Talking or acting?

The ECB meeting on Thursday next week will focus on the financing conditions and the PEPP implementation. We do not expect new policy decisions, but a reiteration of all options on the table while ensuring easy financing conditions.

The main unknown is whether ECB will explicitly coin the recent rise in both nominal and real yields as an unwarranted tightening of financing conditions or fall short of reaching that conclusion and decide ‘only ’ monitor the evolution of y ields. The former should trigger increased bond buying under the existing PEPP envelope (and immediate lower rates during the press conference) while the latter will mean flexibility remains but not additional buying. We believe it is a close call (and is also subject to daily market developments) on which conclusion they will reach given the comments in recent weeks hasn’t suggested major concerns for most GC members.

We lean towards ECB concluding a continuation to monitor and remain short of conclude an unwarranted tightening. This may come at a later stage if conditions worsen ‘enough’. We do not expect talking is enough to contain rates, but action is needed. We therefore see upside risks during the press conference to rates. Should ECB choose to pursue a more dovish stance, we would expect relative rates to become a further drag on EUR/USD. This would be in line with a mild easing of financial conditions while the European recovery remains weak. If not, we see EUR/USD as little changed on the day. Our long-term forecast remains 1.16 on 12M.

We expect ECB to repeat the cautiously optimistic tune regarding the economic outlook of the euro area, with minor revisions to its staff projections (slightly lower growth and higher inflation this year). We expect Lagarde to reiterate that ECB will look through the base effects driven inflation near term.

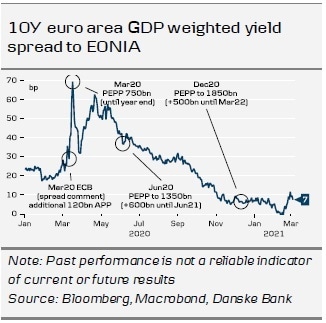

Unwarranted tightening of financing conditions

After the rapid sell-off in European rates, led by the long end in the US, the financing conditions has tightening the past 2 weeks, with only verbal intervention from the ECB to counteract the unwarranted tightening of financing conditions. While financing conditions are overall easy (chart on right), the pace of the tightening as well as the reason thereof (US fiscal package) should have called for ECB using the flexibility within the PEPP package, notably also due to the rise in real rates (for the wrong reasons being higher nominal yields and broadly unchanged inflation expectation). However, recent communication have seen the majority of the GC members closely monitoring the evolution with only ECB’s Panetta and the Greek GC member Stournaras outright calling for a pickup in purchase pace.

Holistic approach to financing conditions

In ECB financing conditions - what to watch, 12 February we lay out what we expect ECB is focussing when assessing the financing conditions. Updating the charts, we still conclude that financing conditions are still accommodative, but after the recent rise in yields adds a headwind with high uncertainty. Chief economist Lane last week also put a great deal of emphasis on the transmission from sovereign rates to banking lending rates, as bank lending rates strongly correlates with sovereign rates in rates up scenario.

Author

Danske Research Team

Danske Bank A/S

Research is part of Danske Bank Markets and operate as Danske Bank's research department. The department monitors financial markets and economic trends of relevance to Danske Bank Markets and its clients.