Talking to your self

S2N spotlight

Today’s spotlight has all the potential to make me look like an idiot. It never stopped me in the past, so why stop now?

When I was younger, I used to think I was weird because I had this constant inner dialogue. I assumed other people were normal and quiet inside, while I had this running commentary, debates, negotiations — and the occasional hostile takeover — happening in my head.

It was only in adulthood that I realised that this inner dialogue is what Carl Jung describes as the transcendent function—the ongoing conversation between your conscious self and the shadow parts of you that don’t speak unless invited. It is not madness but maturation. The psyche is trying to integrate its contradictions.

I write this after an hour of sauna and ice bathing. There is something magical about integrating those two extremes. It was in the quietness of that paradox that I had a powerful flash of self-awareness that I think might resonate with those of you who are growth-orientated.

This morning I found myself swearing at the AI model helping me irrigate my data farm. The more mistakes the AI made, the more I let rip. Let me set the scene: this wasn’t, “Oh shoot, why are you such an idiot?” This was language that would make a drunken sailor blush. This wasn’t just language; it was violence dressed up as strength.

Okay, you get the picture. Let’s take a step back. Who did I hurt? AI doesn’t have feelings. Isn’t having a “sandbox” to discharge your emotions actually a good thing?

But as someone who sees himself as religious and tries to treat people with respect, this behaviour didn’t “feel” right. So let me share the two important lessons I took from this signal cutting through the noise.

First: the more I swore, the less satisfying it became. I escalated impressively, yet the AI remained utterly indifferent. No reaction. No emotional feedback loop. Nothing.

And then it hit me:

Anger needs an audience. When there is no audience, it burns itself out. Entropy does the rest.

I went quiet — not because I’d become enlightened, but because the behaviour had nowhere left to go. The fire simply extinguished itself. That’s when the real insight landed:

Swearing at a machine isn’t dangerous because the machine doesn’t care.

It’s dangerous because you might stop caring how you speak — to others and to yourself.

Last week I wrote that “the markets don’t care about your feelings.” Well, neither does the AI. And that’s the connection.

Backtesting, coding, and markets — they are all non-reactive systems. They don’t soothe you, they don’t respond to your frustration, and they certainly don’t apologise for disappointing you. They simply mirror your internal world.

What you do with that mirror is the whole game.

My takeaway?

Refinement isn’t about never losing your temper. It’s about noticing when you do — especially when no one is watching — and choosing to return to the person you’d rather be. The AI won’t judge you. The market won’t comfort you. But you will know.

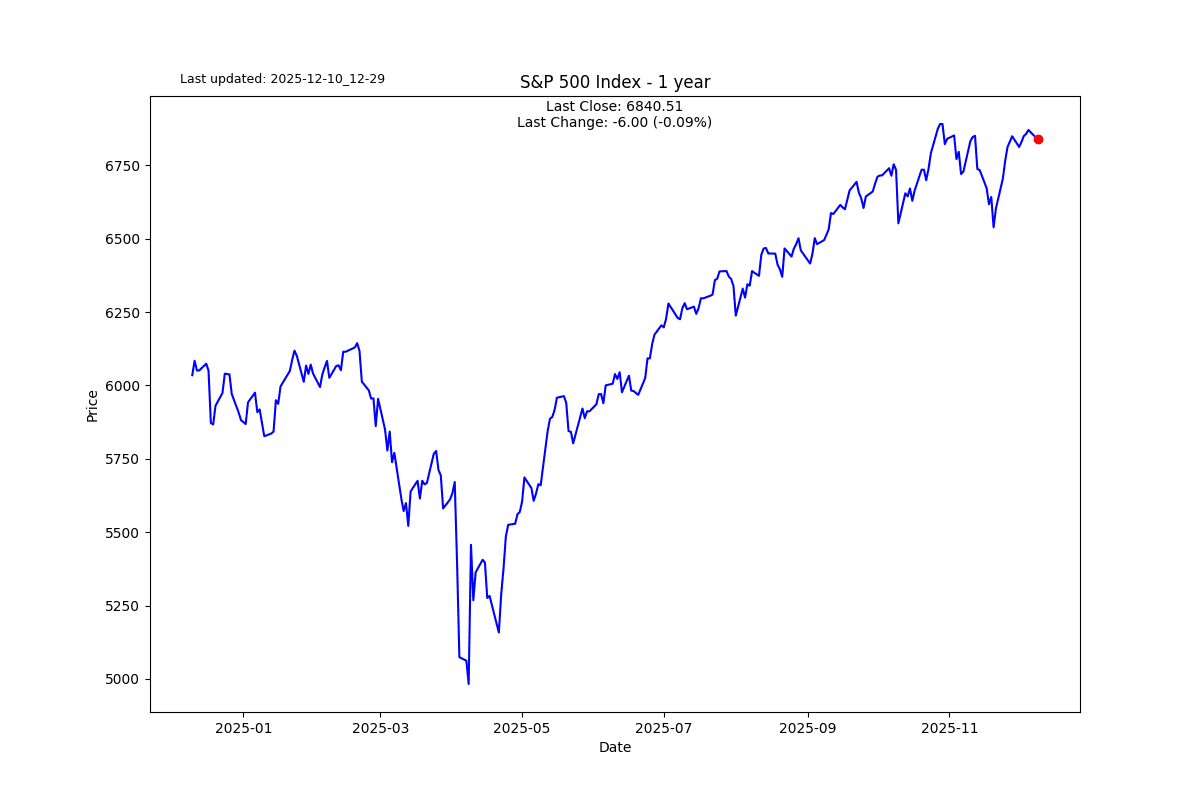

S2N observations

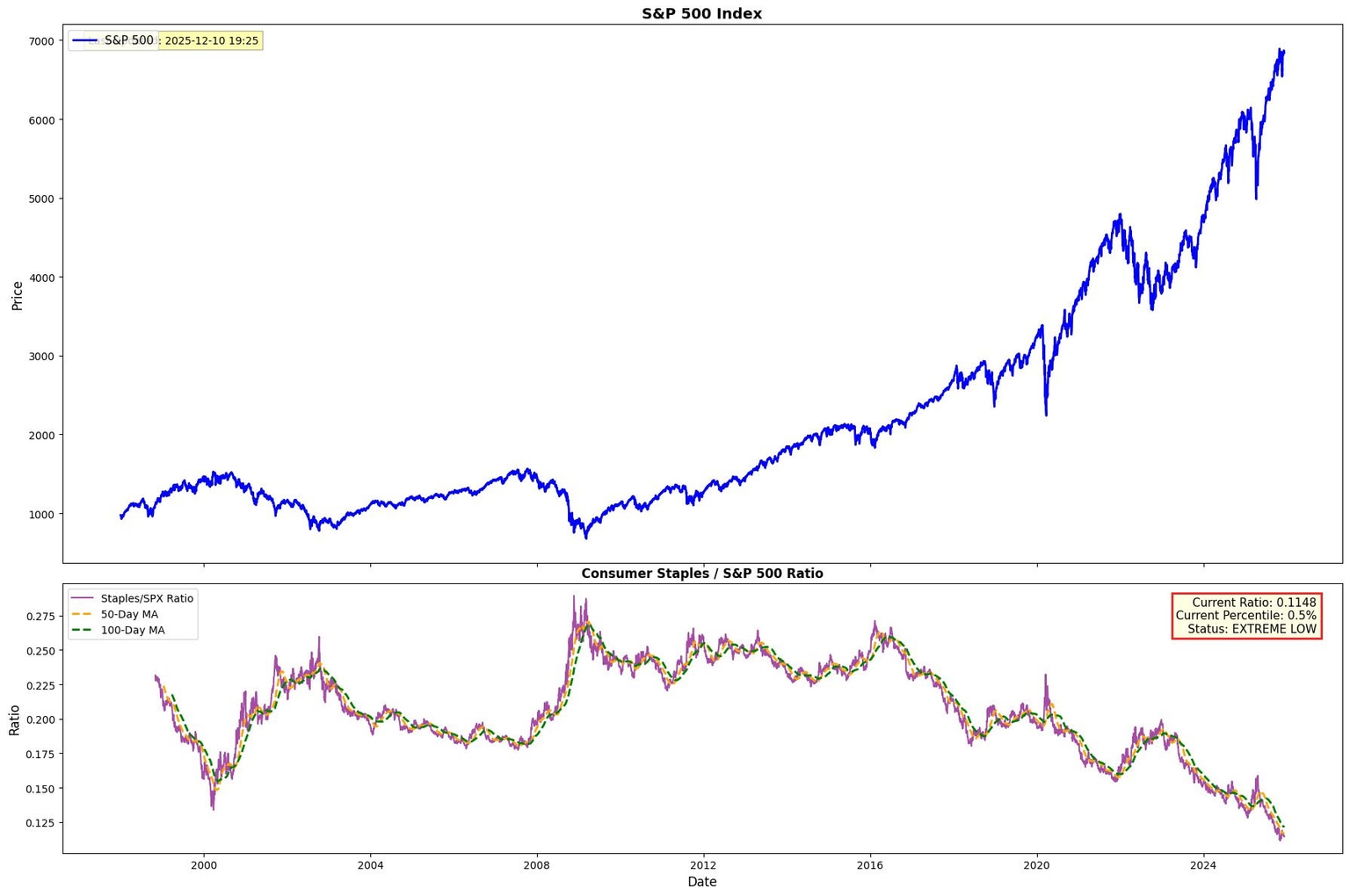

The consumer staples index is trading at an all-time low relative to the S&P 500. If you are wondering what consumer staples are, they are the things people buy on a regular basis regardless of economic conditions. This is the sector you invest in when playing defence, when you are worried about company profits because times are tight. People still need to buy toothpaste and groceries when times are tough. Procter & Gamble, Coca-Cola, Walmart – those kinds of bellwether stocks.

What is abundantly clear is that the market’s psyche is focused on growth to the max. To eternity and beyond. I think it is time to start playing a little defence before it becomes an offence.

S2N screener alert

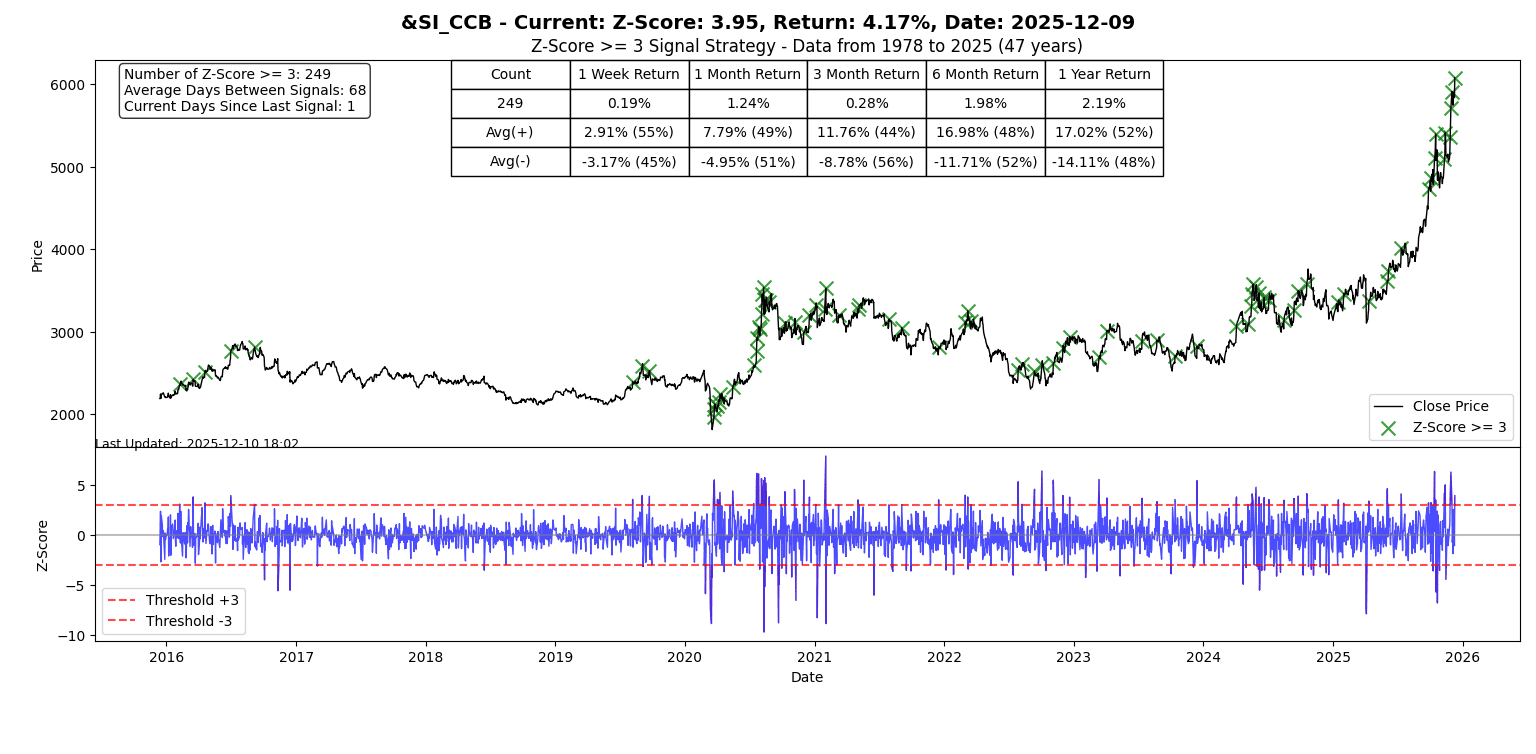

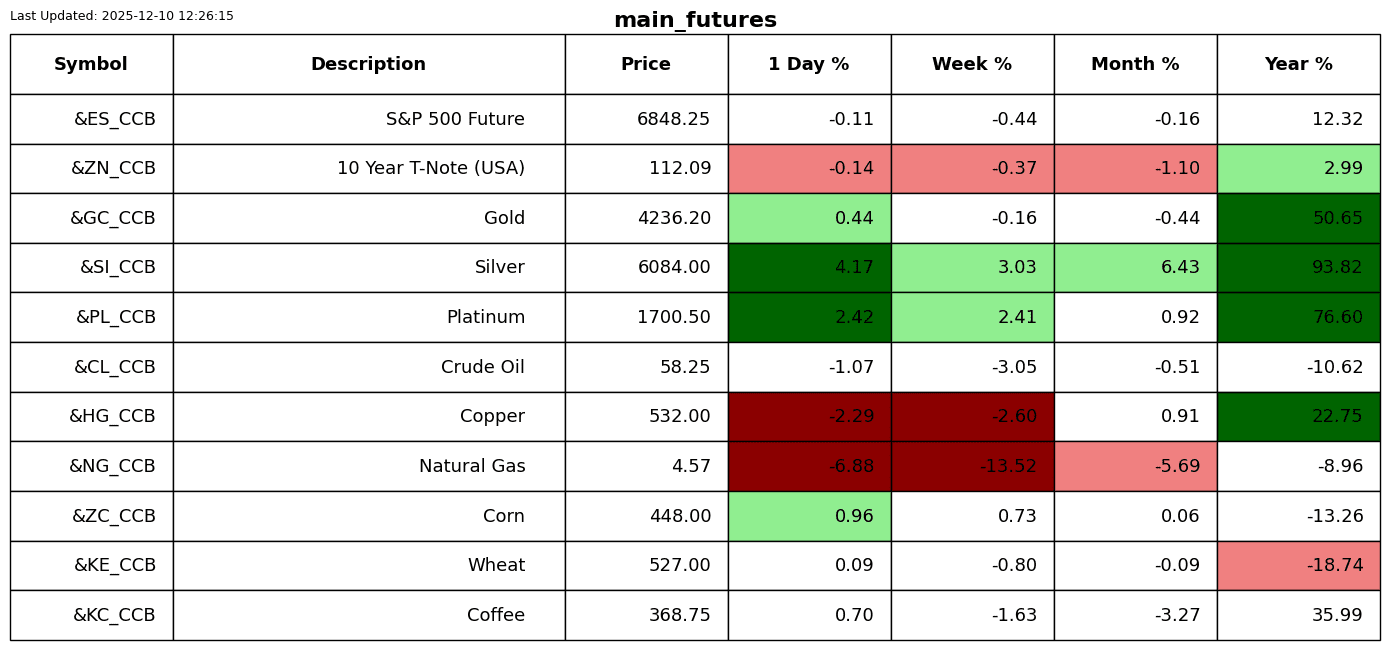

Silver is where it is all happening. Another big day and the first time ever above $60.

S2N performance review

S2N chart gallery

S2N news today

Author

Michael Berman, PhD

Signal2Noise (S2N) News

Michael has decades of experience as a professional trader, hedge fund manager and incubator of emerging traders.