SPX bottoming meets tariffs flush

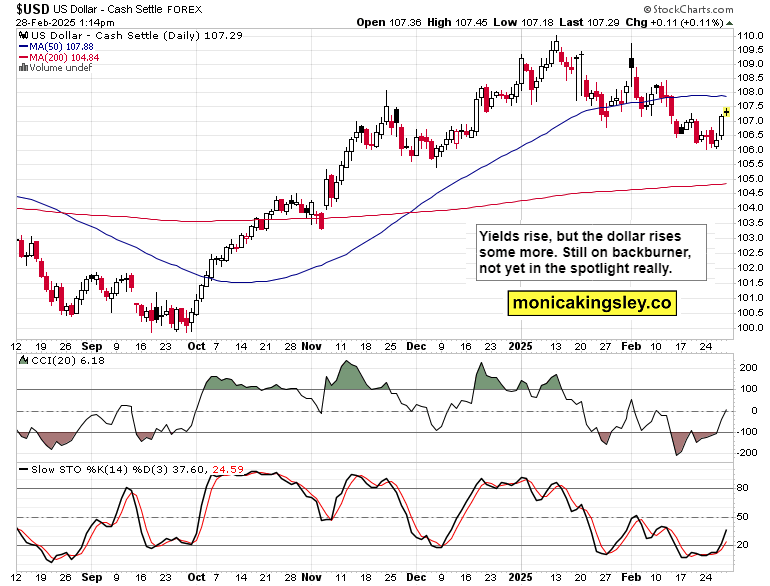

S&P 500 made it through NVDA earnings, made it through not really stagflationary data Thursday, but didn‘t survive the tariffs announcement – there was a reason why I featured in yesterday‘s article both yields and USD. The tentative bottom amid mixed SPY breadth signs before the opening bell, was hit hard and invalidated.

Global trade uncertainty through 25% Mexico and Canada tarrifs kicking in early Mar, and 10% more on China, with 25% on EU waiting in the wings – that introduces much uncertainty and darkens corporate profits outlook. Thus, high beta names, tech were hit so hard since the news was announced New York early afternoon, technicals overpowered.

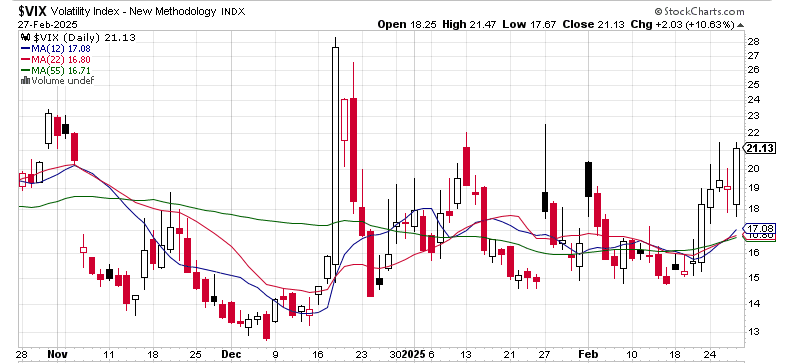

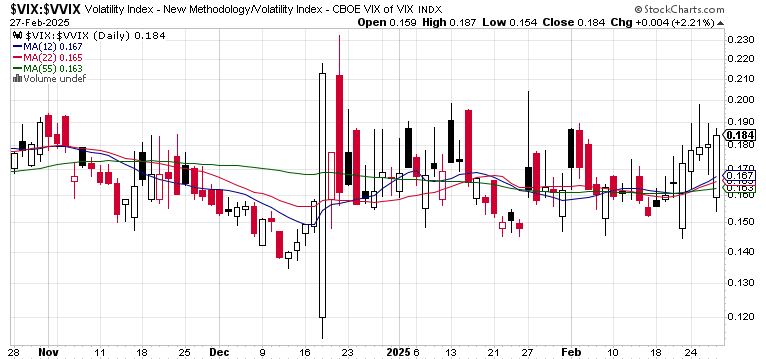

Where does it leave us in bottom searching – is it the time to pick a falling knife, has it fallen and hit the ground allowing for easy picking? In today‘s packed and fast video, I introduce you to volatility-based bottom picking approach, revisit briefly the yen carry trade (it‘s not about Japan still), and examine candle by candle how S&P 500 had been trading yesterday – the practical lessons for us traders and investors you don't want to miss.

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.