Silver Elliott Wave analysis [Video]

![Silver Elliott Wave analysis [Video]](https://editorial.fxstreet.com/images/Markets/Commodities/Metals/Silver/sterling-silver-46984604_XtraLarge.jpg)

Silver Elliott Wave analysis

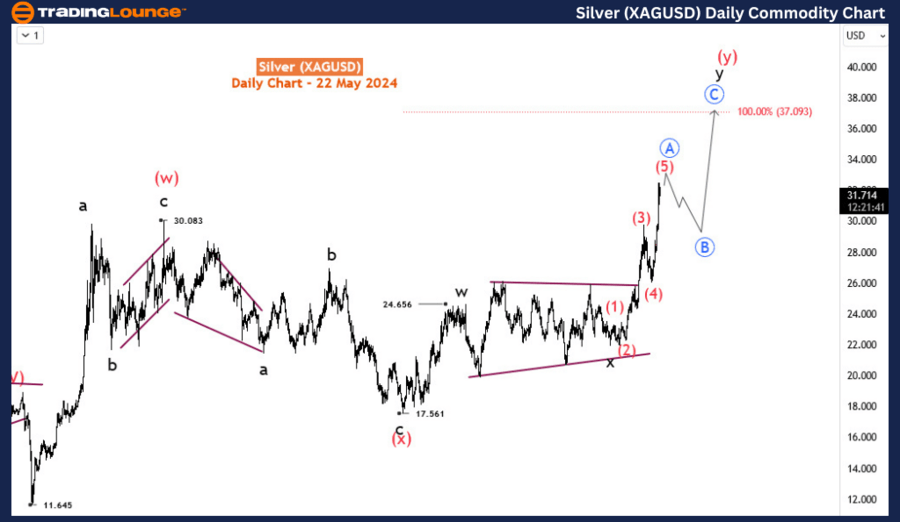

Function -Trend.

Mode - Trend.

Structure - Impulse for blue wave A.

Position - Wave 5 of (5).

Direction - Wave 5 of (5) in play.

Details -Wave 5 of (5) extends higher. There appears to be room for more before prices start turning down for a retracement. Same interpretation as the previous update.

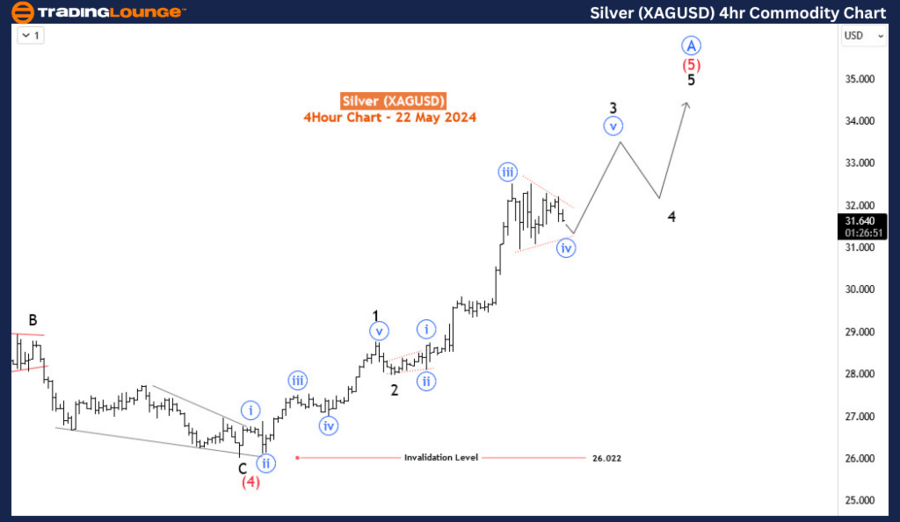

Silver has moved sideways for nearly 72 hours amid a strong year-long bullish trend. The price is more likely to break to the upside to continue this trend. However, if it breaks to the downside, buyers are expected to push the price up again shortly thereafter. Nevertheless, a significant pullback lasting several weeks is anticipated at some point. The question is: how much higher can the metal go before this pullback?

On the daily chart, the price extends the bullish sequence that began at 11.645 in March 2020. This sequence could either complete a double zigzag with a 100% target at 37 and potentially extend further to 48.3. If 48.3 is breached, the likelihood that the sequence will turn into an impulse wave increases. Whether it becomes an impulse or remains a corrective sequence is not crucial at this point since both scenarios project further rallies, with the impulse wave having a higher target. Currently, attention should be on the impulse sequence that started in January 2024, which is expected to complete blue wave A of the primary degree or blue wave 1 of an impulse. The impulse is close to completing its 5th wave—wave 5—after which a pullback is expected.

The H4 chart shows the progress of wave (5) of the impulse and how much further it could go before the pullback begins. The price is currently in wave 3 of (5). Wave 3 appears to be incomplete, with the current triangle serving as the 4th sub-wave of wave 3, i.e., blue wave iv. Traders can expect the triangle to break to the upside to complete wave 3, followed by a minor pullback for wave 4 and further advances for wave 5. At the end of wave 5, we can expect a peak and a downward turn for primary degree wave B (in blue on the daily chart), which could last for several weeks.

Silver Elliott Wave analysis [Video]

Author

Peter Mathers

TradingLounge

Peter Mathers started actively trading in 1982. He began his career at Hoei and Shoin, a Japanese futures trading company.