Technical analysis: NZD/USD gains at risk as sellers push back

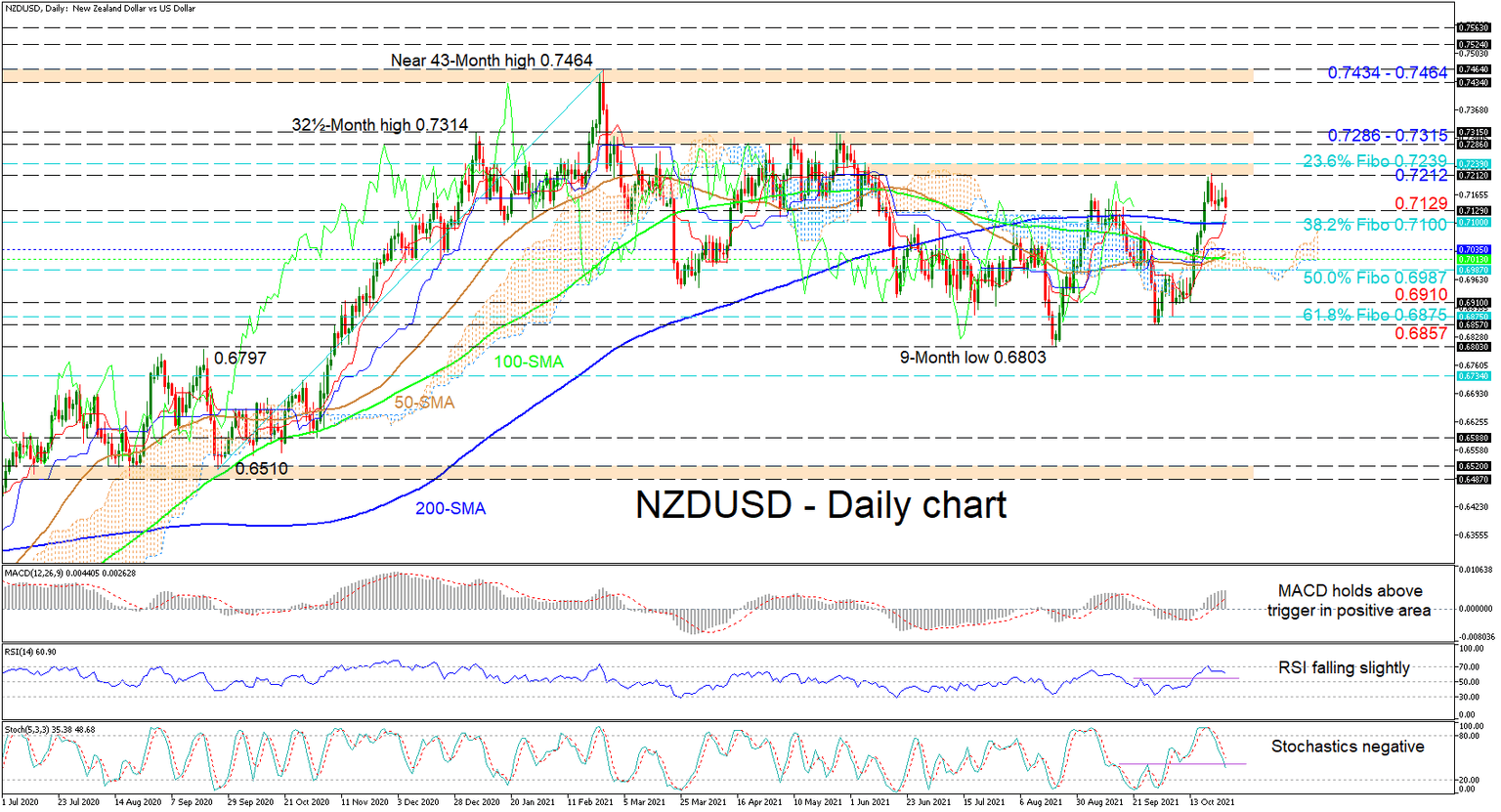

NZDUSD buyers have re-emerged after the minor price retreat but attempt to limit sellers’ ruling power are looking to have been in vain. As of late, the trendless simple moving averages (SMAs) are proposing a more neutral bearing in the pair.

The Ichimoku lines are reflecting the fresh rally and are indicating a pause in positive momentum, while the short-term oscillators are transmitting conflicting messages of directional impetus. The MACD, north of the zero thresholds, is keeping above its red trigger line, while the RSI is looking to fall further in bullish territory. Moreover, the stochastic oscillator is promoting the price pullback in the pair as its negative charge is showing no signs of abating.

In the negative scenario, initial downside friction could develop in the area amongst the 0.7129 obstacles and the 0.7100 handles, that being the 38.2% Fibonacci retracement of the up leg from 0.6510 until 0.7464. If the pair dips past the 200-day SMA, a sturdy support zone may arise in the vicinity of the blue Kijun-sen line at 0.7035 until the 50.0% Fibo of 0.6987. Sinking beneath this buffer zone and beyond the 0.6910 low, the bears could then tackle the region between the 61.8% Fibo of 0.6875 and the 0.6857 troughs.

If buying interest increases, preliminary upside constraints could manifest from the 0.7212 level until the 23.6% Fibo of 0.7239. Successfully breaching this, the 0.7286-0.7315 area of highs could try to deny further progress in the pair. However, if the bulls are triumphant, they may aim for the 0.7434-0.7464 section, molded between the rally peaks of January 2017, January, and February 2018 and the near 43-month high in February of this year.

Summarizing, NZDUSD is exhibiting a neutral-to-bullish tone as its recent rally is persisting above the SMAs. Furthermore, to decisively repower negative tendencies, the price would need to close below the 9-month low of 0.6803, while a jump above 0.7315 could fuel buyers’ confidence.

Author

Anthony Charalambous joined XM in 2019 and specializes in preparing daily technical analysis, using his years of trading experience to provide detailed forecasting for all major asset classes such as forex, indices, commodities and equities.