Silver price holds firm in price discovery as market structure guides context

Silver futures remain in an expansion phase, with structure and price behaviour offering guidance rather than prediction.

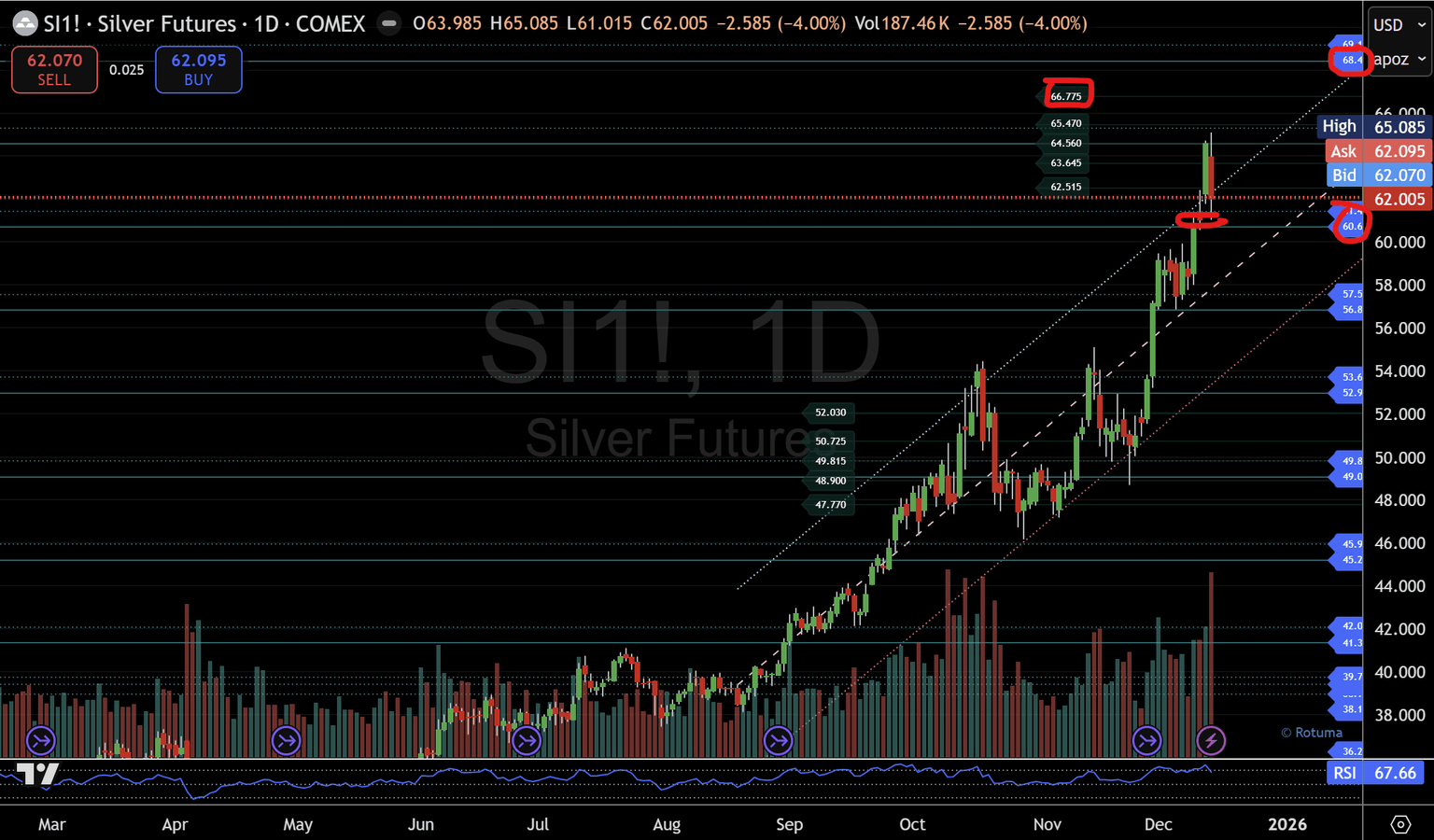

Silver futures continue to trade near multi-year highs, keeping the market firmly in a price-discovery mode. When markets move into uncharted territory, the focus often shifts toward identifying potential resistance levels. However, in price discovery, understanding market structure and price behaviour can be just as important as identifying numerical reference points.

Rather than treating price discovery as a straight-line move, this analysis examines Silver through a structure-first lens, emphasising how price has behaved, where it has paused, and how the broader trend has evolved over time.

Structure provides the framework

Market price movements tend to unfold through recognisable phases — expansion, consolidation, rotation, and continuation. These phases leave behind a structure that helps frame how price may evolve, even when historical reference points are limited.

In Silver’s case, the move into new highs has been accompanied by:

- Strong impulsive advances

- Relatively shallow pullbacks

- Acceptance above prior structural zones

- Sustained trade above a rising price channel

Together, these characteristics suggest the market remains in an expansion phase, rather than showing clear signs of distribution at this stage.

Price behaviour matters more than levels

Price discovery environments are often misunderstood as one-directional moves. In reality, they frequently include volatility, short-term consolidations, and rotations that help build new structure along the way.

From a broader perspective, Silver’s long-term structure remains constructive. Periods of consolidation or pullback would not necessarily weaken the trend, provided the price continues to respect the broader structural framework that has guided the advance so far.

This distinction helps separate trend condition from short-term movement, allowing structure to guide context without forcing directional conclusions.

Where projections fit into the picture

Once the structure is clearly defined, projection tools often naturally align with the broader market path. In Silver’s case, projecting the prior structural expansion highlights a broader extension zone in the mid-to-upper 60s, an area that broadly aligns with commonly observed reference zones during price discovery.

Rather than acting as reversal signals, such areas are best viewed as context zones — regions where price behaviour may provide additional information as the market progresses.

Key structural reference area

Within the current framework, the region around $60.6–$61.4 stands out as an important structural reference.

- Holding above this area preserves the broader bullish structure.

- Failure to hold could invite a deeper rotation without necessarily altering the longer-term trend.

This approach allows structure to frame potential paths forward without relying on fixed outcomes or predictions.

A framework, not a forecast

This analysis does not aim to predict where Silver will peak or reverse. Instead, it offers a framework for observing how price behaves as it navigates the price discovery process.

Structure helps define the road.

Price behaviour helps reveal how that road is travelled.

As long as Silver continues to respect its broader structural framework, the emphasis remains on observing reactions, acceptance, and consolidation — rather than anticipating conclusions.

Author

Denis Joeli Fatiaki

Independent Analyst

Denis Joeli Fatiaki possesses over a decade of extensive experience as a multi-asset trader and Market Strategist.