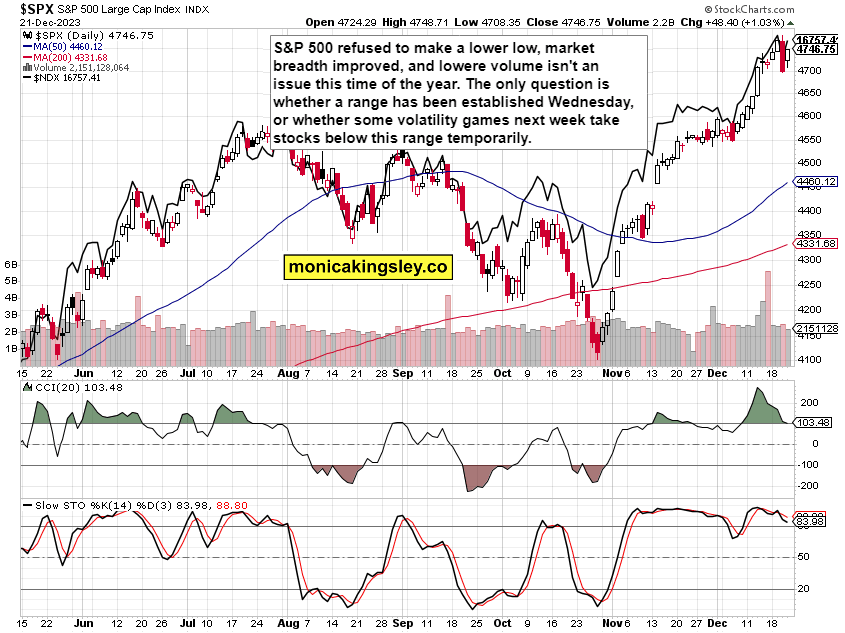

SPX range established, or not

S&P 500 reversed higher into the GDP announcement, yet didn‘t keep the advance following that release. One more decline to establish a higher low, and only then rising steadily through aftermarket. Broad market breadth, no warning sign to speak of – apart from VIX the trouble maker, which was the only one that woke up Wednesday and saw its upswing continued yesterday. At 14.28 though, I called in our intraday channel for its decline, and it did close below 13.65.

So much for the only outlier as neither the dollar nor bonds have spooked the markets really, and today‘s core PCE is likely to show continued disinflation and come below the expected 0.2% - at 0.1% probably. That would mark another good figure (thanks to the way its composition is construed) causing S&P 500 to swing higher in a „inflation has been defeated and rates can be cut in Mar“ celebration. Gold is already behaving as if we‘re there, but let‘s dive more into the stock market prospects posted this European morning in our intraday channel.

Let me wish you Merry Christmas spent with your closest ones in peace if you celebrate – and if not, then take the opportunity for goodness in this world. The next week, I‘ll be issuing daily analyses only in case market circumstances dramatically change – I‘ll as near as always to the action. Happy holidays!

Let‘s move right into the charts – today‘s full scale article contains 3 of them, featuring S&P 500, precious metals and oil.

Tired of seeing those red boxes instead of way more valuable information? Try the premium services based on what and how you trade.

S&P 500 and Nasdaq outlook

Neither yesterday was 4,735 reached, and the VIX turmoil is dying down. Sectoral choices are likewise unaffected, and the more time passes with Wednesday‘s range being respected, the more this sticks and the factors at large (trend and macro) are to prevail in Jan.

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.