Technical analysis: Recommendations for heating oil

Recommendation for Heating Oil: Buy

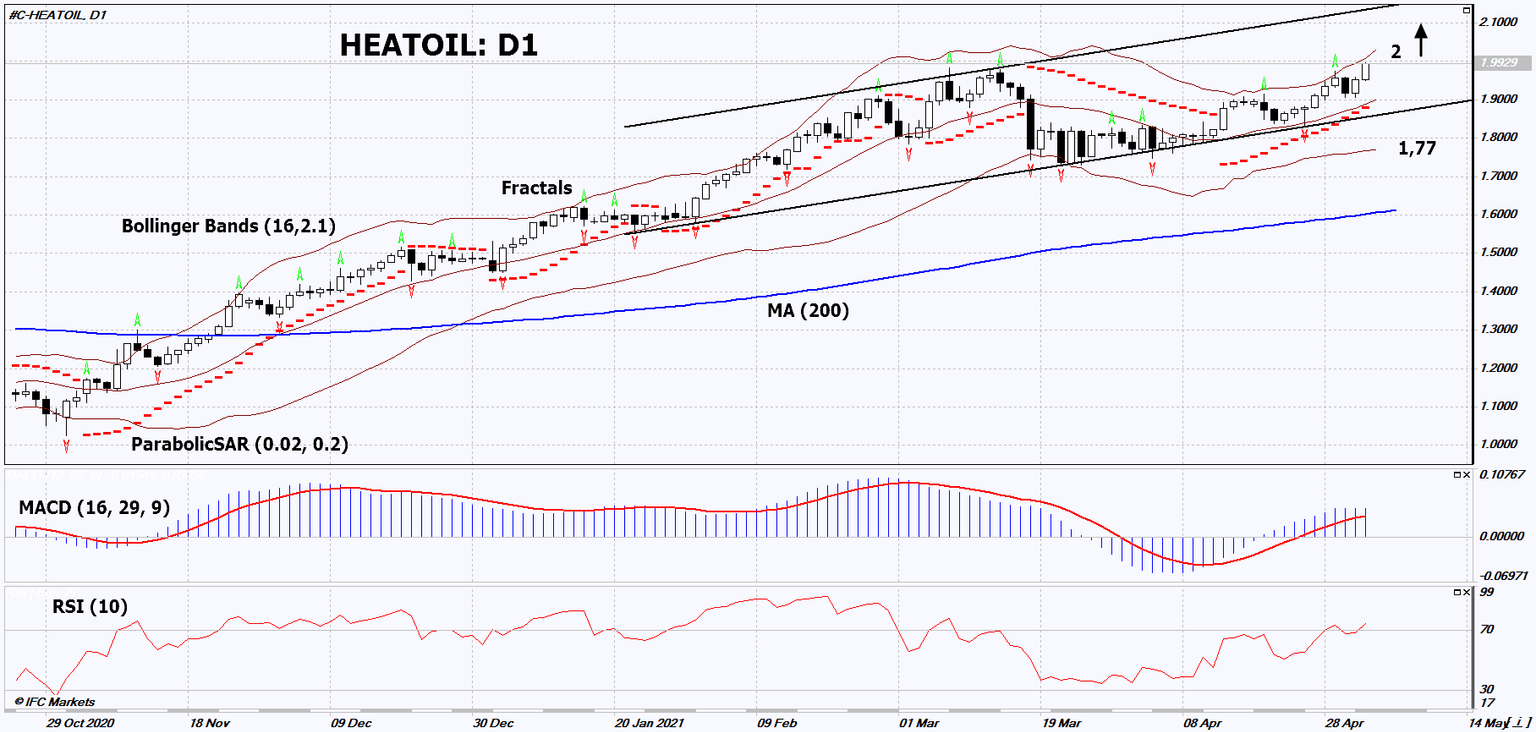

Buy Stop: Above 2

Stop Loss: Below 1,77

RSI: Neutral

MACD: Buy

MA(200) : Neutral

Fractals: Buy

Parabolic SAR: Buy

Bollinger Bands: Neutral

Chart analysis

On the daily timeframe, HEATOIL: D1 is trading in an upward channel. A number of technical analysis indicators formed signals for further growth. We do not rule out a bullish move if HEATOIL: D1 rises above its last high: 2. This level can be used as an entry point. We can place a stop loss below the Parabolic signal, the last lower fractal and the lower Bollinger line: 1.77. After opening a pending order, we can move the stop loss following the Bollinger and Parabolic signals to the next fractal low. Thus, we change the potential profit/loss ratio in our favor. After the transaction, the most risk-averse traders can switch to the four-hour chart and set a stop loss, moving it in the direction of the bias. If the price meets the stop loss (1.77) without activating the order (2), it is recommended to delete the order: the market sustains internal changes that have not been taken into account.

Fundamental analysis

The United States, the European Union and the United Kingdom are going to ease Covid-19 quarantine measures. Will the HEATOIL quotes continue to rise? New York state, New Jersey and Connecticut are going to lift some of the Covid restrictions within 2 weeks. The EU and the UK aim to open up to Covid-vaccinated foreign tourists. This may increase the demand for fuel. In this review, we are looking at the HEATOIL chart, as it was the first to update the March highs. Oil price dynamics may be affected by data on changes in US oil reserves for the week.

Want to get more free analytics? Open Demo Account now to get daily news and analytical materials.

Want to get more free analytics? Open Demo Account now to get daily news and analytical materials.

Author

Dmitry Lukashov

IFC Markets

Dimtry Lukashov is the senior analyst of IFC Markets. He started his professional career in the financial market as a trader interested in stocks and obligations.