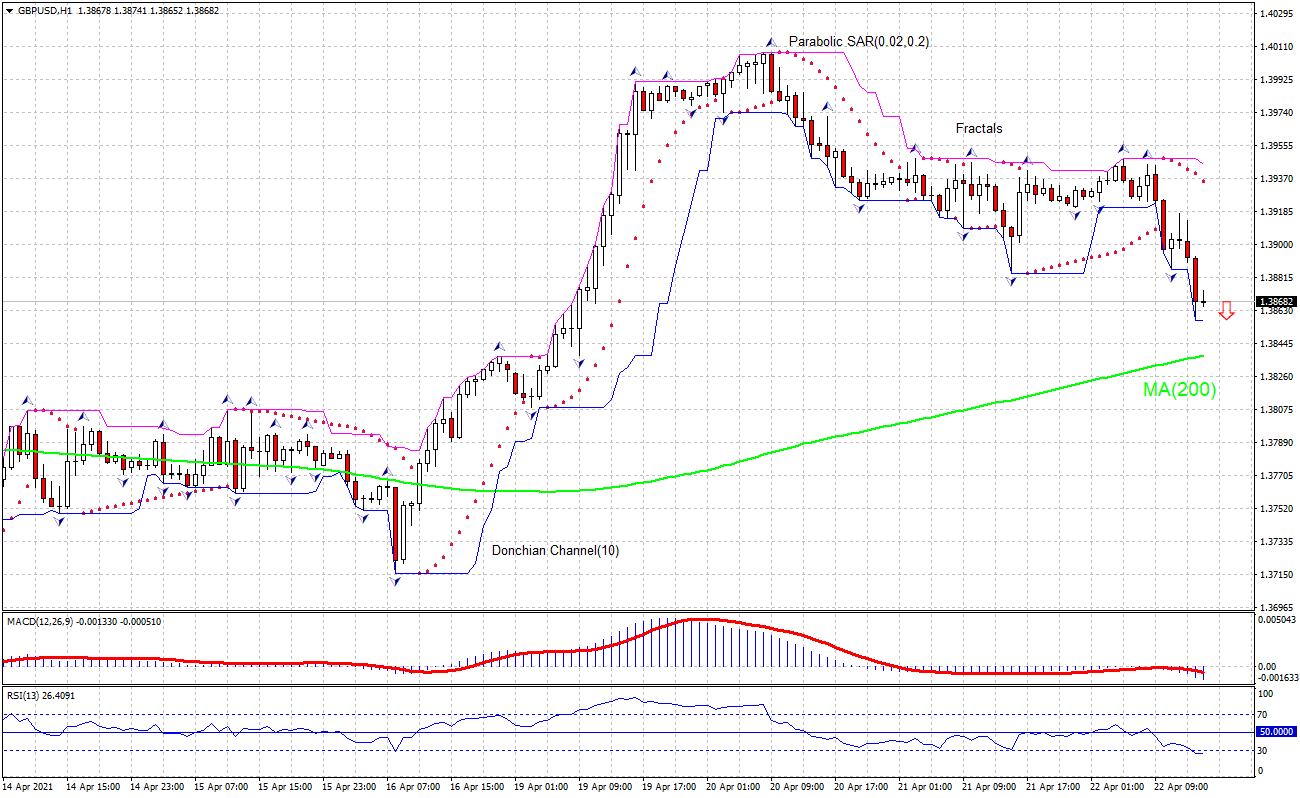

Technical analysis: Will the GBP/USD retreat persist?

Recommendation for GBP/USD: Sell

Sell Stop: Below 1.3858

Stop Loss: Above 1.3945

RSI: Neutral

MACD: Sell

MA(200): Buy

Fractals: Neutral

Parabolic SAR: Sell

Donchian Channel: Sell

Chart Analysis

The GBPUSD technical analysis of the price chart on 1-hour timeframe shows GBPUSD: H1 is falling toward the 200-period moving average MA(200) which is rising still. We believe the bearish movement will continue after the price breaches below the lower bound of the Donchian channel at 1.3858. A level below this can be used as an entry point for placing a pending order to sell. The stop loss can be placed above 1.3945. After placing the order, the stop loss is to be moved to the next fractal high indicator, following Parabolic signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level without reaching the order, we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

Fundamental Analysis

UK’s Confederation of British Industry survey results were worse than expected for April. Will the GBPUSD retreat persist? UK’s Confederation of British Industry survey results were worse than expected for April: the CBI Industrial Trends Survey showed UK Industrial Order Expectations index fell to -8 for April from -5 in March, when an increase to 2 was forecast. This is bearish for GBPUSD.

Want to get more free analytics? Open Demo Account now to get daily news and analytical materials.

Want to get more free analytics? Open Demo Account now to get daily news and analytical materials.

Author

Dmitry Lukashov

IFC Markets

Dimtry Lukashov is the senior analyst of IFC Markets. He started his professional career in the financial market as a trader interested in stocks and obligations.