SPX flush, told you

S&P 500 again offered just one intraday rip that didn‘t change the market structure or momentum – check yesterday‘s packed video as I featured prominently the short squeeze angle on half baked news (aka not solving definitively the tariff matter at hand, leaving uncertainty) and the necessity to go into taking fresh trades only after deciding what kind of trader you are (what you want to capture and what are you willing to risk in the given opportunity as that‘s what defines your position sizing, respecting your rules on conservative percentage of account exposed in any given trade).

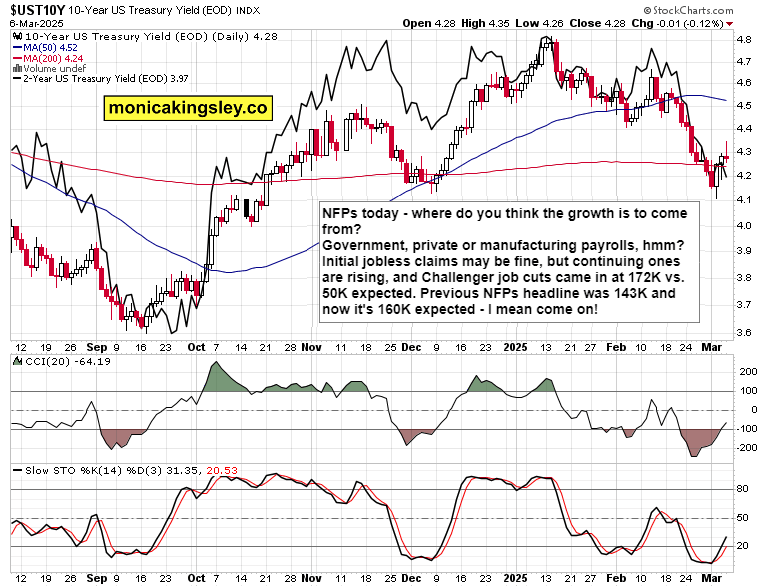

Today‘s packed and fast video features NFPs breakdown (the headline figure cam in at 151K in the end, surprisingly good – clients were ready for a volatile initial reaction, and check for yourself what‘s unfolding in risk taking universe on good incoming data. I haven‘t changed my tune and clients benefit from the short calls, and also from yesterday‘s quick Ellin‘s counter trend play…

More than the NFPs figure, it‘s the market reaction what matters – and even if the data weren‘t disastrous, equities aren‘t buying it. What are they waiting for if this isn‘t that good? Faded. Rhetorical question,

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.