If equities and gold are showing risk aversion, can the dollar not be a beneficiary, too?

Outlook:

Today we get labor productivity and unit labor costs, interesting numbers because the laggardly wage gains are purportedly predicated on lousy productivity. We shall see. We say productivity numbers are fishy.

Then the Fed meets tomorrow, with no change expected but maybe an interesting comment or two. Down in the weeds is a concern for inflation, which is somewhat mysterious because the latest data (Oct) shows headline inflation at 1.8% and core at 2.3%. Again, not the PCE version the Fed looks at but never mind—nobody except a few tinfoil-hat types are predicting runaway inflation. Former Fed chief Volcker, who just died at 92, would presumably be proud. His last book, out earlier this year, stresses the need for far better training of all government administrators and civil servants. It’s hard to know if Volcker was echoing Plato or making a backhanded comment on the many, many unqualified Trumpians, including Trump.

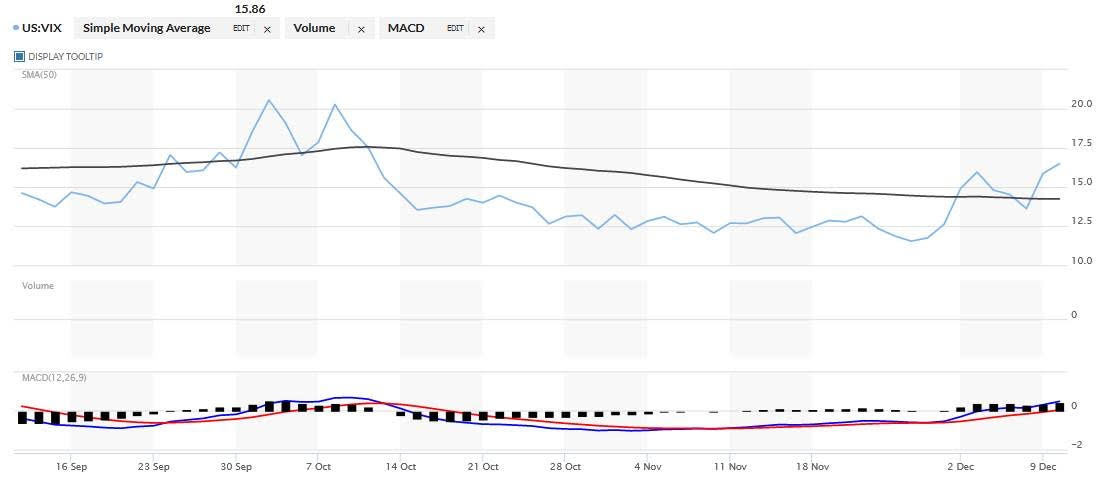

The FX market is watching the equity markets out of the corner of its eye. Yesterday VIX jumped 16%, presumably on fear of the Dec 15 China trade deal deadline. After a rout in all the major indices yesterday, US equity index futures point to a worse day today. Gold, meanwhile, is headed for its best year since 2010, and if it’s not on inflation expectations, it must be some other safe-haven idea.

The dollar is in retreat today on what is perhaps a normal pullback Tuesday, but if equities and gold are showing risk aversion, can the dollar not be a beneficiary, too? Of course, a Phase One deal would remove a great deal of uncertainty and point to additional dollar losses as scaredly-cats exit. This is going to happen anyway as the futures rollover approaches.

Politics: This morning we will get the articles of impeachment from the Judiciary Committee, which votes on them and then passes to the full House, probably next week. It appears there are only two, abuse of power and obstruction of Congress. What happened to bribery and objection of justice? Nobody really knows, but ideas include that the two charges will get the most Dem votes and that is good PR.

Another, and not mutually exclusive with the first one, is that two charges are simple and easily understood by the public, which got befuddled by the Mueller report. The bribery charge is not refuted as factual evidence by the Republicans, but is still tricky because it rests on a few words—“I’d like to ask a favor, though.” Hard evidence of withholding military aid is still being covered up by the White House. Still, the Dems are pointing out at every opportunity that the aid was released because Trump “got caught” using it extortionately. We say the average Joe is perfectly capable of understanding “attempted burglary” or “attempted murder” as just as indictable as the actual crime.

Also last evening we got the 450+-page report from the Inspector General saying the FBI was not politically motivated to initiate the investigation into any Trump collusion with the Russians in interfering in the 2016 election. The boss, the attorney general, disagrees with his own inspector general and is clinging to the unfair “witch hunt” charge, as is a regional AG currently conducting his own investigation. What a mess. Meanwhile, Rudy is still in Ukraine drumming up “evidence” of Ukrainian interference, the Russian fake story, and nobody knows who is paying his way—it’s not Trump.

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a free trial, please write to [email protected] and you will be added to the mailing list..

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

Author

Barbara Rockefeller

Rockefeller Treasury Services, Inc.

Experience Before founding Rockefeller Treasury, Barbara worked at Citibank and other banks as a risk manager, new product developer (Cititrend), FX trader, advisor and loan officer. Miss Rockefeller is engaged to perform FX-relat