The data on jobs/employment is confusing

Outlook

Again the global equity market meltdown dominates the environment. Is this the real deal? Yeah, probably, if not in a straight line. See the tidbit below comparing this time to the 2008 financial crisis.

Rapidly moving risk-off may get fuel or a firehose from US developments today, including the S&P services PMI and consumer confidence. One idea is the BLS report on “real earnings,” which can be used to extrapolate inflation. Chandler reports “In August, the difference between the average hourly earnings and real earnings was 3.0%.” The August CPI was 2.9%, so close enough for government work.

The data on jobs/employment is confusing. Renaissance economist Dutta keeps saying the employment situation is “deeply unbalanced,” which seems about right. It’s not clear the Fed is going to heed the mixed messages from the various reports, which do not add to the existing perception that employment is not healthy but not a death’s door, and if the Fed fails on inflation, its reputation is mud.

Before moving on from employment, remember that the unemployment rate comes from the household survey is among the least reliable indicators of all the material the BLS publishes.

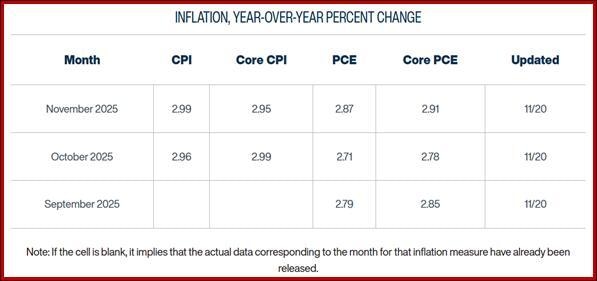

We really wish we could see what the hundreds of Fed economists have on inflation. The Atlanta Fed has an “underlying inflation dashboard” but the dates are all September. Its business inflation expectations slipped to a mere 2.2%. The Cleveland Fed forecast for Oct and Nov shows small upticks, with headline CPI at 2.99% from 2.96% in Oct and core PCE sat 2.91% in Nov from 2.78% in Oct. This is knocking on the door of 3% when the target is 2%, and if we expect higher inflation from tariffs in Q1, no wonder the Fed is cautious and hawkish.

Yesterday the CME FedWatch tool had the probability of a rate cut down in the low 30’s. During the day, it went up to 39.6% at 2 pm. This likely means the bettors turned away from the priority of inflation in favor of the unemployment gain, even though the various jobs reports were not that bad. The equity meltdown may be in there, too. As of 6:40 am ET today, the probability of the Dec rate cut has moved up to 64.4%. This is vaguely dollar negative.

We are going to seesaw between cut and no cut until we get an answer. This is upsetting any and all forecasts in yields and FX. Now there is talk of postponing the cut to January, and the probability of a cut then (Jan 26) is 50.2%. So, if the Fed doesn’t do Dec, it may do January. This doesn’t make a lot of sense. If inflation fear holds back the Fed is Dec, what could possibly change to allow it only six weeks later? Presumably by then we will have actual inflation data.

One more issue: the Fed cares deeply about its reputation. This takes the form of commentators in newspapers, board rooms and management suites. “Behind the curve” is the usual curse. We have no compelling evidence that the Fed gives a hoot about its reputation among the average citizens, who don’t know what it does, anyway. But the average citizen is concerned about inflation. This pertains mostly to food but also utilities and shelter. The average citizen is also concerned about jobs, which are increasingly “hard to get.” But at a guess, inflation is more important to the average citizen. So, how much does the Fed care about that?

Tidbit: Bloomberg opinion writers examine the comparison between the AI bubble and the dot-com bubble and also the subprime-mortgage crisis that led to the 2008-09 meltdown. A critical point: the jerks who bundled subprimes did their math wrong. The correlation of one failure to others was far higher than they thought, meaning the pinball effect turned into falling dominoes. This is one of those cases of contagion.

When it comes to the current AI bubble, there is a valid comparison: “The real risk isn’t that lofty AI valuations will suddenly crash to zero. It’s that relatively small stumbles in the AI story could mean correlations suddenly go to one across the market, the economy, and the whole financial system.”

Yes, indeed.

Forecast

The Fed is mandated to act on data pertaining to inflation and employment, but realistically, it cannot avoid seeing what the stock market is doing, at least not under crisis conditions. One really bad day is hardly a crisis, but this particular one has been building for a while.

The switcheroo in the CME fed funds betting from “no cut” to “yes, cut” is confusing. Why do almost two-thirds now see a rate cut after the jobs report was not at all bad? It’s hard not to whisk in a dollop of stock market fear to the bettors, if not the Fed.

A rate cut that favors both the stock market and the labor market seems logical and to hell with inflation until it gets scary high. This is hardly the Fed’s attitude, but projecting it onto the Fed means the usual risk-off favoring the dollar is contaminated. A cut now followed by rising inflation means a reversal down the road. Remember that reputation obsession. But at the same time, a rate cut now may mean avoiding a hard landing.

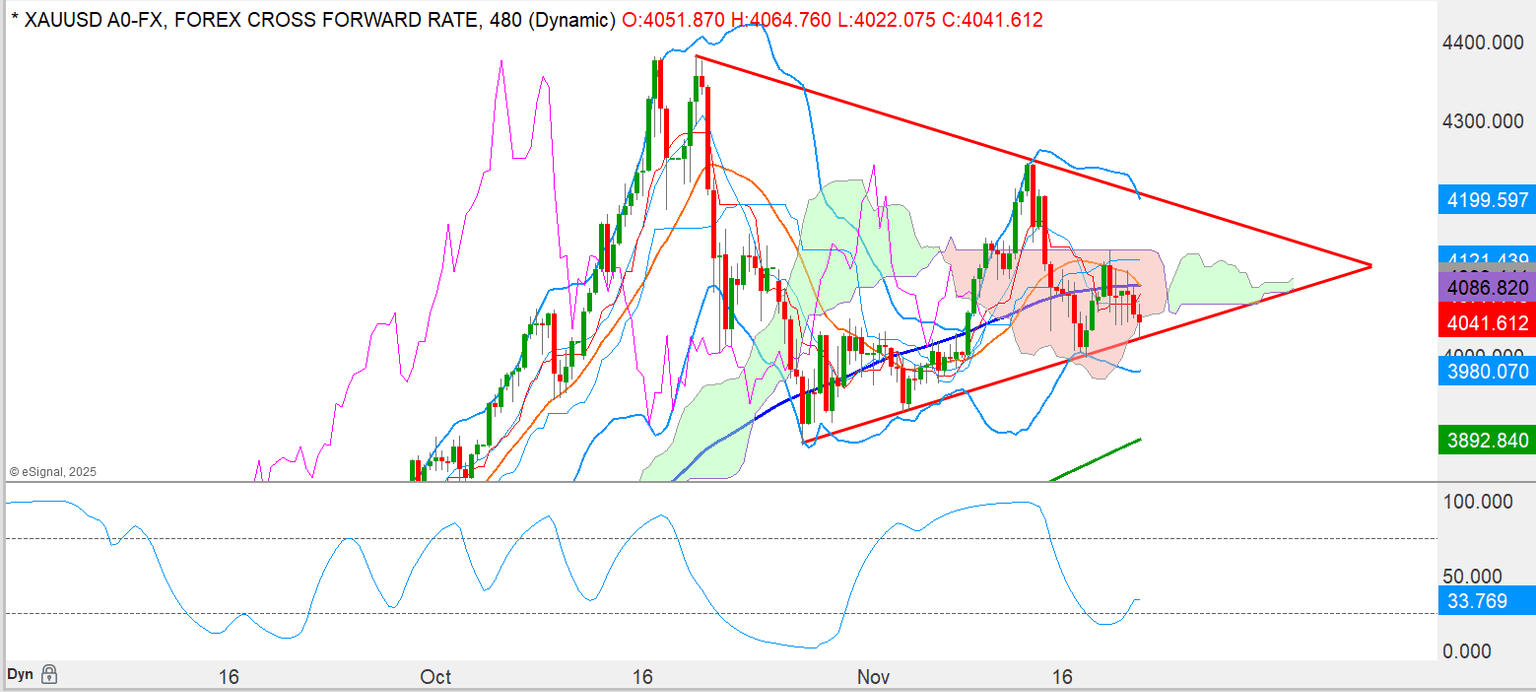

The only recommendation we can make under these circs is to get out of everything, especially crypto, which seems to be taking the hardest of hits. Patience is a virtue when all around you are losing their minds. Trying to game this one is foolish. And watch gold. Nobody can explain why it’s not rising, unless it has become like crypto, a sentiment toy.

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

Author

Barbara Rockefeller

Rockefeller Treasury Services, Inc.

Experience Before founding Rockefeller Treasury, Barbara worked at Citibank and other banks as a risk manager, new product developer (Cititrend), FX trader, advisor and loan officer. Miss Rockefeller is engaged to perform FX-relat