Stocks to add to the long-term portfolio in 2021 [Video]

![Stocks to add to the long-term portfolio in 2021 [Video]](https://editorial.fxstreet.com/images/Markets/Equities/list-of-stock-market-indices-21508951_XtraLarge.jpg)

Building a long-term portfolio requires deep research. Investors first of all have to look for industries that have the biggest potential growth in the coming years. I believe exploration and development of precious metals properties is one of such industries. Uncertainty and the possible beginning of depreciation in the global stock market add more positive to gold and silver miners. SilverCrest Metals is one of the strongest companies in this sector.

Fundamental analysis and basic company information

The company acquires, explores, and develops precious metal properties in Mexico. It primarily explores for silver and gold properties. The company’s principal property is the Las Chispas project that consists of 28 concessions totaling of 1400.96 hectares located in Sonora, Mexico. SilverCrest Metals Inc. was incorporated in 2015 and is headquartered in Vancouver, Canada.

Market Cap: CA$1.834b

Shares outstanding: 129.23m

The symbol in US stock exchange - SILV

The company’s short-term assets marginally exceed its short-term liabilities. A similar situation is with long-term assets and long-term liabilities.

SILV had and has no debts, while its equity keeps rising each year. With that in mind, we expect to see earnings and revenue growth in the coming few years.

However, the company did not report any dividends payouts. So, SILV stocks might be not suitable for investors focused on collecting dividends.

Technical analysis

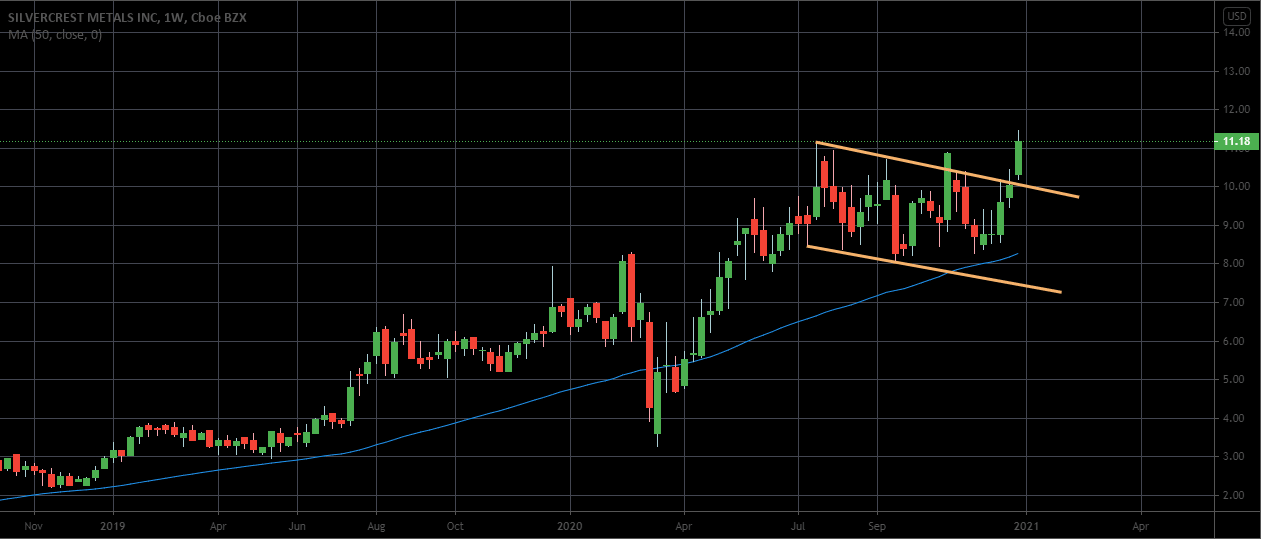

Cycles forecast building long-term bottom later this year. We have a clear flag pattern on the weekly chart and the price has already broken above the trendline last week. It is still too early to say if this breakout was real or false. We need to see more price action to confirm the signal. Consolidation around breakout level can build momentum to rally to new highs. Once and if the new uptrend is established, stocks can double or even triple in the coming 3 - 5 years.

SILV has fundamental and technical setups for a rally. It can give a good trading opportunity for skilled traders and investors in the coming few years. Slowdown of economic recovery after the coronavirus pandemic can trigger a long term rally of the whole sector.

Author

Inna Rosputnia

Managed Accounts IR

Inna Rosputnia is a stock and futures trader, portfolio manager and financial analyst that has been in the trading industry for the last 12 years.