SPX bottom near?

S&P 500 reversed to the downside on high volume, and the open short position became profitable from the get-go. No matter the premarket jubilation driven by retreat in bond yields, the bottom is clearly not yet in, and it‘s a matter of both technicals and hawkish monetary policy guidance. The bets on the Fed to back off tightening and go at least neutral, appear very premature – the plan is still to raise by 75bp in Nov and by 50bp in Dec with 25bp more early 2023, and Evans saying in effect the central bank is moving too fast without appreciating the effects of tightening already in, is a lone voice. Now, if I were to hear noises suggesting only 50bp in Nov or 25bp in Dec, that would change the picture.

For now though, the tightening is felt mostly abroad, driving the surge in the dollar and associated Treasury sales by foreigners who need to support their currencies/make commodity purchases in dollars from Europe, UK to China and Japan. The Fed shrinking its balance sheet thus puts additional strain on long-dated yields which haven‘t yet found a bottom as I‘ve argued in prior Monday‘s extensive analysis. The BoE intervention jubilation proved short-lived, and even if the dollar is in corrective mode, it didn‘t trigger a lasting rebound in either stocks or bonds.

This could (and in my opinion would) change on the upcoming CPI next Thursday (13th), which would signal to the Fed that inflation is somewhat down (signs of a peak) – a nice Q4 rally in stocks and bonds can develop, but it won‘t be sustainable or lasting just like the summer rally wasn‘t. No matter the bad PCE deflator data (remember that the core figure excludes food and energy), the probability of the Fed maintaining its highly restrictive course, went actually down on a week-to-week basis – the worry clearly is that the Fed is approaching the moment when it breaks something (i.e. the tightening cure is starting to get heavier on negative effects than inflation/inflation fear itself in market‘s mind), and the good unemployment claims show that it won‘t be breaking in the States. This also helps explain the late week precious metals resiliency.

The direction in stocks until the reprieve later in Oct, is though down, and the downside risks are accentuated – but what would facilitate the upcoming rally? Stabilization in yields at the long end of the curve is a precondition, and that‘s when some bullish divergencies and weakening selling pressure in stocks would be seen. The conditions for a rebound are slowly materializing (including VIX making lower highs), and it‘s up to the buyers to act on them as Oct draws to its close. That would be the good finish to the year (Santa Claus rally) before the worldwide recessionary winds stiffen next year.

Remember that it takes easily a year for the rate raising effects to play out, and this tightening pace was fastest since the mid 1990s when Greenspan took Fed funds rate from 3% to 6% - and we‘re hearing Mester still say that the current one (4.5% Fed funds rate at year end is projected by the way) isn‘t yet restrictive, and I told you last week about their plans to keep it at a slightly restrictive level for a longer time in a bid to avoid tipping the economy into recession.

This has obviously negative implications for commodities, which wouldn‘t thrive in an economic decline the way precious metals would. This concerns even crude oil facing modest headwinds – but not of the copper magnitude. A period of instability in the markets is upon us shortly, and it‘ll play itself out in currencies and sovereign bonds first of all, affecting the rest of the asset classes next.

Today‘s analysis has been one of those extensive ones – keep enjoying the lively Twitter feed serving you all already in, which comes on top of getting the key daily analytics right into your mailbox. Plenty gets addressed there, but the analyses (whether short or long format, depending on market action) over email are the bedrock, so make sure you‘re signed up for the free newsletter and that you have Twitter notifications turned on so as not to miss any tweets or replies intraday.

Let‘s move right into the charts – today‘s full scale article features good 6 ones.

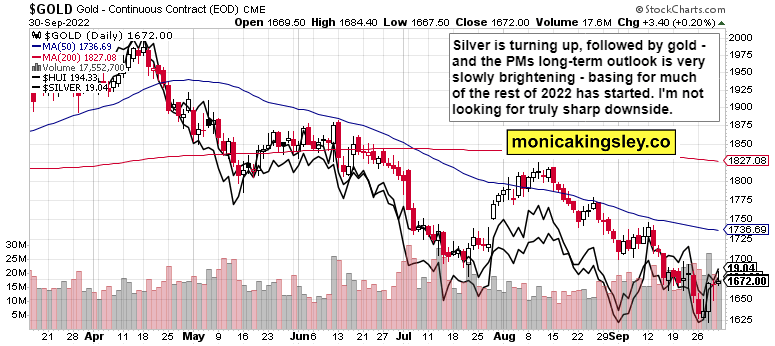

Gold, silver and miners

Silver is likely to keep doing better than gold, the physical market suggests still. Crucially, miners are hinting at ongoing accumulation – the heavy volume and miners to gold ratio are promising even though the metals themselves haven‘t yet reacted much.

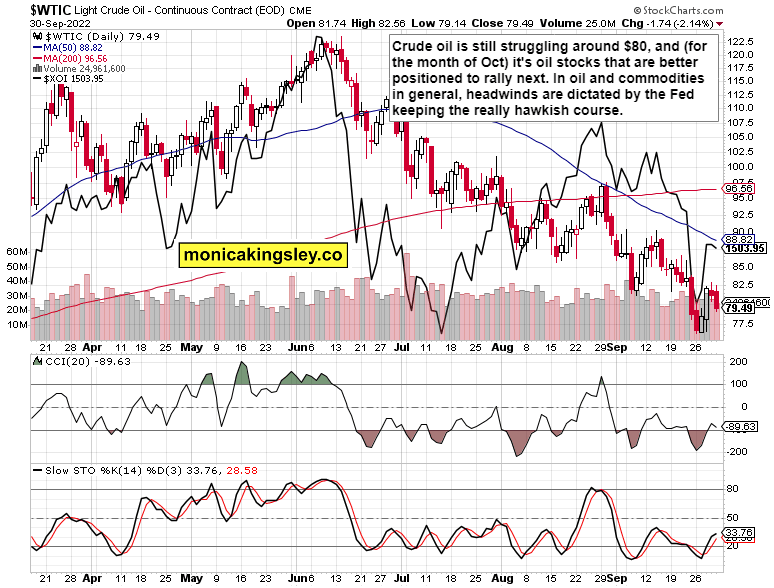

Crude oil

Crude oil still has a fine opportunity to rise on the real economy not deteriorating too badly (no matter order cancellations and inventory build ups beyond WMT or NKE – there simply isn‘t evidence of crude oil demand destruction in the States). Demand from China, end of SPR drawdowns and onset of winter season remain the wildcards and bullish arguments that are balanced out against weakening real economies around the world – the hypothesis of a nice rounded bottom in WTIC being carved out, is still in play – and further supported by the Oct 05 OPEC+ meeting where 1mln barrels a day production cut could be agreed. Oil stocks though are to weather the storms stretching to 2023.

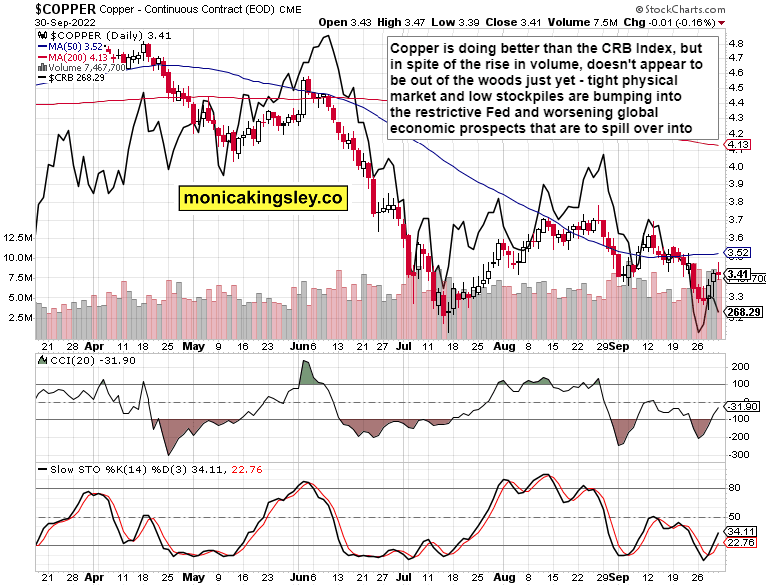

Copper

Copper upswing appears to be sold into, and coinciding with the upcoming instability in stocks and bonds. The consolidation is receiving bearish undertones.

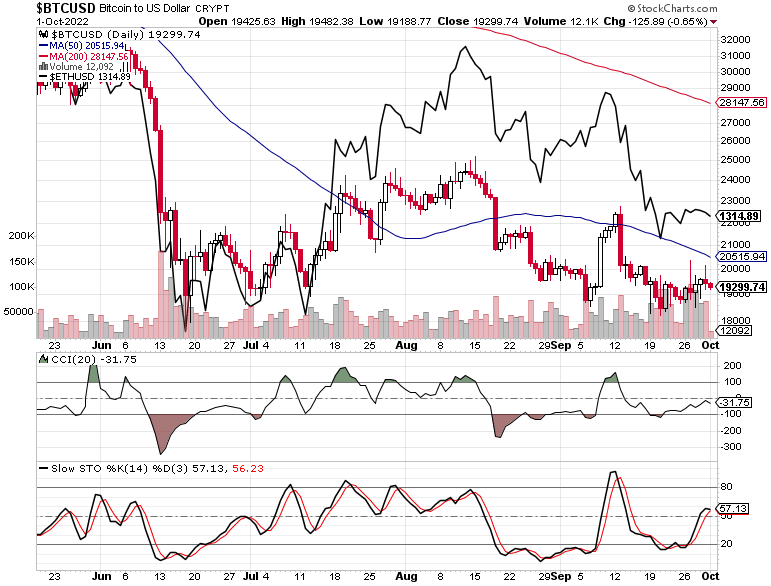

Bitcoin and Ethereum

Cryptos aren‘t surging really on the premarket retreat in yields, volume isn‘t swinging too much higher either. Until the bears reappear, Bricoin and Ethereum would muddle through, lagging behind stocks in appreciation on a daily basis (as regards today).

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.