The China tariff crisis is not over but has just begun

The dollar went through a whipsaw in yields and equities on the flimsiest of reasons—a ridiculous 100% tariff on China that was withdrawn, sort of, as soon as Trump saw the US stock market effect. As noted above, Bloomberg complains he was in such a hurry to chicken out, he did so even before Chinese equities had a chance to respond.

As we saw in April, warnings that this time the US stock market is a bursting bubble were shot down early and with a 12-bore—US equities, led by those top tech names, took off again. At the same time, silver hit the highest high (over $50) since 1980, along with highs in gold. This is equal parts flight to safety and mania.

Flight to safety gets some push from Trump getting revenue and outright shares in some big companies. This is not conventional capitalism and if a Dem had done it, there would be riots. Bloomberg points out that Microsoft bonds sell for more than US sovereign paper, which are supposed to be the gold standard, so to speak, against which all others are compared. Well, Microsoft is Triple A and the US is only Double A.

It’s important to note that the China tariff crisis is not over but has just begun. Trump has been off in the Middle East pretending he brought peace to the area, something no one has done in thousands of years and he certainly didn’t, either. He got 20 hostages in return for 20,000 prisoners and no actual deal. While that was going on, nothing changed on the China tariff front. China is not feeling friendly or intimidated and there is a lot more to come. Upcoming is Trump attending the APEX conference and meeting Pres Xi, after sullenly saying he wouldn’t attend. It’s being held Oct 27-29 in Seoul. We can hope for some progress before then.

In this topsy-turvy world, we worry the most about the trend in yields. The yield crash last week was buyers rushing in and demanding more Treasuries on trade war fear. See the chart showing the year-to-date. The downward slope in the yield trend since Trump took office seems to mean flight to safety is outrunning inflation fear. But note that the correlation with the dollar index is not all that good these days. The divergence began right after Trump’s “liberation day” on April 2.

Forecast: The dollar is on a recovery mini-trend that looks like it’s going to keep going. Nobody likes it and it’s hard to believe in when the Fed is coming up on a rate cut in late Oct and inflation must rear its head sometime soon, but there it is.

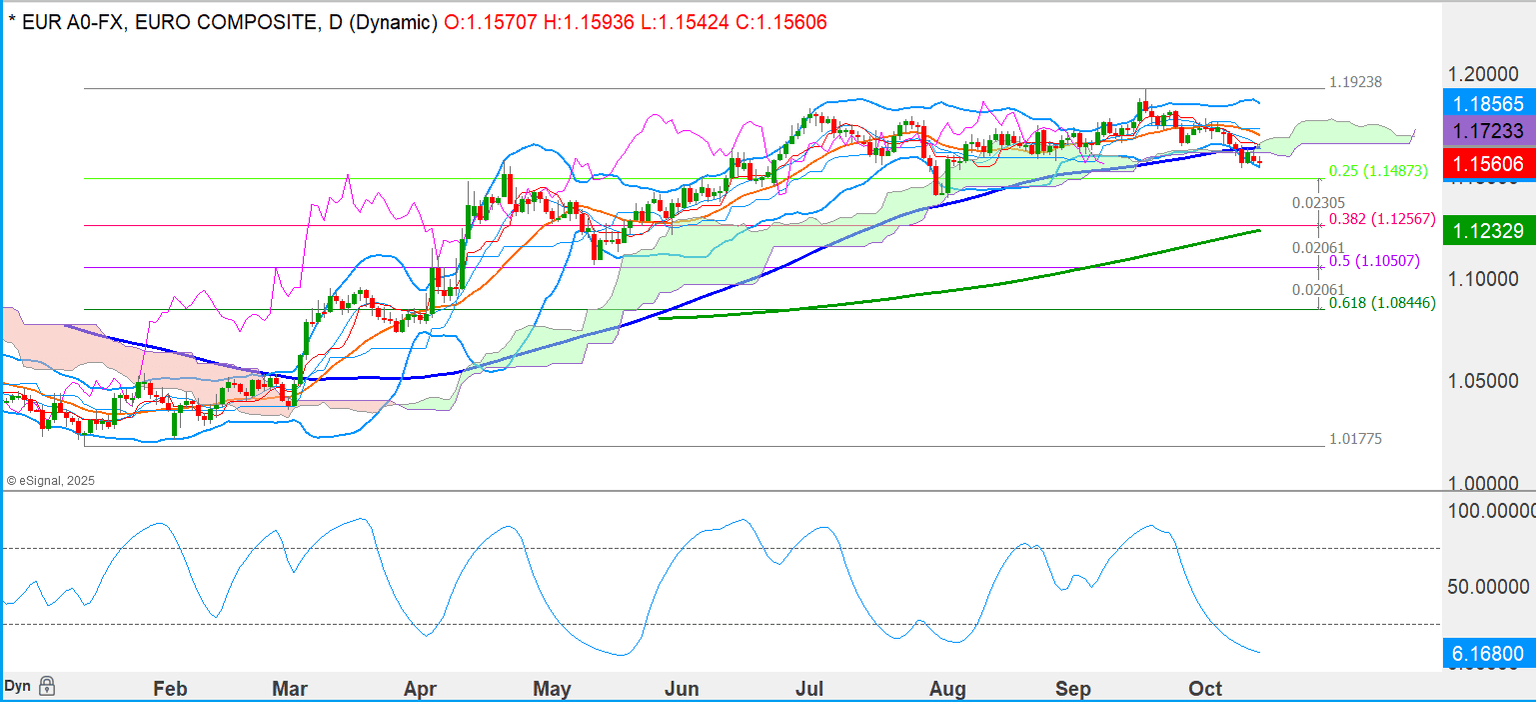

If the worst case scenario continues to develop, for the euro the next milestone is the previous low at 1.1401 from July 30. Before that, it’s the low on May 12 at 1.1066, which is kissing distance of the 50% retracement. Fib retracements are superstitious hooey but so many believe in them that they often become self-fulfilling. In-between and near the 38% retracement line is the 200-day, another meaningless number, at 1.1235.

See the chart on the last page. We doubt he euro will fall below the July low, robust US economy or not, for the simple reason that the US generally is so out of favor among investors.

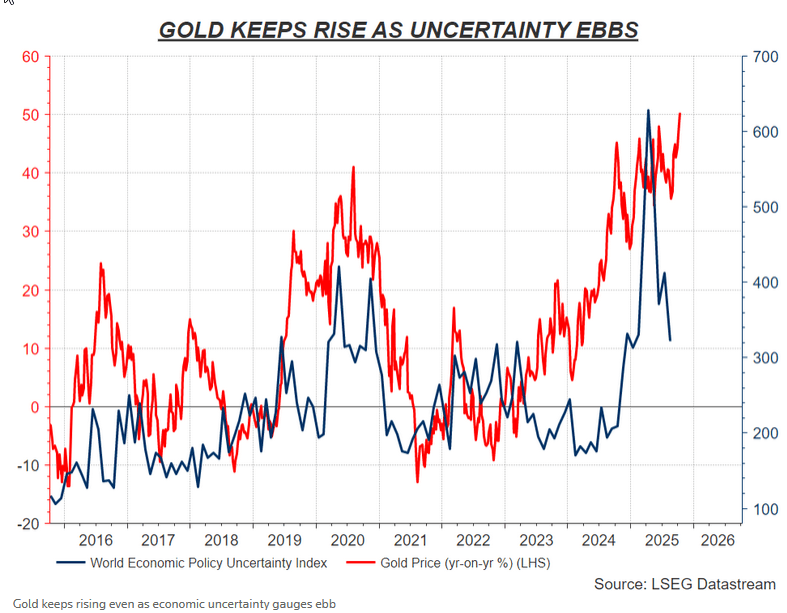

Tidbit: Reuters points out that gold itself is in a bubble, up about 56% year-to-date and still rising, despite a relaxation in an uncertainty index. We have no idea how the uncertainty index is calculated but it seems intuitively obvious that as long as Trump is in the White House, uncertainty is hardly going to fall and can only rise. We still have the Fed takeover, a potential partial default on the debt, and heaven only knows what other havoc he will wreak.

Tidbit: From Jared Bernstein yesterday: Trade deals should be done behind closed doors, not on social media. “None of this makes the sweeping tariffs, many of which could soon be deemed illegally implemented (SCOTUS will hear the case in early Nov.), any less of an own-goal kick. It’s just that a) imported goods are 11% of our GDP, less than half the share for e.g., EU countries, and b) while some smaller, less capitalized and insulated businesses have been hit hard by the tariffs, others, at least so far, have found ways to cope.

“Last thought on this, for now. Rare earths are not that rare. They can be hard to extract but we’ve got ample deposits here in the U.S. What we don’t have is refining capacity, of which 90% resides with China. This is thus a strong candidate for industrial policy, and some of that has been afoot in recent years, but it is a huge challenge with long lead times. But if your U.S. industrial policy scorecard is currently limited to clean energy production and semiconductors, you should consider adding rare-earth refining capacity.”

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

Author

Barbara Rockefeller

Rockefeller Treasury Services, Inc.

Experience Before founding Rockefeller Treasury, Barbara worked at Citibank and other banks as a risk manager, new product developer (Cititrend), FX trader, advisor and loan officer. Miss Rockefeller is engaged to perform FX-relat