Sterling outperforms in 2024, however, downside is a risk for 2025

While 2023 was a year for raising rates, the main theme that markets were focussed on in 2024, was when rate cuts would begin, with some suggesting that the Fed could start reversing course in March of this year, with the Bank of England following soon after.

This came across as optimistic and mispriced in the extreme, and so it proved given that at the time the US economy was still performing well, while in the UK, inflation was still well above 6%.

This time last year I pointed out that it was more likely that the ECB might be first out of the traps perhaps as soon as the end of Q1, with the Bank of England soon after, with the Fed last to start its cutting cycle.

As it turned out the idea that the ECB would be first to cut was a correct one as Christine Lagarde announced the first of 4 rate cuts back in June, even if the timing was off by a few months, with the Bank of England following in August and the Fed with a jumbo 50bps cut in September.

As for the UK, market pricing in December last year was for 75bps from the Bank of England by June which in the end was way off, along with a lot of other market pricing, which as 2024 got underway soon got priced out very quickly as the UK economy got off to a strong start, along with the US economy.

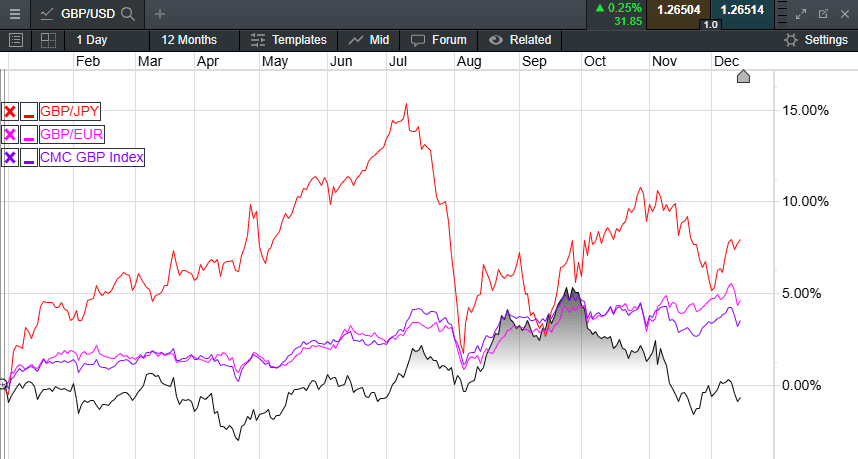

This repricing saw both the US dollar and the pound make a strong start to the year, with the US dollar surging to a 40-year high against the Japanese yen.

While the yen was melting down against the US dollar, the pound managed to hold its own in the first half of the year, before peaking in October just above 1.3400 and a 2 and a half year high.

Since those summer peaks we’ve undergone a bit of a pullback for the pound with the darker economic outlook serving to play a small part of a strong first half of the year.

The biggest pullback came against the Japanese yen on a combination of intervention from the Bank of Japan, but also some sterling weakness in the lead-up to the October budget, along with a rebound in the US dollar which came about as a result of the November election, and which prompted widespread US dollar strength across the board.

This bounce in the US dollar manifested itself quite nicely against the euro, which makes up 57% of the US dollar index, and saw the euro sink close to a 2 year low at 1.0333 in November, before rebounding.

GBP performance year to date 2024

Source: CMC Markets

What’s next for the pound?

The main question for 2025 is how many more rate cuts are we likely to see, having seen the rate cut cycle get underway in the summer and whisper this quietly, whether the next move in rates might be higher?

There are some small corners of financial markets social media where the idea is being bandied about even though the market isn’t pricing it yet.

Nonetheless we have seen the markets reprice how many more rate cuts might be coming, and while the Bank of England seems to think we’ll see the base rate back at 3% by the end of next year, they also say that inflation won’t fall back to target until 2027.

For 2025, the central bank will not only need to keep its focus on prices, but will also have to contend with a slowing economy at a time when wage inflation could stay sticky for longer, and job losses could start to rise sharply towards the middle of next year.

The recent jump in wage growth to its highest levels this year, along with a sharp drop in hiring speaks to the challenges facing the Bank of England next year, and could make it extremely difficult for the monetary policy committee when it comes to cutting rates as much as they would like in 2025.

So, what does that mean for the pound against the USD, and the euro?

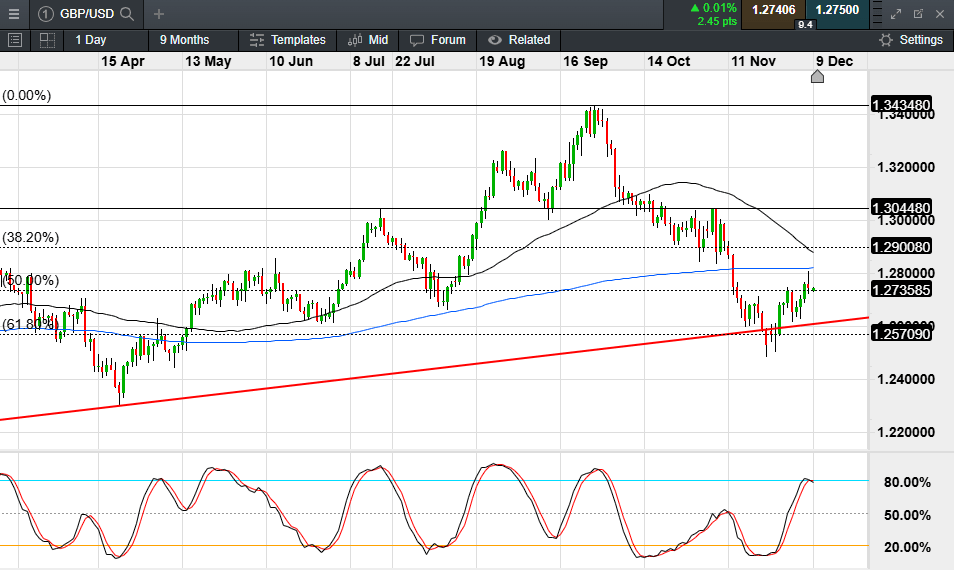

Against the US dollar the pound does appear to be struggling somewhat after its September peaks above 1.3400.

The move up from the October 2023 lows at 1.2050 topped out at 1.3435 in September before slipping back to 1.2485 last month in the wake of the October budget. We’ve seen a modest rebound since then but haven’t been able to recover back above the 200-day SMA which currently sits at 1.2825.

We need to see a move back above this long-term average to stabilise, or risk a return towards the recent lows and possibly the 1.2000 area, on a break below 1.2480.

GBP/USD daily chart

Source: CMC Markets

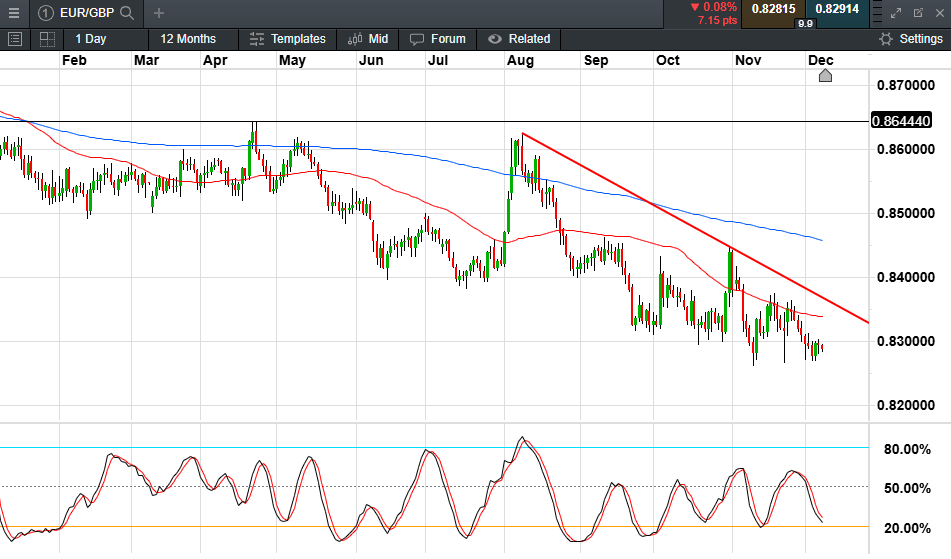

As for EUR/GBP the pound has performed much better, although that probably has more to do with the fact that whatever the UK’s problems are, the euro area’s problems are much worse, with no clear consensus on how to remedy them, with euro weakness accelerating sharply in August.

EUR/GBP daily chart

Source: CMC Markets

The 0.8250/60 area is the key support for the euro against the pound. If that area gives way, then we could see a return to the March 2022 lows at 0.8200, and then below that we’re talking pre-Brexit vote levels.

Who would have predicted that all those years ago when we were being told that we were heading for disaster, and that the pound would head to parity against both the US dollar, as well as the euro.

It is true that we did get close to parity against the US dollar, however as far as the euro is concerned parity seems a long way away now, and in 2025 could get further away still.

Author

Michael Hewson MSTA CFTe

Independent Analyst

Award winning technical analyst, trader and market commentator. In my many years in the business I’ve been passionate about delivering education to retail traders, as well as other financial professionals. Visit my Substack here.