Stocks meet fewer cuts

S&P 500 could only move sideways thanks to hot GDP, and the heavy buying into the close was equally decisively reversed. Tech had gone nowhere, not even industrials – just financials on still 61% Jun cut odds rose, but the overall sectoral perspective was a defensive, risk-off one.

The pause button is hitting the rally, and even before the core PCE data, Bitcoin (crypto were the only market open on Easter Friday) was pointing lower. Then the data came, largely in line with expectations, but that‘s still enough to question the pace of disinflation and progress towards the Fed‘s still valid 2% goal. Forget not that the oil upswing I had been calling for, this rise since early Feb, is to still show up in future inflation data.

Then Powell spoke, walking back his dovish FOMC conference performance to a degree, meaning we‘ll hear some higher for longer mantra again.

It‘s time to reveal Friday‘s prediction made to clients while intraday gains had been delivered, and the week‘s best opportunities likewise crowned.

(…) The goal for swing traders unwilling to ride the negative inflation surprise (core PCE would come in hotter as its key components of healthcare and financial services with insurance are to be quite hot, and less prominent housing weighting than in CPI wouldn‘t save core PCE from coming in hotter overall) is to be position-free if you don‘t want to tolerate high risk of weak entry to next week featuring at least two dozen ES points. Less rate cutting bets (key driver of yesterday‘s good showing in equities) equals risk-off moves, so be warned and ready.

In other words, some bearish gap next week, and the broadening rotations driving S&P 500 higher when Nasdaq relatively underperforms, yet Russell 2000 has been making it through the rate cut bets gyrations (from out of nowhere 7, then practically 0, settling for 3, waiting to see them dialed back to 2, only for 3 to remain), won‘t save the 500-strong index from getting checked.

So, we have expanding and not slowing down economy, Powell walking a tight rope in election year, the Treasury running sizable deficits outside of a recession, very much loose financial conditions, accommodative global liquidity (beyond ECB, SNB or PBOC without USDJPY getting smoked) and the great debate being not whether there would be more rate hikes in response to inflation developments, but whether the rate cutting cycle starts in Jun really for sure (no doubt about it now), and whether there would be 3 or only 2 rate cuts this year – all amid still soft landing mainstream expectations, and we know how positive for stock market returns the latest stages of soft landing hopes before these turns to „oops“ are.

Summing up, sizable downturn is unlikely to follow Monday‘s setback unless Powell gets truly hawkish and first rate cut pushed beyond Jul. We aren‘t yet at the top, but the air is to be getting thinner in the weeks and months ahead, because equities will get more selective, and the degree of earnings and guidance surprises of Q1, won‘t be repeated.

Will the Fed err on the side of inflation or on the side of growth? I continue to think they would pick growth and employment support policies. Watch consumer discretionaries, Russell 2000 and of course gold for signs of what‘s interpreted as dovish Fed and still bullish equities.

For now, capacity utilization rate isn‘t to sink the stock market, recession isn‘t being thrown around at all, and job market establishment survey data get all the attention – well worth watching with a longer time horizon in mind.

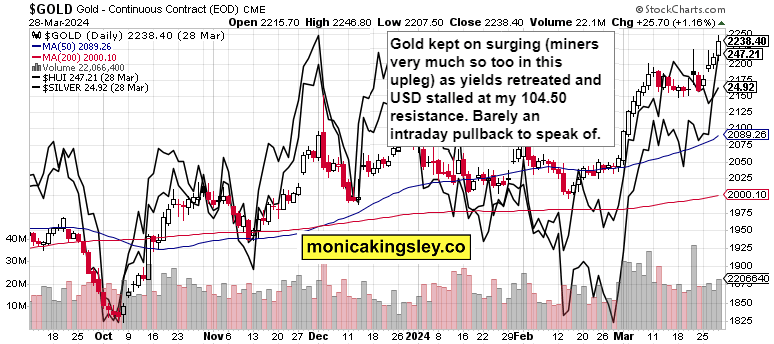

Gold, Silver and Miners

Source: www.stockcharts.com

Gold did shake off hot GDP with ease, and overcame first $2,230 and then $2,240 following intraday consolidations. The upswing won‘t be materially dialed back unless Powell starts tightening the screws (unlikely) – intraday flushes are still to be bought as USD sits on 104.50 resistance, and I don‘t see much fresh hawkishness propelling it higher. With 10y yield rising to 4.59, watch out for a gold range to develop, with $2,230 being the short-term floor not in immediate jeopardy.

Crude Oil

Source: www.stockcharts.com

Oil likewise as my key bullish pick did well, conquering $82.50 on rising volume and no selling into the close. Black gold would be more resilient to 10y interest rate increases, which are sure to follow Powell‘s speech. Note how well energy is still doing, and will be continuing so.

Copper is a bit off the radar screen, and undeservedly so – its range above $3.98 invites for buying into weakness – and given China‘s appetite and stocks situation, we‘re very unlikely to see $3.85 in the weeks and months ahead.

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.