Silver prices hit critical support amid market uncertainty

-

The recent dip in silver price has taken silver to a critical support level.

-

The upcoming Federal Reserve interest rate decision adds complexity to the silver market.

-

Geopolitical tensions in the Middle East have increased demand for silver.

The release of better-than-expected US JOLTS Job Openings data has significantly impacted silver prices, causing a dip below the $28.00 mark. The stronger-than-anticipated job openings, around 8 million, have bolstered the US Dollar (USD) and led to a rise in the US Dollar Index (DXY) and 10-year US Treasury yields. This has created downward pressure on silver, as a stronger dollar makes commodities like silver more expensive for holders of other currencies. The anticipation of the Federal Reserve's interest rate decision, with expectations of a potential rate cut later in the year, adds further complexity to the silver market. Investors are closely watching the Fed's guidance, as dovish signals could weaken the dollar and potentially support silver prices.

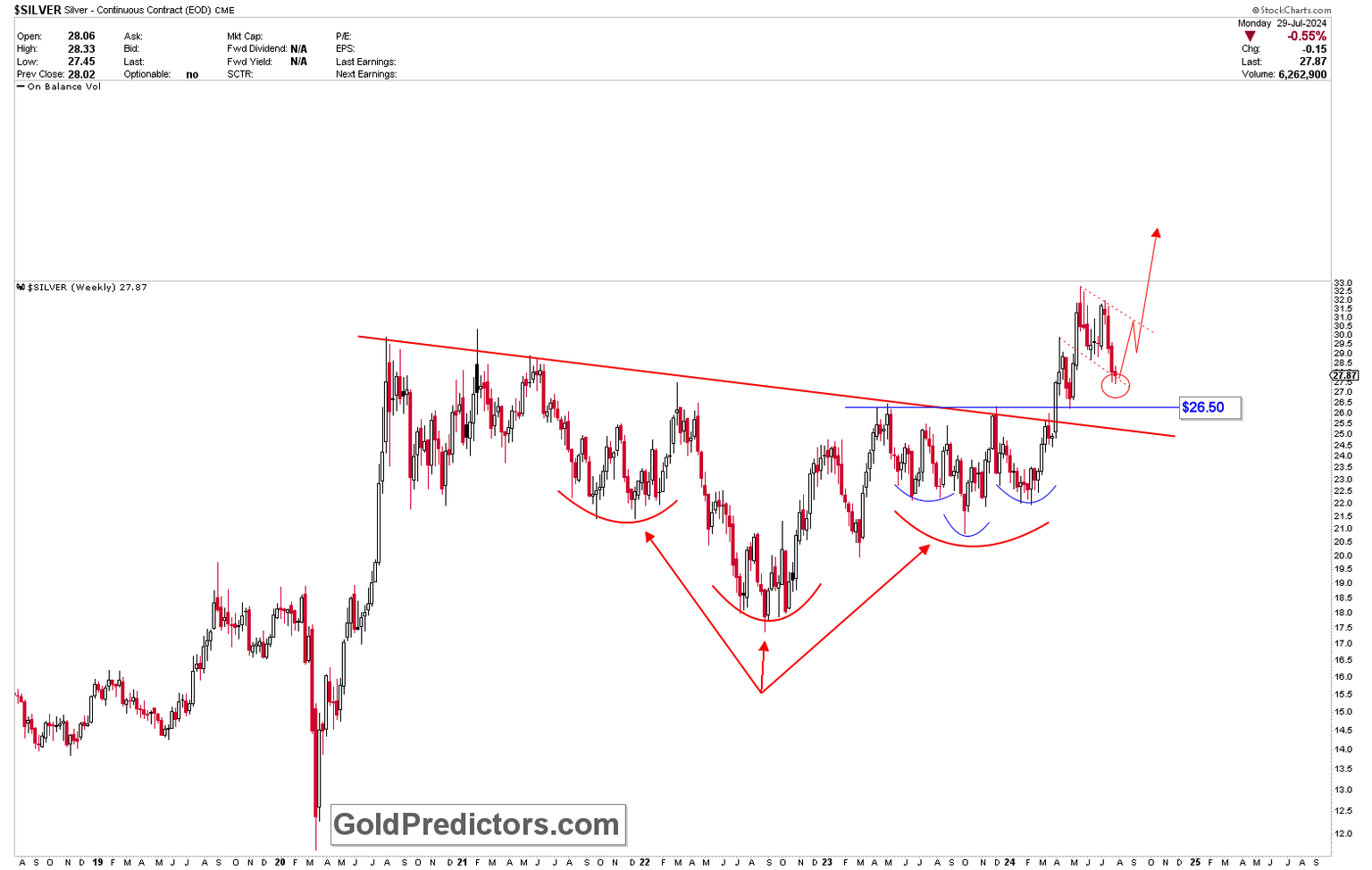

However, the price decline following the economic data release has hit strong support, as shown in the chart below. This support is indicated by the downtrend channel, suggesting that prices have approached a medium-term support area. The chart also demonstrates that the silver market has been trading within a solid bullish technical formation, evidenced by the inverted head and shoulders pattern. This pattern was broken by another bullish formation, highlighted in blue. The breakout above $26.50 triggered a significant rally, and the correction to $26.50 was tested a few months ago, which spurred silver demand. The current correction has brought the market to a vital support region, from which a rally is expected.

Ongoing tensions in the Middle East, especially Israel's attack on Beirut targeting a Hezbollah commander, have caused both gold and silver prices to rise. With silver bouncing back from key support levels, prices may stabilize and potentially aim for the $35-$50 range.

Bottom line

In conclusion, the recent dip in silver prices below $28.00 has reached a strong technical support area. The ongoing crisis in the Middle East may increase demand for silver, potentially stabilizing prices around these levels. As investors await the Federal Reserve's upcoming policy decisions, the possibility of dovish guidance could support a recovery in silver prices, potentially targeting the $35-$50 range.

Unlock exclusive gold and silver trading signals and updates that most investors don’t see. Join our free newsletter now!

Unlock exclusive gold and silver trading signals and updates that most investors don’t see. Join our free newsletter now!

Author

Muhammad Umair, PhD

Gold Predictors

Muhammad Umair is a financial markets analyst and investor who focuses on the forex and precious metals markets.