Strong DAX seasonals

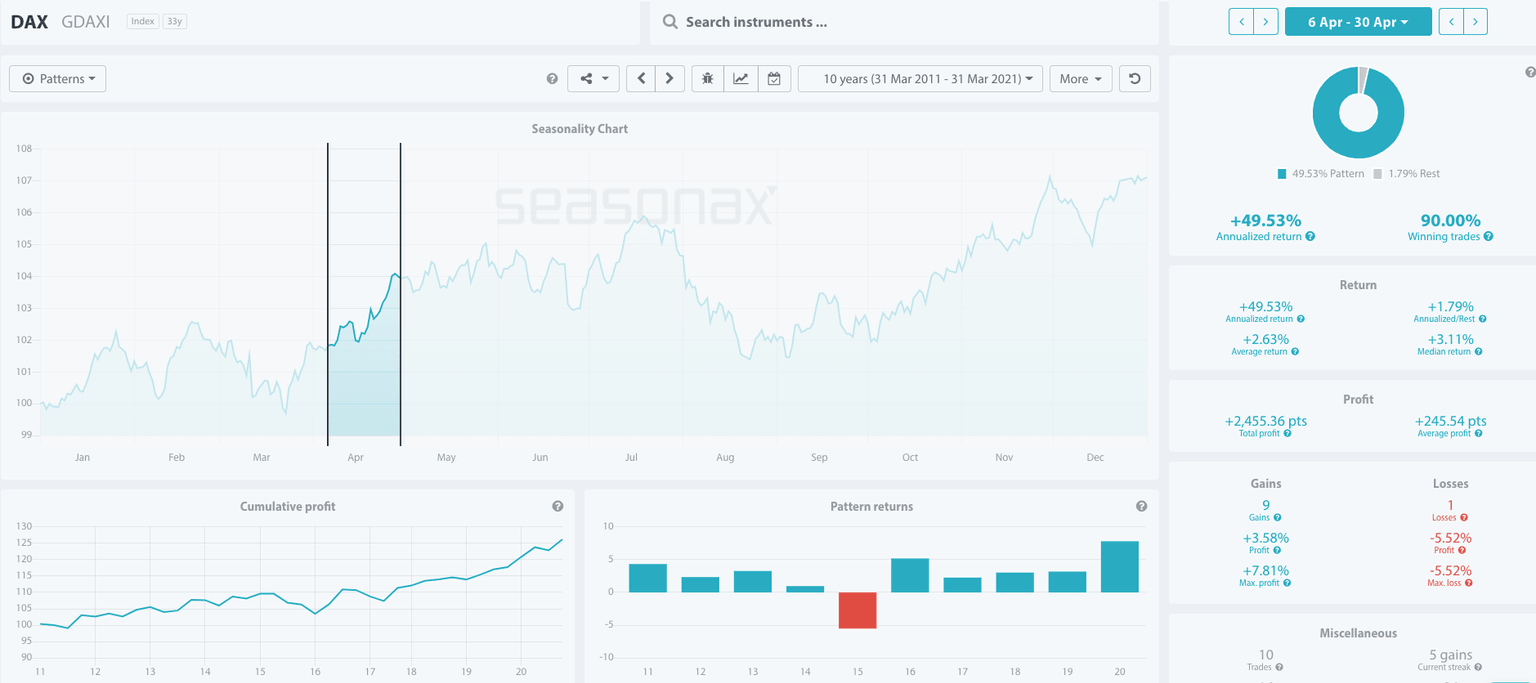

There is a general enthusiasm for German stocks despite the recent set back in terms of COVID-19 across the eurozone. Taking a look at the seasonals we have the following data from April 06 – April 30 over the last 10 years.

The DAX has been helped higher by the run-up last month in Volkswagen stocks as it makes a move for the electric car market. In fact, the rising DAX futures the day after further lockdowns were announced in France was an important affirmation that investors are happy to keep buying German stocks even with an impending third wave of infections.

The average gain has been +2.63% and the maximum profit was +7.81% last year. The only year of loss was in 2015 with a drop of -5.52%. The win ratio is 90% and you can see the further breakdown here of the max drop during those periods. Aside from the year of loss in 2015, the largest drawdown was -3.54% in 2014. So, the pattern is skewed to the upside for the DAX.

The only area of concern is further lockdowns across the eurozone. However, it hasn’t held the DAX back so far, so perhaps investors are just content to keep looking to the time when the virus is finally under control. Any return back down to 1460 would offer good value to buyers and provide a key area to define and limit risk. The upside surprise would be if there was a sudden increase in the speed of vaccinations across the eurozone. So, two way risks here along with the strong seasonals.

Author

Giles Coghlan LLB, Lth, MA

Financial Source

Giles is the chief market analyst for Financial Source. His goal is to help you find simple, high-conviction fundamental trade opportunities. He has regular media presentations being featured in National and International Press.