Tariff wars become all too real

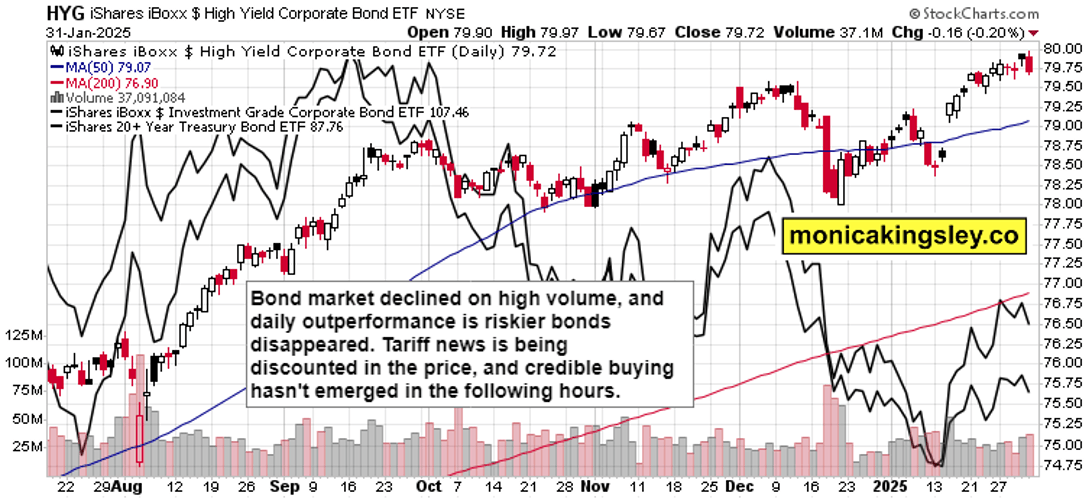

S&P 500 was drifting higher premarket, waving off the tariff threat before the weekend with a mainstream article talking newly about Mar 01 deadline, and not this weekend implementation (with China 10% on top) – forcing a reversal in stock market path. With both Canada and Mexico accepting the challenge with counter tariffs of their own (Canada eyeing TSLA, too), and China as well taking countermeasures and going the WTO challenge route, the path is set for a bearish gap Monday open the way it was the case the week before with DeepSeek. See Bitcoin below $100K, and remember how it was a week ago.

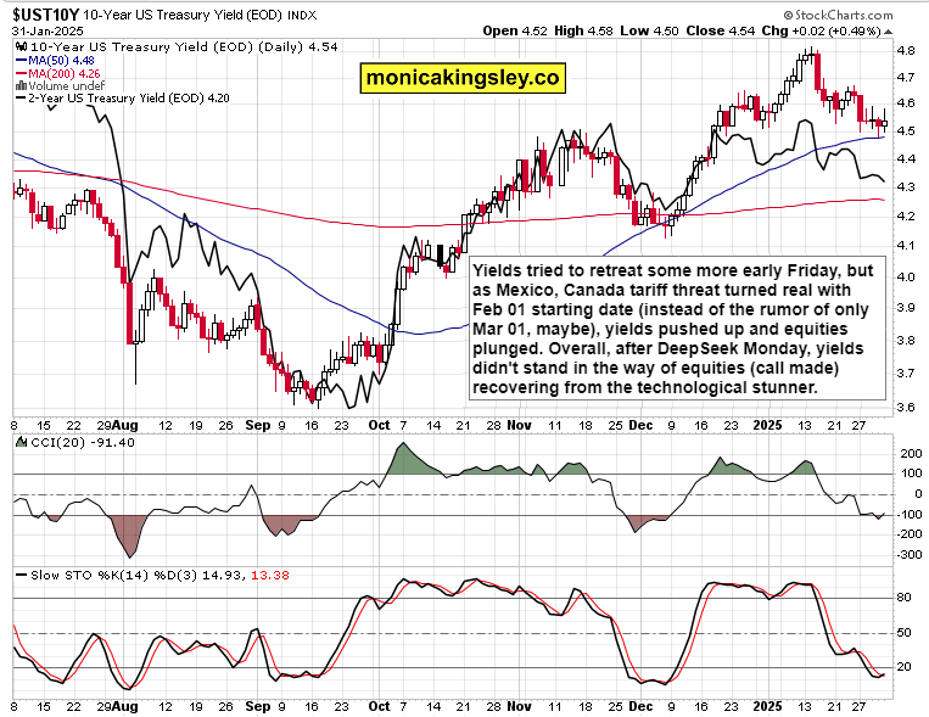

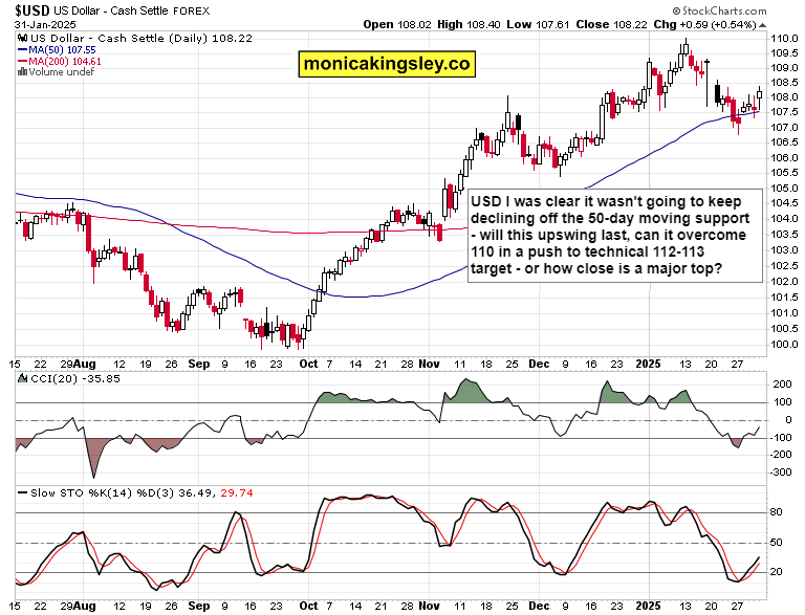

Where next for S&P 500, Nasdaq, gold or oil? What lessons can be drawn from the last couple of hours Friday as regards sectors? With yields trying to rise, and being rejected to a greater extent than USD, what‘s ahead in the shifting market tides?

Saturday‘s video raises all the right questions across the asset classes, clues dropped just enough. Examine the precision of gold and oil price predictions, the fact called that yields wouldn‘t stand in the way of equities – all in the context of continuous assessment of AI landscape shifts.

Negotiated tariffs solution, or greater melee ahead as Trump admin is taking on the trade deficit? What about the dollar‘s path, what to make of industrials – or other (in the week and year) best leading S&P 500 sectors? Any lessons from Nasdaq ratio to S&P 500, NVDA vs. SMH?

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.