The data we do get this week about the labor market will show what we already know

Outlook

In the US today, we get home sale prices, the Chicago PMI, JOLTS and consumer confidence. Tomorrow it’s ADP private sector jobs and ISM manufacturing PMI. Those are the biggies until nonfarm payrolls on Friday, which now seems unlikely to materialize if the government is still shut down. Overnight tonight it’s the Tankan and on Thursday, comments from BoJ chief Ueda, with the odds of a rate hike later in Oct growing by the minute but made uncertain by politics.

Realistically, the US government shut down has little effect on the overall economy, which is booming. Nitwits and libertarians say “See? We don’t’ need such a big government.” Then the hurricane hits their house and there is no FEMA, or they break a leg in a field and there is no more rural hospital within 200 miles. It’s an enduring issue—how much government is too much government? Republicans don’t want to pay for the healthcare of the dumbbells who lead unhealthy lives and run up the Medicaid costs. They also don’t want to acknowledge these are their voters. The optimum government size is a long-standing debate (remember the Tea Party?) that deserves better treatment. To be fair, while Europe seems to have this issue under control, sort of, countries as disparate as the UK and China are struggling, too.

From the point of view of foreign investors, they have lived through ten of these US government shutdowns so far without getting upset or changing course. The last one was during Trump 1. All the same, a shutdown is unsettling and drives anxiety up the wall, especially with the even more unhinged Trump grabbing all the headlines.

At a guess, the data we do get this week about the labor market will show what we already know—it’s soft, it’s getting softer, it’s at odds with rising capital spending, and where does AI or old-fashioned automation come into it? Bottom line, more uncertainty.

Forecast

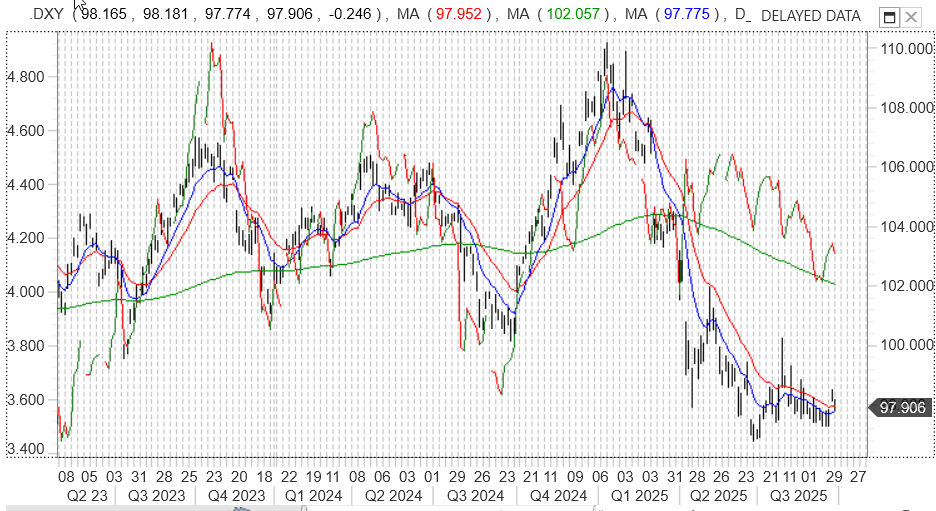

The 10-year yield is continuing to fall back, but not by as much as the dollar index. See the chart of the two in the Chart Package. For years they have danced together but now we have a meaningful divergence. Global hedgers may like the assts for yield but not want the dollar part, but can it be hedged entirely away? The dollar index has fallen far more than the yield.

It’s likely that sub-par data this week, especially ADP, will only encourage those who see two rate cuts by year-end, and that a hit to the dollar.

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

Author

Barbara Rockefeller

Rockefeller Treasury Services, Inc.

Experience Before founding Rockefeller Treasury, Barbara worked at Citibank and other banks as a risk manager, new product developer (Cititrend), FX trader, advisor and loan officer. Miss Rockefeller is engaged to perform FX-relat