GBP/JPY technical analysis – Pullback edges towards the cloud; ascent still intact

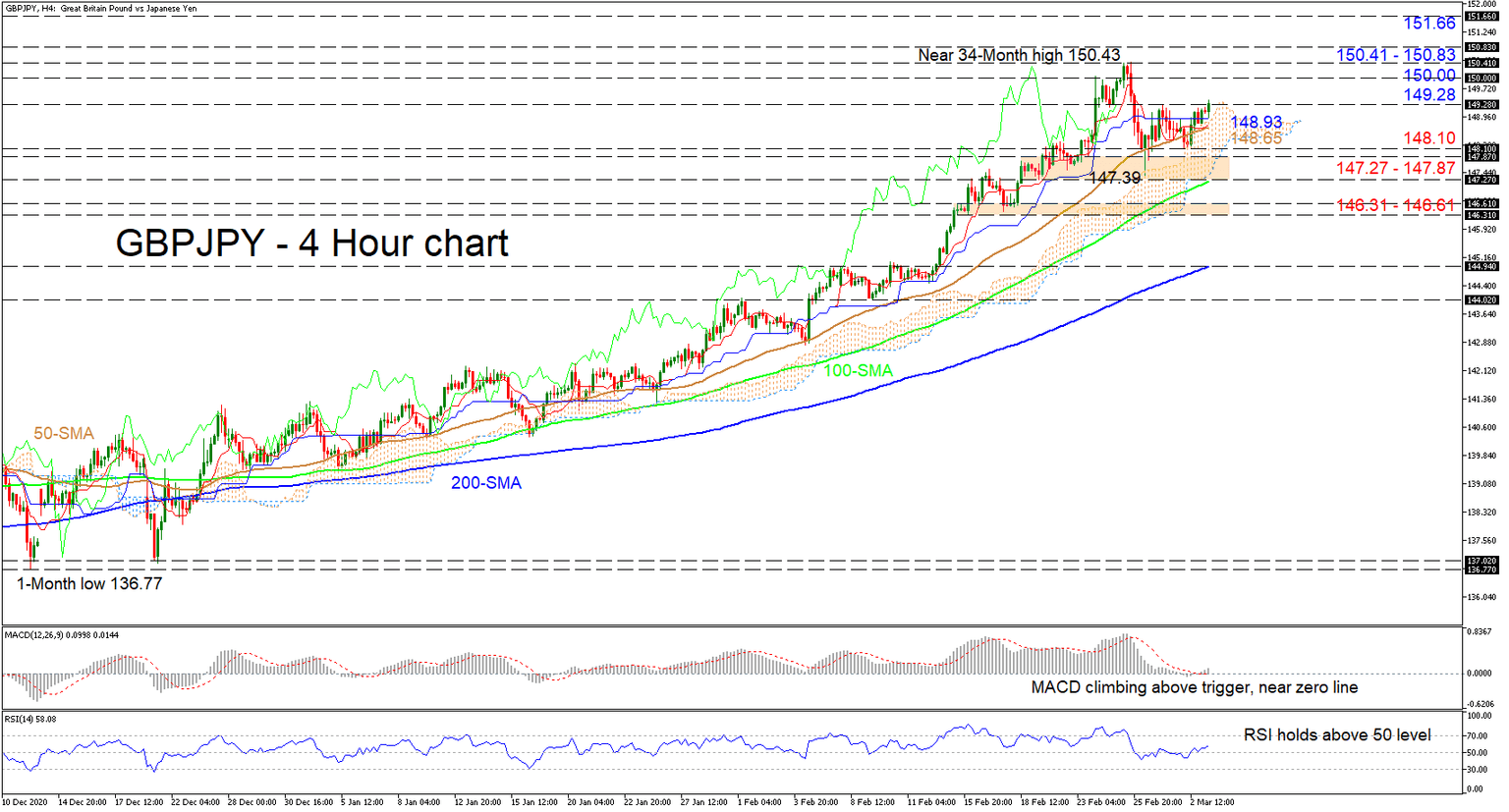

GBPJPY is consolidating after fading from its near 34-month peak of 150.43 and is currently tackling the 149.28 barrier. The pair continues to find footing off the cloud’s upper boundary, while the Ichimoku lines are backing a more neutral price tone. Specifically, the 50-period simple moving average (SMA) is buoying the price, while overall the SMAs are defending the predominant bullish structure.

Also lately the short-term oscillators are suggesting improvements in positive momentum. The MACD, is increasing above its red trigger line, which is now mostly in-line with the zero threshold, while the RSI, is sustaining its lunge into the positive territory.

If buyers find significant traction off the cloud’s upper band and close above the capping 149.28 resistance, the pair could quickly propel to challenge the 150.00 psychological number. Successfully stepping over this, the next significant resistance may be encountered between the 150.41 level and the 150.83 high. Triumphing over this section, which also contains the multi-year high of 150.43, the price could then target the 151.66 barrier, being an inside swing low, identified in April 2018.

On the flipside, if sellers try to steer the price down into the Ichimoku cloud, support could originate from the blue Kijun-sen line at 148.93 until the rising 50-period SMA at 148.65. Retreating further, the nearby low of 148.10 could come next ahead of the critical support section of 147.27-147.87, which is reinforced by the 100-period SMA. Deteriorating past this zone, which contains the 147.39 trough, and ultimately under the cloud, the pair may sink towards the 146.31-146.61 support region.

As things stand, GBPJPY’s bullish bias remains firm above the SMAs, the Ichimoku cloud and the 147.27-147.87 support boundary. Yet, a retraction under the 146.31-146.61 border could throw some doubt into the bullish picture.

Author

Anthony Charalambous joined XM in 2019 and specializes in preparing daily technical analysis, using his years of trading experience to provide detailed forecasting for all major asset classes such as forex, indices, commodities and equities.