Silver’s doing exactly what it was likely to do

As I warned my subscribers, silver was likely to form a double top, with the second high slightly above the previous one.

That’s what’s taking place right now.

Breakout or fakeout? The $51–$52 question

Silver just jumped above $50, meaning that it’s already above the first top. The question now becomes:

How high is too high for the white metal?

Given the momentum and the breakout that we just saw (to new all-time highs), and knowing silver’s tendency to form fake-breakouts, it wouldn’t be surprising to see silver top at about $51 - $52 before surprising almost everyone and sliding.

This means that we might not have seen the top today just yet. It also means that my previous comments on silver – and other markets – remain up-to-date:

Probably forming a double-top. The second top is likely to be slightly above yesterday’s one.

Here’s why:

Silver’s 2011 top was a double top. The second high was slightly above the first one.

The second top formed in less than a week after the first top had formed.

Silver’s 2008 top was also a double top. The second high was slightly above the first one.

The second top formed in a bit more than one week after the first top had formed.

Can 2008 and 2011 really tell us anything about what’s likely to happen now? Even though both happened so long ago and the geopolitical and economic environment is so different?

Of course. The fear and greed that make people react similarly to similar price moves continue to work in the same way regardless of geopolitics.

Besides, silver topped in a double-top manner in pretty much all recent cases.

While silver’s long-term upside is enormous in my view (and those that had bought silver for their retirement are likely to be extremely happy with the results), it still looks like it needs to decline significantly before truly breaking out and soaring tens of dollars higher.

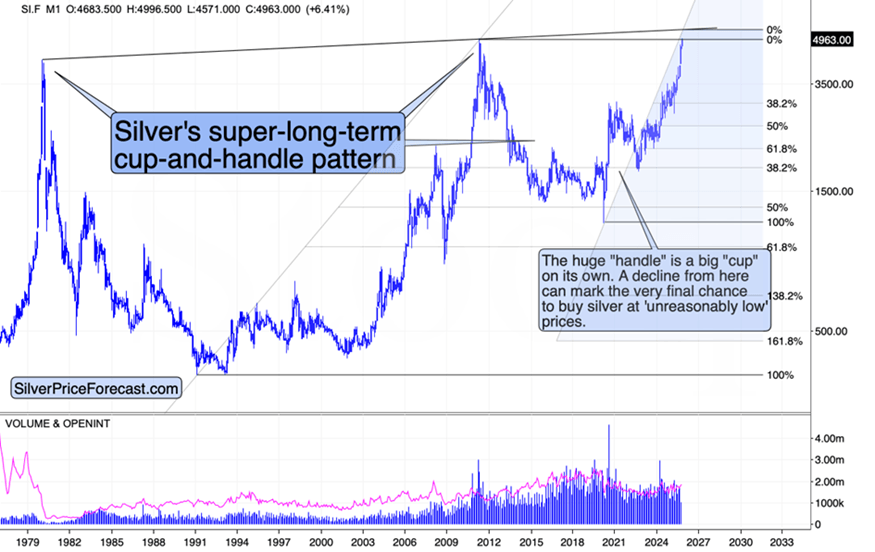

Speaking of silver’s long-term upside, it’s clear not only based on fundamentals, but also given silver’s very long-term technical picture.

Yes, silver is likely to decline along with gold and miners in the following weeks/months, but after that…

After that it’s likely to soar in an unprecedented manner.

Silver formed a very-long-term cup-and-handle pattern, with the 1980 – 2011 performance being the cup and the 2011-now part being the handle.

Interestingly, the 2011 – now performance is a cup of its own kind. We have a cup that’s actually a handle of the bigger pattern.

This means that when we get this decline and the final handle is formed, we’ll then be likely to get a spectacular rally based on both patterns. How high could silver soar then? I don’t give you the exact number right now, but $100 is on the lower end of the likely values.

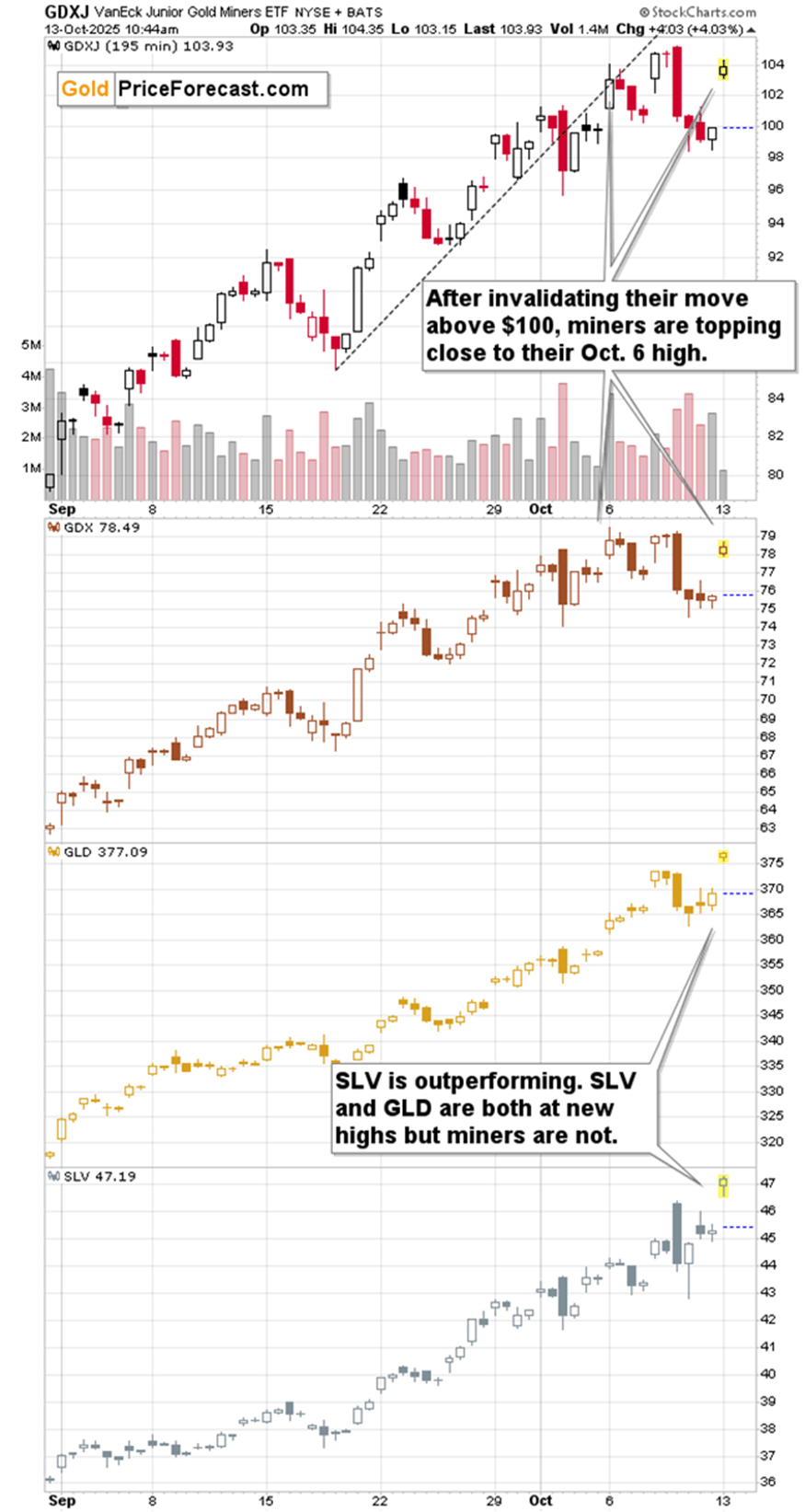

Again, a bigger decline is likely to take place earlier, and today’s performance of mining stocks confirms that.

Caution ahead: The rally’s final stretch?

Gold, silver, and miners are up, but while gold and silver are up to new highs, mining stocks are not – they are only testing their Oct. 6 high – nothing more.

The miners are underperforming while silver is outperforming – that’s a classic behavior that we see close to the tops.

Now, as I wrote earlier, we might have the final top this week or in the week – at least in silver (and gold).

Will we get miners at new highs as well? That’s possible, but I doubt that – please note that based on Friday’s close, October was a down month for both: GDX and GDXJ.

In my view, this is the period when it’s dollars to the upside and tens of dollars to the downside in case of the mining stocks.

And silver? It’s likely to soar, but not without declining first.

Of course, the above is up-to-date at the moment of writing these words, and the outlook can change if silver manages to successfully confirm this breakout. I strongly suggest that you stay informed about the latest news on the precious metals market right now, even if that was not normally your focus area.

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

Author

Przemyslaw Radomski, CFA

Sunshine Profits

Przemyslaw Radomski, CFA (PR) is a precious metals investor and analyst who takes advantage of the emotionality on the markets, and invites you to do the same. His company, Sunshine Profits, publishes analytical software that any