Sterling wavers as UK retail sales rises for fourth month

The British pound was little changed as traders reacted to the mixed retail sales numbers from the UK. According to the Office of National Statistics (ONS), the UK’s headline retail sales rose for the fourth consecutive month in August. The volume of sales rose by 0.8% from July and by 2.8% on a year-on-year basis. The core retail sales, which excludes the volatile food and energy products, rose by 0.6% in August and by 4.3% on an annualised basis. These numbers signal that the UK recovery is slowing down as the number of people of out of work continues to increase. The retail sales numbers came a day after the Bank of England (BOE) delivered its rates decision.

The euro is little changed today as traders react to the mild economic data from Europe. Earlier on, data from Germany showed that producer prices fell from 0.2% in August to 0.0% in August. That pushed the PPI down to -1.2% on an annualised basis. Meanwhile, in Italy, data from the statistics bureau showed that industrial new orders rose by 3.7% in July while industrial sales rose by 8.1%. Other data from the ECB showed that the current account fell from 20.7 billion euros in June to 16.6 billion euros in July.

The Canadian dollar was also little changed as traders reacted to the Canadian retail sales data and relatively higher crude oil prices. According to the statistics office, the headline retail sales rose by 0.6% in July, a sharp decline from the previous month’s increase of 23.7%. The core retail sales declined by 0.4% in July after rising by 15.5% in June. Further data showed that Canadian wholesale sales rose by 4.3%% while the new housing price index rose by 0.3%. The Canadian dollar also reacted to the higher oil prices as Brent and West Texas Intermediate (WTI) rose by 0.40% and 0.45%, respectively.

GBP/USD

The GBP/USD pair is trading at 1.2988. On the four-hour chart, the price is below the 38.2% Fibonacci retracement level. Also, the price is forming an ascending triangle, with the resistance at the 1.3000 level. The RSI, on the other hand, has continued to rise and is currently at the 58 level. Therefore, the price is likely to continue rising as bulls attempt to move above the resistance level at 1.3000.

EUR/USD

The EUR/USD pair is trading at 1.1845. On the daily chart, the price is slightly above the lower side of the ascending channel. The price is also along the middle line of the Bollinger Bands. Also, the Relative Strength Index (RSI) has started declining, which is a sign of divergence. Therefore, the pair is likely to remain in the current channel during the American session.

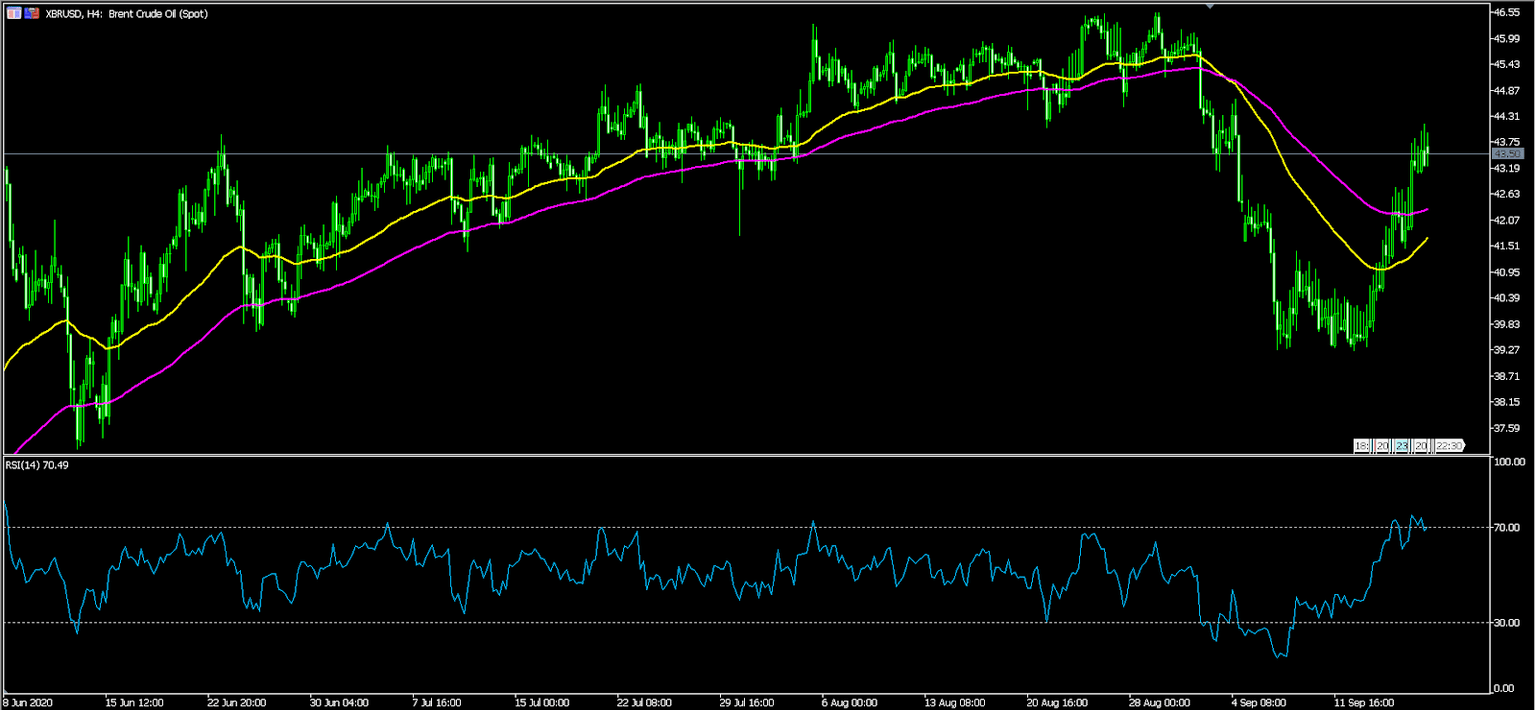

XBR/USD

The XBR/USD pair climbed to an intraday high of 44.21 as traders reacted to the emerging supply concerns. On the four-hour chart, the price is above the 50-day and 100-day moving averages while the RSI has risen to the overbought level. The price also seems to be forming a bullish pennant pattern, which is usually a bullish sign. Therefore, the price is likely to continue rising as bulls aim for the next resistance at 45.00.

Author

OctaFx Analyst Team

OctaFX

OctaFX is a market-leading forex broker, providing personalised forex brokerage services to customers in over 100 countries worldwide.