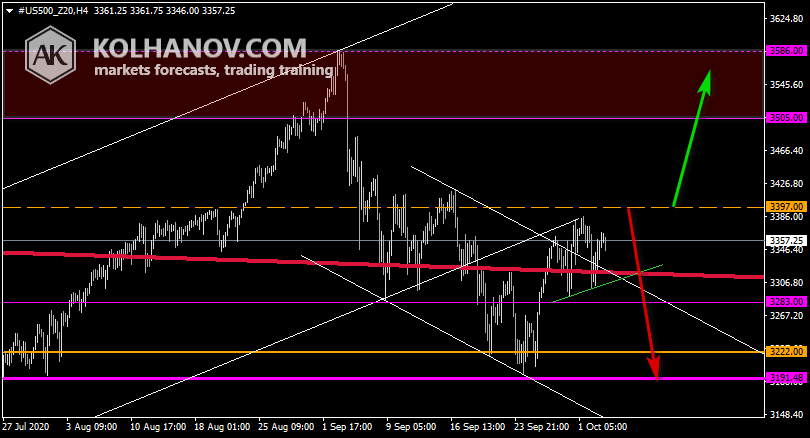

S&P 500: Downtrend expected to continue while it trades below 3505

Thursday Forecast

Uptrend scenario

An uptrend will start as soon, as the market rises above resistance level 3505, which will be followed by moving up to resistance level 3586.

Downtrend scenario

The downtrend may be expected to continue, while market is trading below resistance level 3505, which will be followed by reaching support level 3420 - 3397 and if it keeps on moving down below that level, we may expect the market to reach support level 3283.

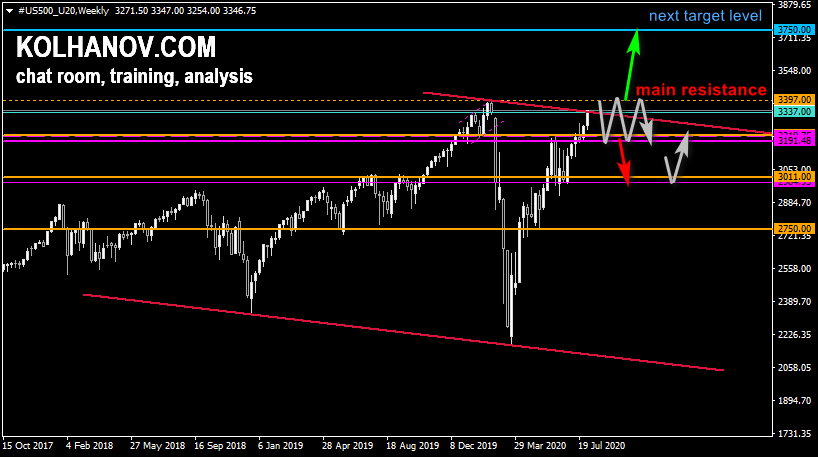

This/Next Week Forecast (October 12 - 16, 2020)

Uptrend scenario

The uptrend may be expected to continue, while market is trading above support level 3397, which will be followed by reaching resistance level 3505 and if it keeps on moving up above that level, we may expect the market to reach resistance level 3586.

Downtrend scenario

An downtrend will start as soon, as the market drops below support level 3397, which will be followed by moving down to support level 3283.

Previous week S&P 500 forecast chart

Fundamental Analysis

Slowdown in labor and manufacturing sectors showing fair price on the level 3000.

Long-Term Forecast (Quarter III: July - September, 2020)

Uptrend scenario

The uptrend may be expected to continue in case the market rises above resistance level 3397, which will be followed by reaching resistance level 3750.

Downtrend scenario

An downtrend will start as soon, as the pair drops below support level 3191, which will be followed by moving down to support level 3011.

Author

Anton Kolhanov

Anton Kolhanov

Anton Kolhanov is a trader and an analyst. He started to study the Forex market in 2003.