses and the profound reshaping that lies ahead. I remain hopeful that we will find our way. Humankind has an incredible will to survive—we will innovate and adapt, though the journey will at times be painful. It may even require society to reshape its wants, which could ultimately make us more fulfilled.

My goal is to help provide some visibility into this new fishing boat’s course and to do my part to avoid a shipwreck.

S2N observations

The US National Debt crossed $37 trillion about an hour ago.

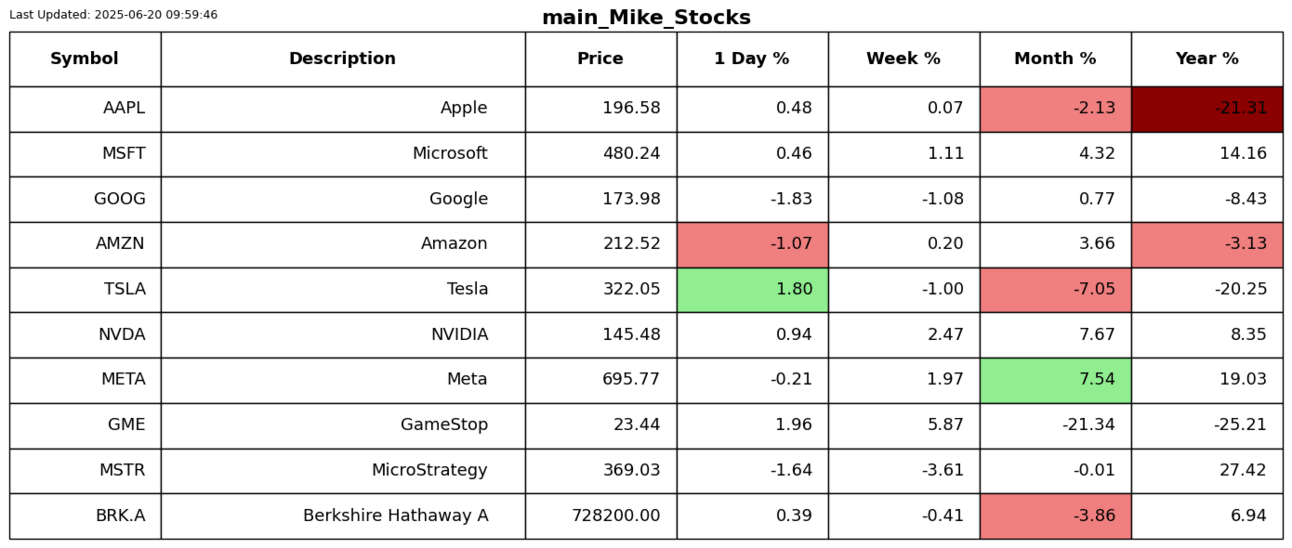

I notice that the Russell 1000 equal-weighted index is trading at the same level it was in October 2021. Just helps you see the point I was making earlier in the AI island economy that a few innovators are dominating. There are not nearly as many eaters of the pie as one might think.

S2N screener alert

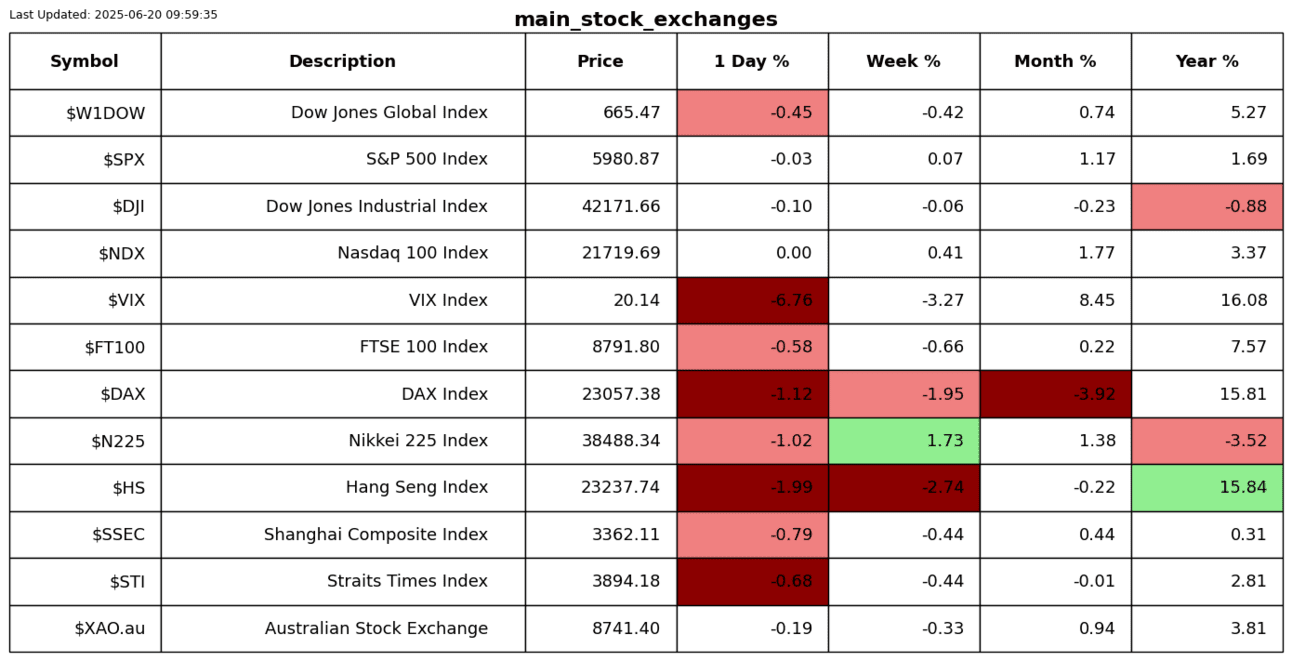

Quite extraordinary. The Tel Aviv Stock Exchange just wrapped up its strongest week since May 2020, according to data from its research unit.

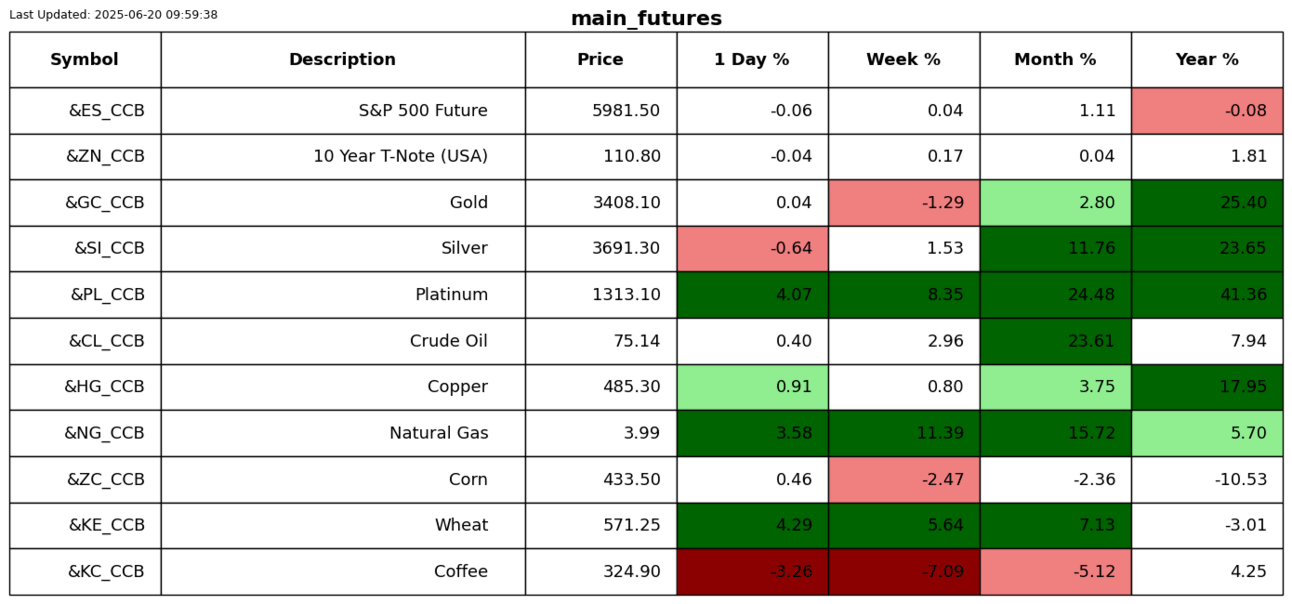

Platinum is up 24% for the month and had another big day with a z-score over 3.

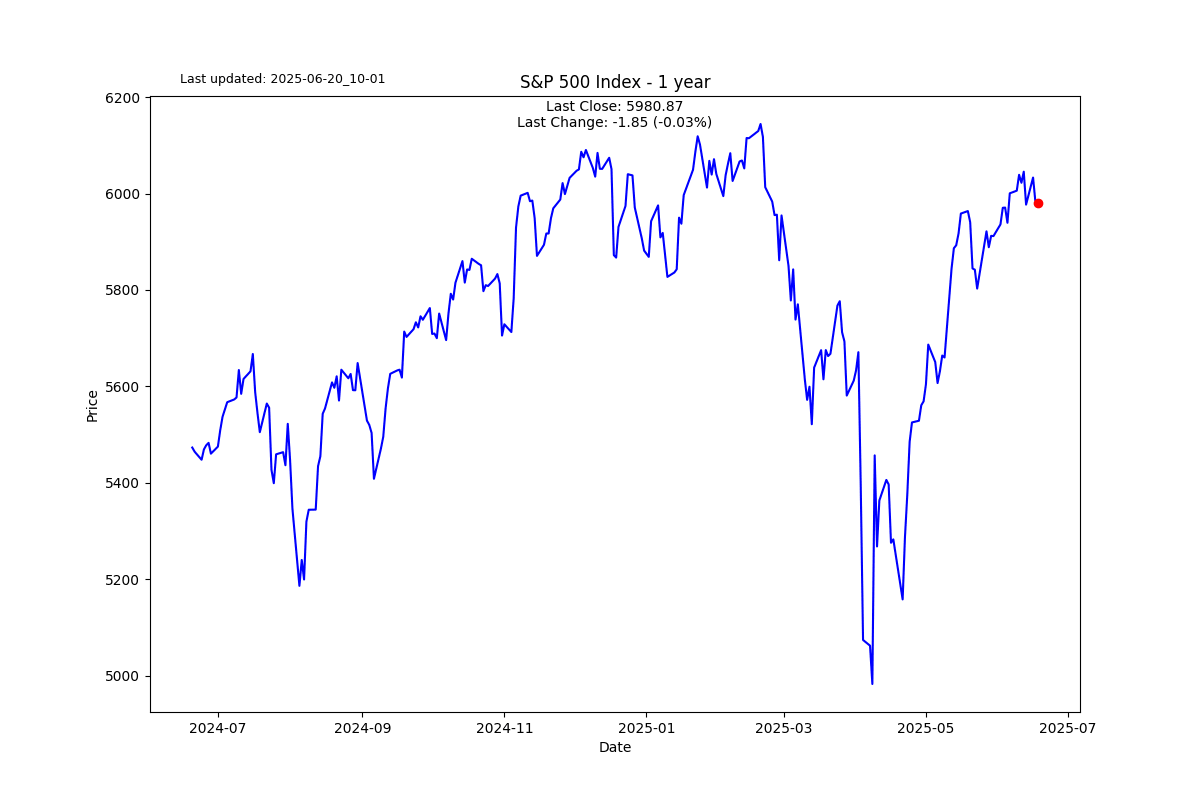

S2N performance review

S2N chart gallery

S2N news today

Author

Michael Berman, PhD

Signal2Noise (S2N) News

Michael has decades of experience as a professional trader, hedge fund manager and incubator of emerging traders.

-638859870916514077.png&w=1536&q=95)

-638859871158480602.jpg&w=1536&q=95)

-638859871313304099.png&w=1536&q=95)

-638859873489147368.jpg&w=1536&q=95)