Silver price soars to $28 as the US dollar falls

The British pound rose against key currencies as investors reacted to positive numbers from the UK and the Bank of England (BOE) interest rate decision. According to Markit, construction PMI in the UK increased to 58.1 in July from the previous 55.1. That was the second consecutive month that the PMI has been above 50. The services and manufacturing PMIs released this week also showed that the UK economy is making a modest recovery. Meanwhile, the BOE concluded its meeting earlier today. As most analysts were expecting, the central bank left interest rate unchanged at 0.10% and vowed to act if the economy continues to deteriorate.

The price of gold and other precious metals continued to increase as investors remained optimistic about their prospects. Gold price rose by 0.35% while solver rose by almost 4%. In the past few months, the metals’ price has continued to increase, boosted by ultralow interest rates and increased liquidity in the form of quantitative easing. The two factors have led to negative real yields in the US, Europe, and in some Asian countries. As a result, most investors have moved from cash to these metals. Interestingly, cryptocurrencies like Bitcoin and Ethereum have also continued to rise.

Global stocks were mixed today as investors continued to focus on corporate earnings. In Europe, the DAX index declined by 0.82% even after impressive earnings from Siemens and Deutsche Telekom. In the UK and France, the FTSE 100 and CAC 40 dropped by more than 1.45% and 1.10%, respectively. Meanwhile, in Asia, the Hang Seng fell by 0.70% while the DJ Shanghai rose by 0.30%. In the United States, futures tied to the Dow Jones and S&P 500 are in the red as investors watch the ongoing stimulus negotiations. Separately, data from the Bureau of Labour Statistics showed that more than 1.1 million Americans filed for jobless claims in the previous week.

GBP/USD

The GBP/USD pair climbed to 1.3187 which is its highest level since March. The price is above the short and longer-term moving averages while the RSI has started moving closer to the overbought level of 70. Importantly, the pair moved above the previous resistance level of 1.3170, meaning that bulls are outweighing the bears. Therefore, the upward trend is likely to continue ahead of the nonfarm payroll numbers that will come out tomorrow.

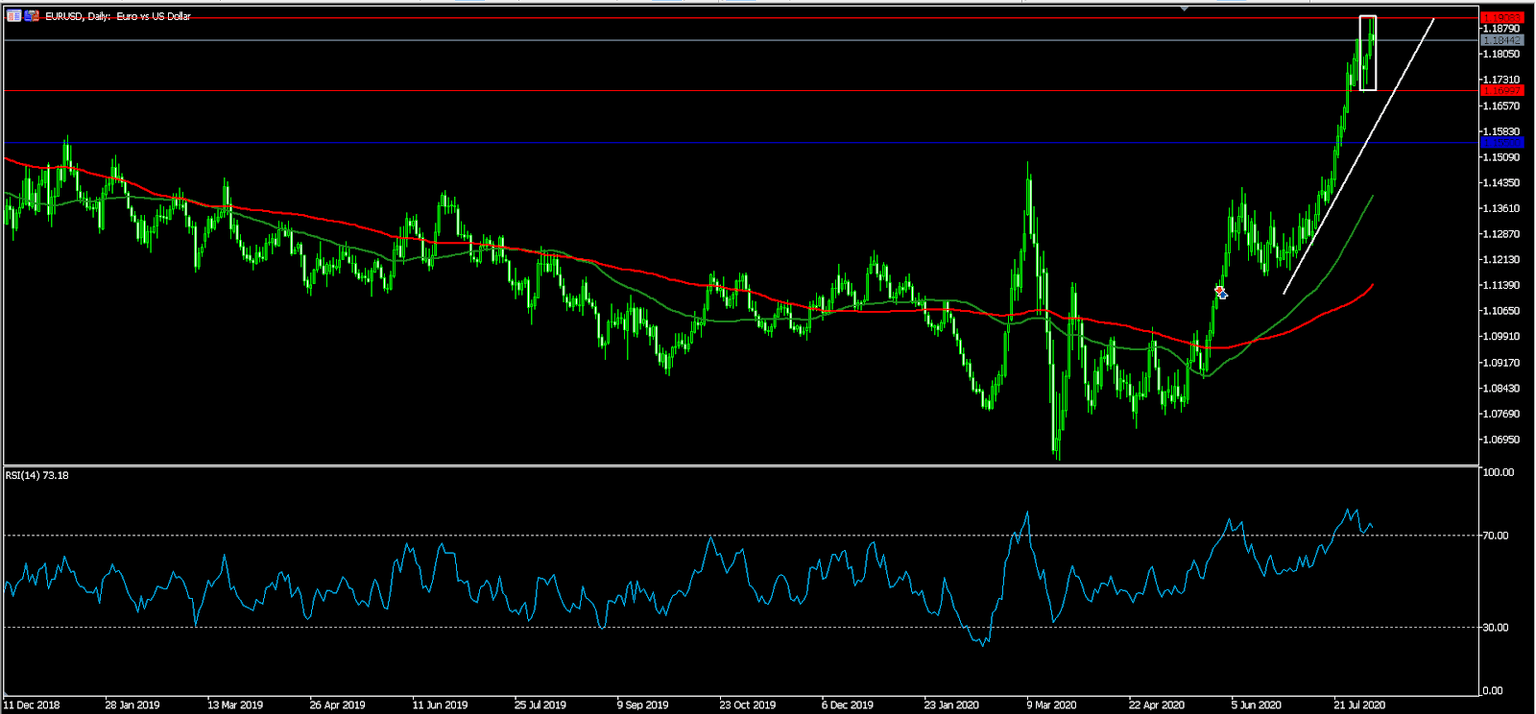

EUR/USD

The EUR/USD pair rose to an intraday high of 1.1918 and then pared back some of those gains. On the daily chart, the price has been in a sharp upward trend while the RSI remains in the overbought level. Also, the price is significantly above the short and longer-term moving averages. Still, it seems like the pair is forming a consolidation pattern, as evidenced by the white rectangular shape. Therefore, the pair is likely to remain near this level ahead of the NFP data that will come out tomorrow.

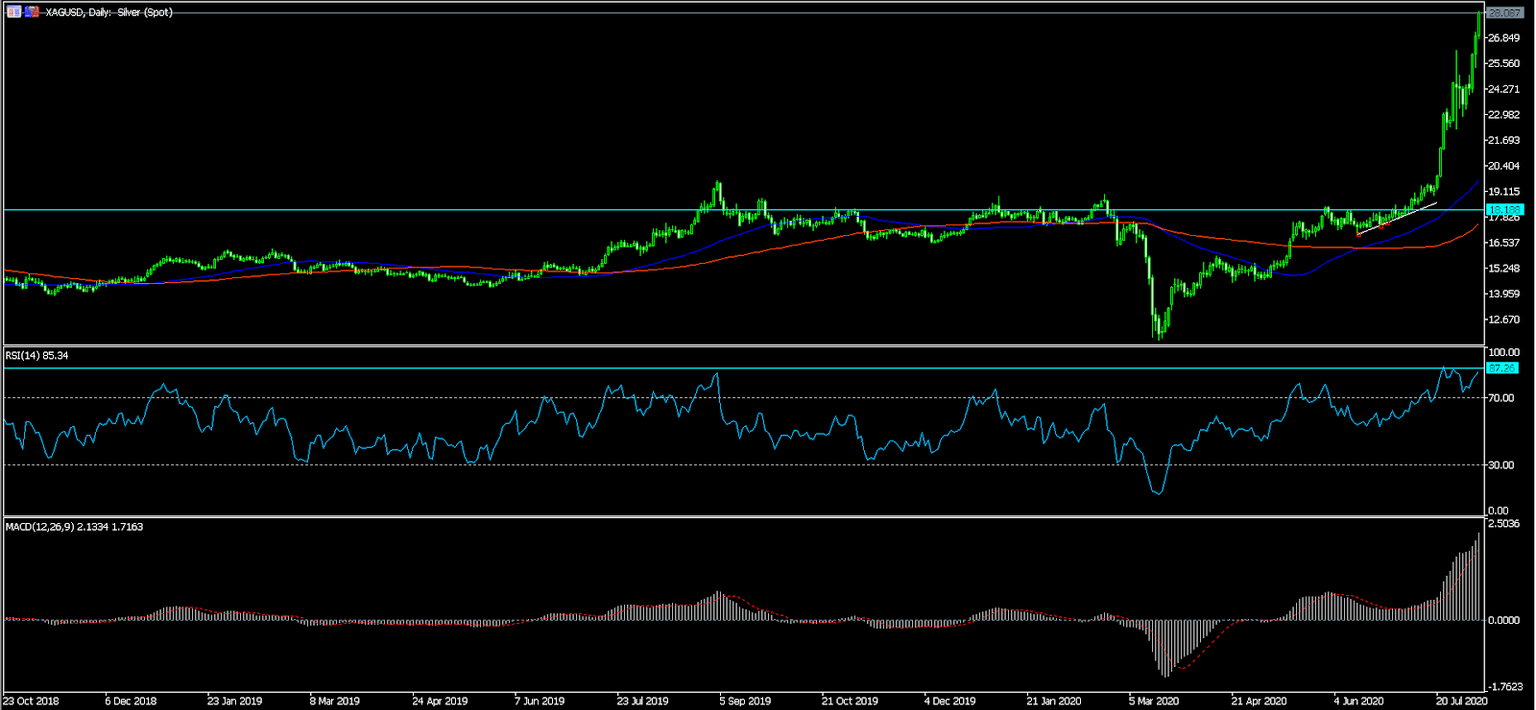

XAG/USD

The XAG/USD pair soared today as more investors moved to invest in silver. The pair climbed to an intraday high of 28.00, which is a multi-year high. The price is above the short, long, and medium-term moving averages. The RSI and the MACD have moved to their highest level in years. The daily chart shows that bulls remain in charge, meaning they will now attempt to test the next resistance level of 30.

Author

OctaFx Analyst Team

OctaFX

OctaFX is a market-leading forex broker, providing personalised forex brokerage services to customers in over 100 countries worldwide.