S&P 500: First support at 4120/10

Emini S&P 500, Nasdaq, Emini Dow Jones

Emini S&P JUNE through minor resistance at the new all time high of 4209/11 to the next targets of 4220/22 & 4231/33 reaching 4238. However prices then suddenly collapsed leaving a negative bearish engulfing candle.

This is a warning to bulls – coupled with a diverging stochastic, this could signal an over due correction to the downside.

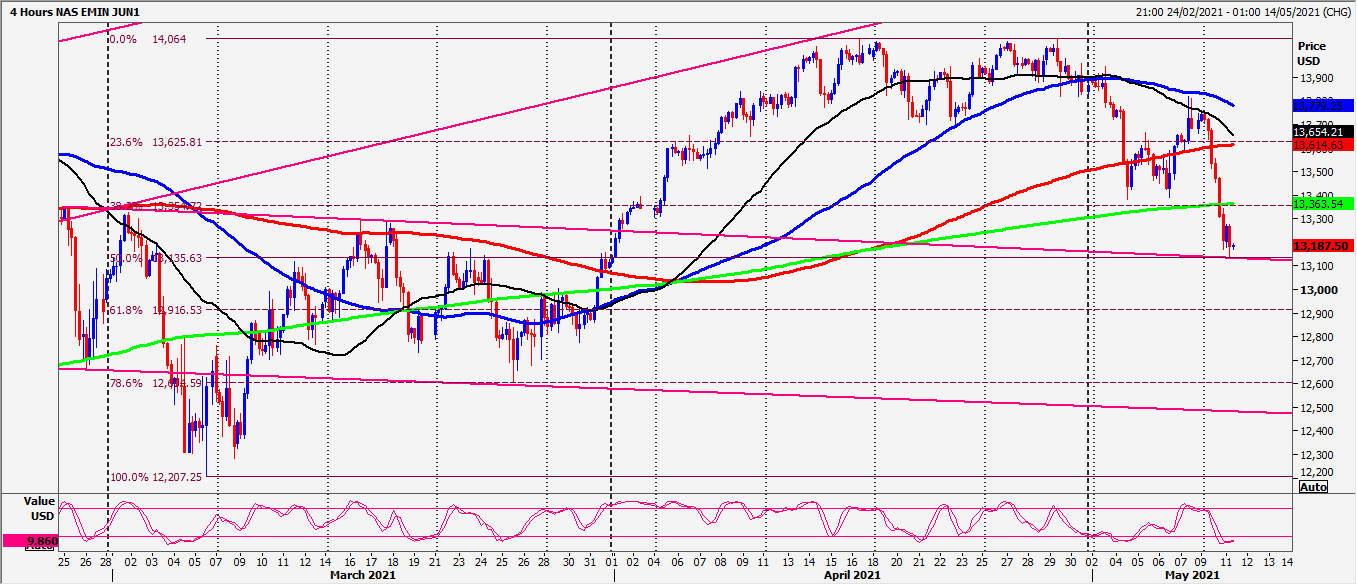

Nasdaq JUNE breaking key support at 13350/250 which can accelerate moves to the downside initially targeting 13140/130 & 12970/930.

Emini Dow Jones the strongest of the 3 & we continue higher to the next targets of 34630/660, 34720/770, 3490/950 & almost as far as 35050/100.

Daily analysis

Emini S&P first support at 4120/10. A break below 4100 signals further losses to 4083/80, perhaps as far as 4050/45.

First resistance at 4165/75. Above 4185 opens the door to 4200/10 before a retest of the all time high at 4235/38. Next target is 4251/58 & 4275/78.

Nasdaq break of key support at 13350/250 can accelerate moves to the downside initially targeting 13140/130 & 12970/930. Below 12900 risks a slide to 12650/600.

First resistance at 13350/380. Above 13400 is more positive for today initially targeting 13550 then 13650/700.

Emini Dow Jones topped at the big 35000 level. first support at 34500/460 today. Below 34400 risks a slide to minor support at 34190/160. Further losses target 34000/33950 but we expect very strong support at 33730/660. Longs need stops below 33590.

Minor resistance at 34730/750 before a retest of the all time high at 34950/35000. Bulls then need a break above 35050 to target 35380/430.

Chart

Author

Jason Sen

DayTradeIdeas.co.uk