The BoE: A meeting of contradictions

The Bank of England delivered a rate cut as expected on Thursday, however, it was the commentary that followed along with the BOE’s updated forecasts for growth and inflation that shocked investors, and the initial reaction to the report was dovish. However, now that the dust has settled a bit, traders are not so sure. GBP is picking up from its lows and UK yields are also , although they are still lower on the day.

It's no wonder that the market is doubting the initial dovish reaction to this report. It was a meeting full of contradictions. The BOE dramatically cut its growth forecast for this year by half, at the same time as increasing its GDP forecasts for 2026 and 2027. The arch dove and the arch hawk came together and voted for a 50bp rate cut, the BOE says that inflation will rise to 3.7% at some point this year, at the same time as service prices are expected to moderate, there are risks to both the demand and supply trajectories in the economy, and the MPC will continue to take a gradual and careful approach to reducing rates, even though interest rates in the UK remain restrictive and growth is weakening.

A difficult narrative to follow

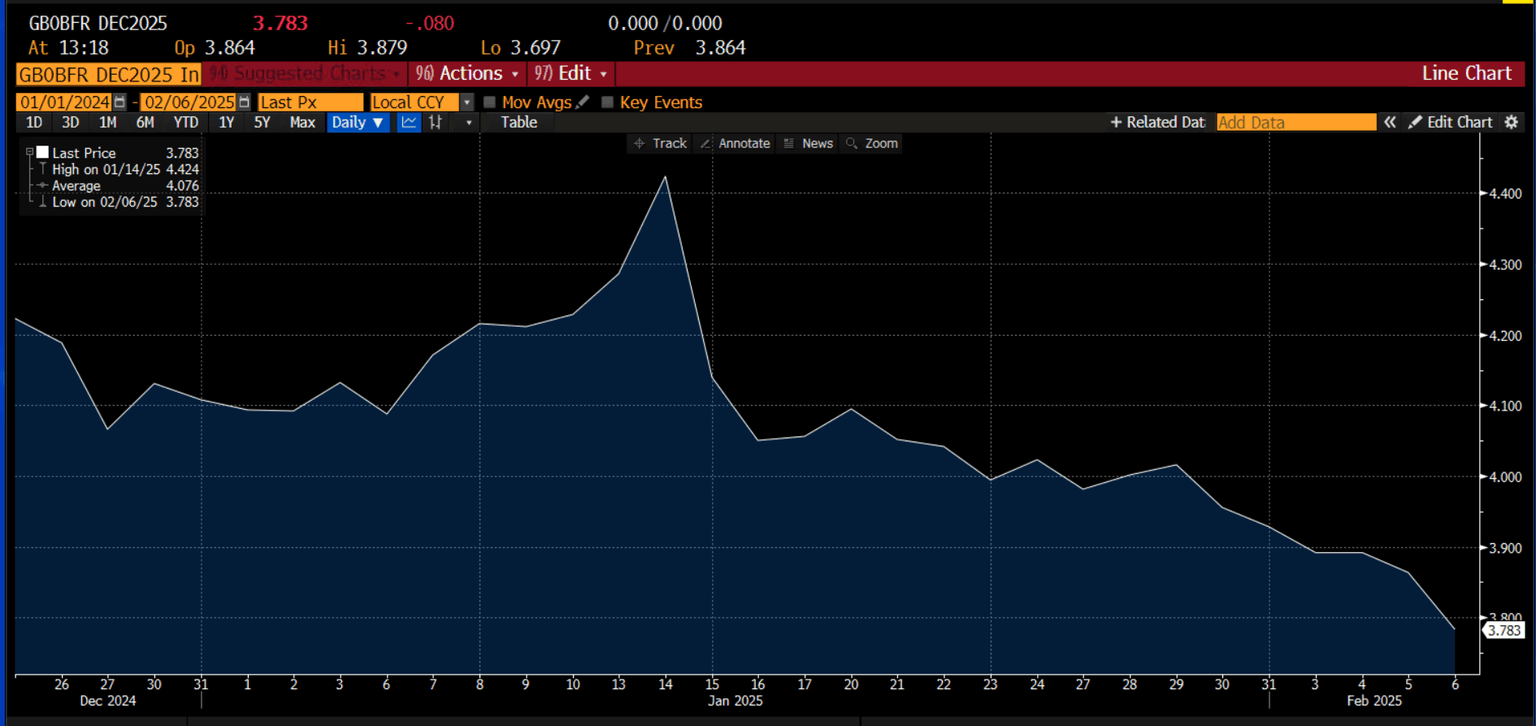

The BOE’s narrative is very difficult to interpret, and it can be read as both dovish and hawkish. The immediate reaction has been dovish: bond yields fell, and this weighed in the pound, which is the weakest performer in the G10 on Thursday. The OIS market is still expecting just over 2.5 further rate cuts this year, about the level of rate cuts as has been expected in recent weeks. There has been a small reduction in the market’s expectations for interest rates by year end, they have fallen to 3.76% on Thursday, they were 3.86% on Wednesday.

So, why is the pound still weak and 2-year bond yields remain at their lowest level since before Chancellor Rachel Reeves’ notorious budget? We think that the bond market, and by extension the FX market, is doubting the BOE’s message that it will only cut rates in a gradual and careful manner, instead, the market may not buy the BOE’s message about the degree of slack in the economy. There is a huge amount of economic data due before the BOE’s next meeting, which could shift the dial for rate cut expectations.

Catherine Mann’s decision could lead some to doubt BoE’s resolve to keep rates restrictive for the long term

We also think that Catherine Mann’s decision to vote for a 50bp rate cut is giving the market food for thought. Mann is an arch hawk, who has mentioned in previous speeches her preference for a ‘shock and awe’ approach to rate cuts, i.e., bigger cuts when the going gets tough for the economy. The fact that she thinks the economic picture is so dire that we need a 50bp rate cut, is a sign that the BOE could be behind the curve when it comes to setting interest rates at an appropriate level for the UK economy.

BoE can’t dodge Trump’s tariff threats

Another interesting nugget from this report was the lack of concern for the labour market, although the unemployment rate ticked higher in the 3-months to November, and employer NI will come into force from April, which could drive up unemployment even further. Regarding Trump and Tariffs, BOE Governor Andrew Bailey said that it remains ‘unclear’ what form global trade policies will take and the impact they will have on the economy. This may have contributed to the upgraded inflation forecasts, however, if Trump deescalates his tariff threats, like he has done with Mexico and Canada, then the inflationary impact from tariffs could be minimal.

The BOE has also noted that it is tricky to know what is driving the UK’s economic weakness, and this is leading to uncertainty about the disinflation process. While there are many factors weighing on the UK economy, one of the biggest is the blow to consumer and business confidence in recent months. If the BOE thinks that confidence will improve in the coming months, then economic weakness could be short lived. However, an improvement in confidence could be hard to achieve, since it may require the government rolling back on the policies announced in October’s Budget, which seems unlikely.

OBR growth cuts now a near certainty

With only 2 full rate cuts now expected for this year, the OBR’s growth forecasts that will be released with the Spring Statement next month, are all but certain to be revised lower. This is a blow to the government, and suggests that the government will need to decide: 1, does it balance the books (raise taxes) or 2, take a pro-growth stance, like it professes to do? Depending on what the Chancellor does next month, this could have a big impact on the BOE’s future policy path.

Will the vigilantes react to the weaker GDP forecast?

Overall, the market has had a mixed reaction to this report, but growth fears are weighing heavily on the pound. Although bond yields are falling on Thursday, the weaker growth forecasts combined with extensive Gilt issuance, could lead to the bond market vigilantes targeting the UK once again.

Chart: December interest rate expectations have fallen sharply in 2025, as the growth outlook deteriorates. The BOE’s rate decision has added to this downward pressure, even though the BOE has said that it will take a cautious and careful policy path in future.

Source: XTB and Bloomberg

Author

Kathleen Brooks

XTB UK

Kathleen has nearly 15 years’ experience working with some of the leading retail trading and investment companies in the City of London.