Technical analysis: USD/CAD eyes critical resistance border

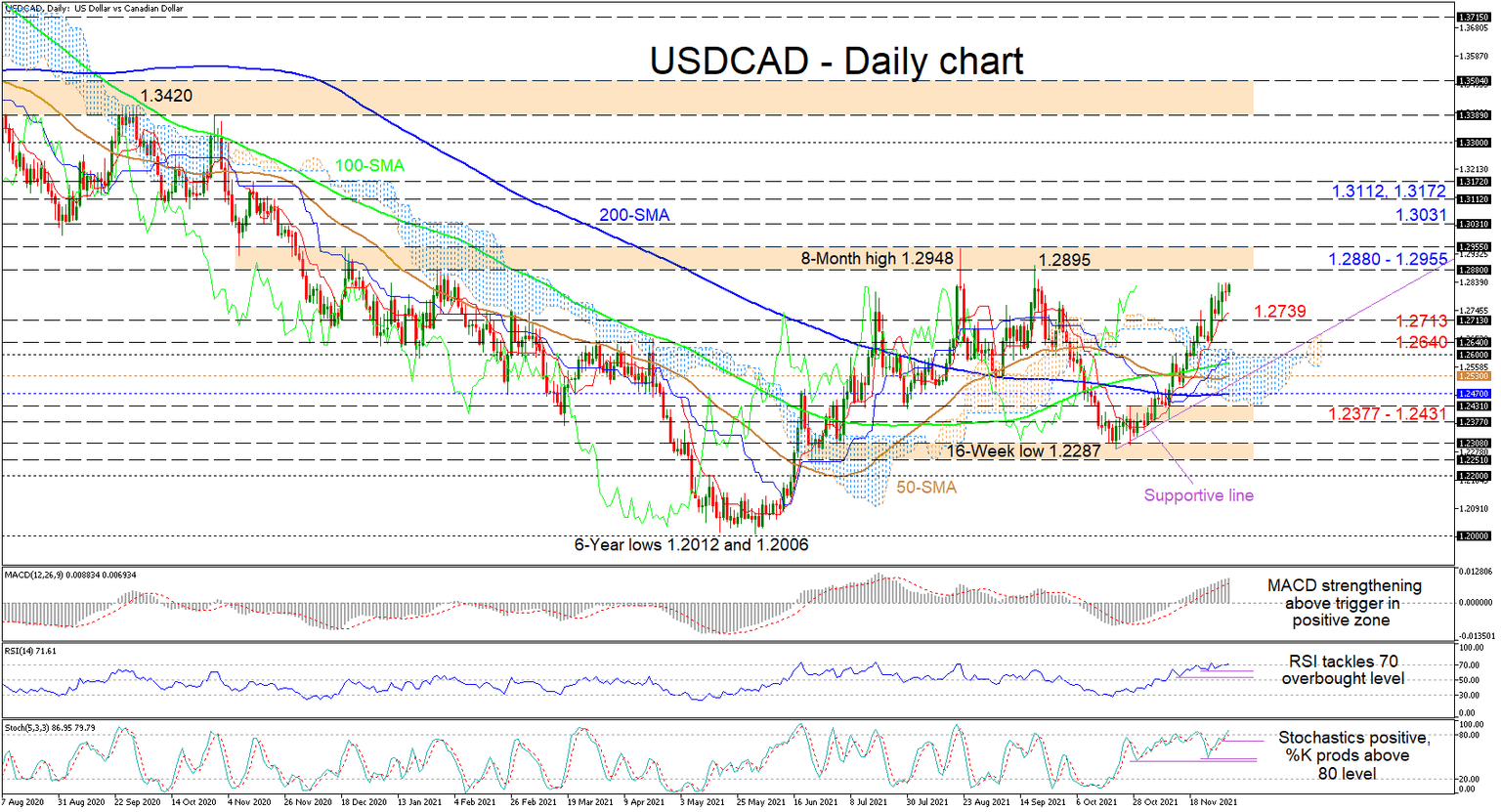

USDCAD is extending a one-and-a-half-month ascent above the Ichimoku cloud and towards the resistance ceiling of 1.2880-1.2955, which started to take shape around the later part of December 2020. The simple moving averages (SMAs) are currently not sponsoring a definitive trend in the pair.

The climbing Ichimoku lines are indicating a predominant bullish drive, while the short-term oscillators are conveying an upside preference in the pair. The MACD, some distance above zero, is improving above its red trigger line, while the stochastic oscillator’s %K line has climbed into overbought territory. The RSI is sustaining a bullish bearing but presently is flirting with the 70 threshold.

Maintaining its current trajectory, the price could initially combat the reinforced 1.2880-1.2955 resistance barrier. Should this critical boundary fail to limit additional gains from unfolding, buyers could then tackle the 1.3031 border before navigating towards the mid-November 2020 highs of 1.3112 and 1.3172 respectively.

Otherwise, if sellers resurface and steer the price beneath yesterday’s low of 1.2777, prompt support could arise around the red Tenkan-sen line at 1.2739 and the adjacent 1.2713 low. Retracing further, the pair may meet the 1.2640 obstacles before facing a tough zone of support between the 1.2600 handle and the 50-day SMA at 1.2530. In the event the price manages to dive past this key zone, overlapped by potential diagonal support pulled from the eight-week low of 1.2287, sellers may then challenge the 200-day SMA at 1.2470 before pursuing the 1.2377-1.2431 support band.

Summarizing, USDCAD is currently sustaining a bullish tone and a thrust beyond the crucial 1.2880-1.2955 resistance boundary could boost the bullish bias in the longer-term picture. Otherwise, credence will be given to the formation of a medium-term trading range between the 1.2251-1.2308 floor and 1.2880-1.2955 ceiling.

Author

Anthony Charalambous joined XM in 2019 and specializes in preparing daily technical analysis, using his years of trading experience to provide detailed forecasting for all major asset classes such as forex, indices, commodities and equities.