Sterling and BoE preview

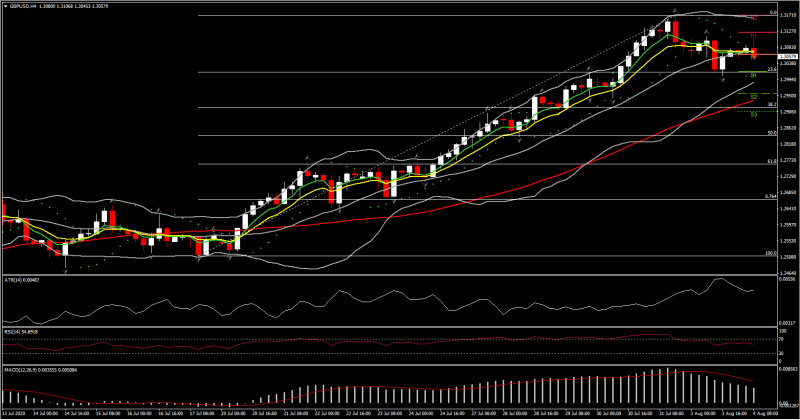

Sterling put in a rare week of outperformance last week, printing a new 5-month peak against the USD, 3-week highs versus the EUR and 8-month highs against the JPY.

There are some positive factors with regard to the UK. One is the pick-up in the pace of economic recovery, as evidenced by;

the much stronger than forecast preliminary July PMI data (outperforming Eurozone PMIs and showing the private sector to be back in expansion for the first time since lockdown)

and the CBI’s July distributive sales report, which flagged a near full recovery in the retail sector (by rising to a +4 headline, up from -37 in June and the best reading since April last year, with sales in upcoming months seen at near seasonal norms).

Helping the Pound last week were also signs that have led markets to factor in improved odds for an EU-UK trade deal, with a number of sourced press reports suggesting that discussions are going better than the official line suggests.

An FT article last week asserted that the EU is willing to drop its demand that the UK accepts EU state-aid rules and oversight of the ECJ (European Court of Justice), and that “while further work is needed, a middle ground is clearly emerging”. This followed a Reuters report earlier in the week that EU trade negotiator Barnier believes UK PM Johnson wants a deal, despite the UK government’s often repeated assertion that it’s willing to take the UK out of the single market at year-end without a new trade deal if it doesn’t get what it wants.

This week meanwhile, the UK currency has been directionally more neutral against the EUR and most other currencies. Cable has made a rebound peak at 1.3109 after setting a 5-day low at 1.3004 yesterday. Despite the fact that the Pound outperformed last week, it still registers as the weakest of the main currencies on the year-to-date, and by some distance in trade-weighted terms, while recent Dollar underperformance had been somewhat flattering the Pound.

There is now a summer hiatus in negotiations, which will resume in the week of August 17th. Narratives last week had also been noting a pick-up in the pace of economic recovery in the UK, while localized lockdowns, including in the economically-important Manchester area, and the continued media-driven “feardemic,” is clouding the outlook for the UK economy at a time when government pandemic business support measures have started to unwind (compensation for furloughed workers has been reduced).

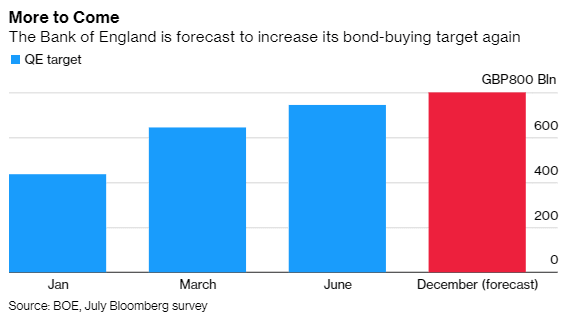

The BoE reviews its policy this Thursday, where a no change is widely anticipated, alongside what will no doubt be a reassuringly strong commitment to maintain ultra-accommodative policy. Additionally, the key theme will be any discussion in regards to the effective lower bound (ELB) and negative interest rates, and future path of QE and resumption of bond buying.

In the last meeting there was a split of MPC members votes for the decision on the policy rate, by 8-1 in favour of expanding the QE program. However this time there are splits over the economic outlook with Chief Economist Andy Haldane being the optimistic one while Silvana Tenreyro says the bounceback will probably be limited, however there is less division on monetary policy, even though Haldane voted against the latest round of quantitative easing, preferring to wait for more evidence.

However of most interest is the release of its quarterly policy review with revised growth and inflation forecasts.

Author

With over 25 years experience working for a host of globally recognized organisations in the City of London, Stuart Cowell is a passionate advocate of keeping things simple, doing what is probable and understanding how the news, c