Silver miners ETF (SIL): Getting ready for a wave III

Wave 3 is the most powerful wave in an Elliott Wave Structure. In this article, we will be looking at an opportunity to catch wave 3 in Silver Miners ETF and also look at Silver and Gold charts to further support the view. The Global X Silver Miners ETF (SIL) provides investors access to a broad range of silver mining companies. The Global X Silver Miners ETF (SIL) seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Solactive Global Silver Miners Total Return Index. Let’s take a look at the Monthly chart of Silver Miners ETFs.

SIL silver miners ETF monthly elliott wave analysis

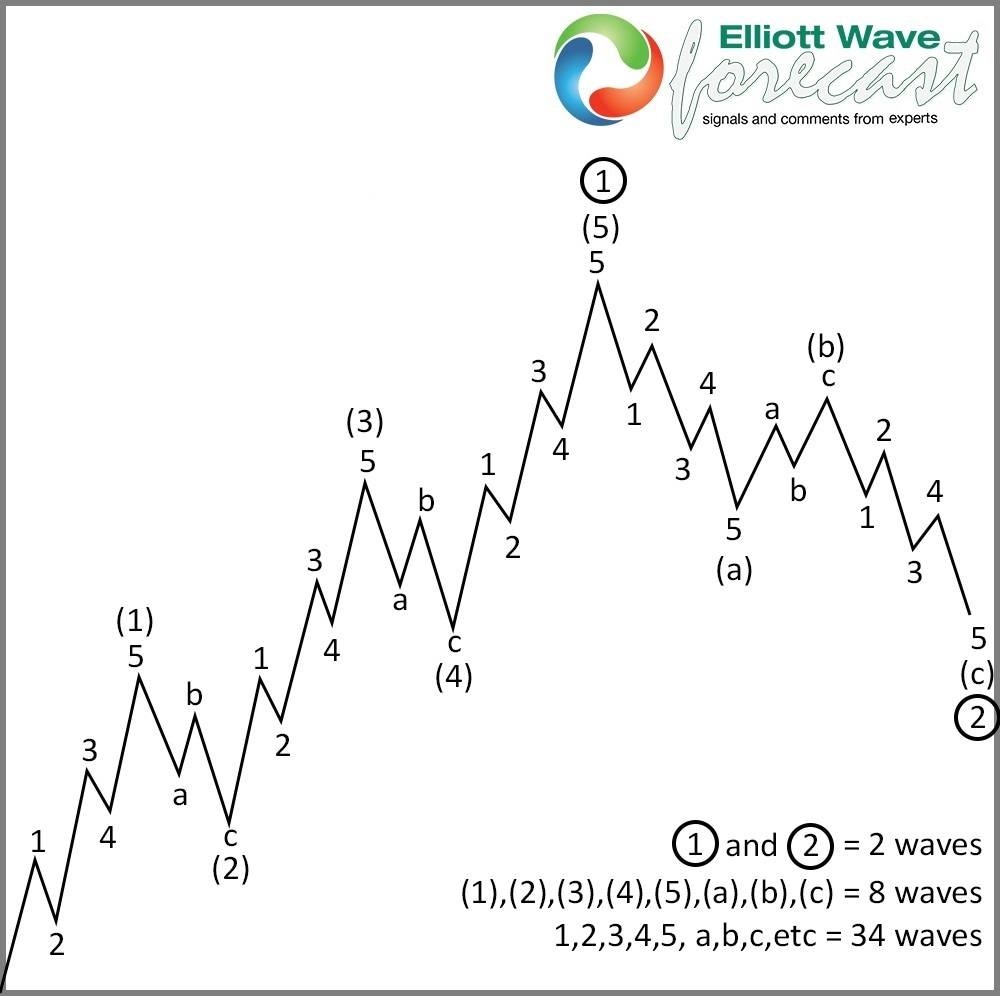

Chart below shows SIL Silver Miners ETF completed wave ((a)) at 94.03 back in 2011. It is worth noting that this is when Gold and Silver also saw a peak back in 2011. This was followed by a 3 waves pull back to 14.94 in 2016. Then SIL ETF rallied as an impulse to 54.34 ending in August 2016, following this it saw a 3 waves pull back to 16.00 in March 2020 before it started rallying again. It rallied to 52.87 ending in August 2020, now the cycle from March 2020 low is over and SIL ETF is in a pull back right now. There are 3 types of extensions in an impulse structure, extension can either take place in wave 1, wave 3 or wave 5. When the extension takes place (image shown below) in wave 3, the chart looks like what Silver Miners SIL ETF chart looks at the moment.

5 Waves elliott wave impulse

3 Types of extensions in an impulse wave

XAGUSD (Silver) Long-term Cycles

It is worth noting that peak in Silver was the same as in Silver Miners ETF (SIL) and wave ( II) low in SIL was the secondary low in Silver in March 2020. It is evident that Silver will not trade below zero line as no one would pay you to get Silver from there which supports the view that correction of the Grand Super cycle in Silver ended in March 2020. Moreover, Gold has already broken above 2011 peak and has an incomplete bullish sequence suggesting Silver will also be looking for a break of 2011 peak and if that happens, Silver Miners ETF should follow so the current pull back is a good opportunity for buyers to look for an entry to catch a possible wave III.

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com