September Nonfarm Payrolls preview

This Friday we get September’s labour market report from the US. The market is expecting non-farm payrolls to expand by 150k, up from 142k in August. The unemployment rate is expected to remain steady at 4.2%, and YoY growth in average annual earnings is also expected to remain at August’s level of 3.8%.

Leading indicators are mixed

The Federal Reserve has said that it is focusing on the full employment side of its mandate now that inflation is moderating. Thus, this week’s data is pivotal for markets. In the lead up to this week’s payrolls report, other employment indicators have been mixed. For example, JOLTS job openings surged in August, rising to 8.04mn, up from 7.71mn in July, and higher than the 7.69mn expected. This was the highest rate of job openings since May, and it suggests that the US labour market is still tight. This data supports stronger than expected payrolls, which could be on the cards for September. However, on the other hand, the employment component of the ISM manufacturing index moderated sharply in September. The employment component of the ISM manufacturing index has a historical relationship with the payrolls report. The September reading fell to 43.9, from 46.0, which is deep in contraction territory and is one of the lowest levels since 2020. Initial jobless claims have been mostly stable, but they have trended slightly lower in recent weeks, which supports a stable unemployment rate.

Fed rate cut expectations get scaled back

Leading up to this meeting, the Fed Funds market has started to price out the prospect of another 50bp rate cut from the Federal Reserve at its meeting on November 7th. There is now a 34% chance of a 50bp rate cut, down from more than 50% last week. The market is now expecting a 25bp rate cut in November, after Fed chair Jerome Powell toned down his rhetoric about the need for larger rate cuts in a recent speech, and as expectations rise that the US economy grew strongly in Q3. The Atlanta Fed’s GDPNow model is predicting that US GDP grew by 2.5% last quarter. This is a robust rate of growth that would negate the need for a super-sized rate cut from the Fed, in our view. There is one more payrolls report after this before the November FOMC meeting. Thus, on its own, this report may not have a dramatic impact on near-term US interest rate expectations.

Will Payrolls follow the recent trend for stronger US economic data?

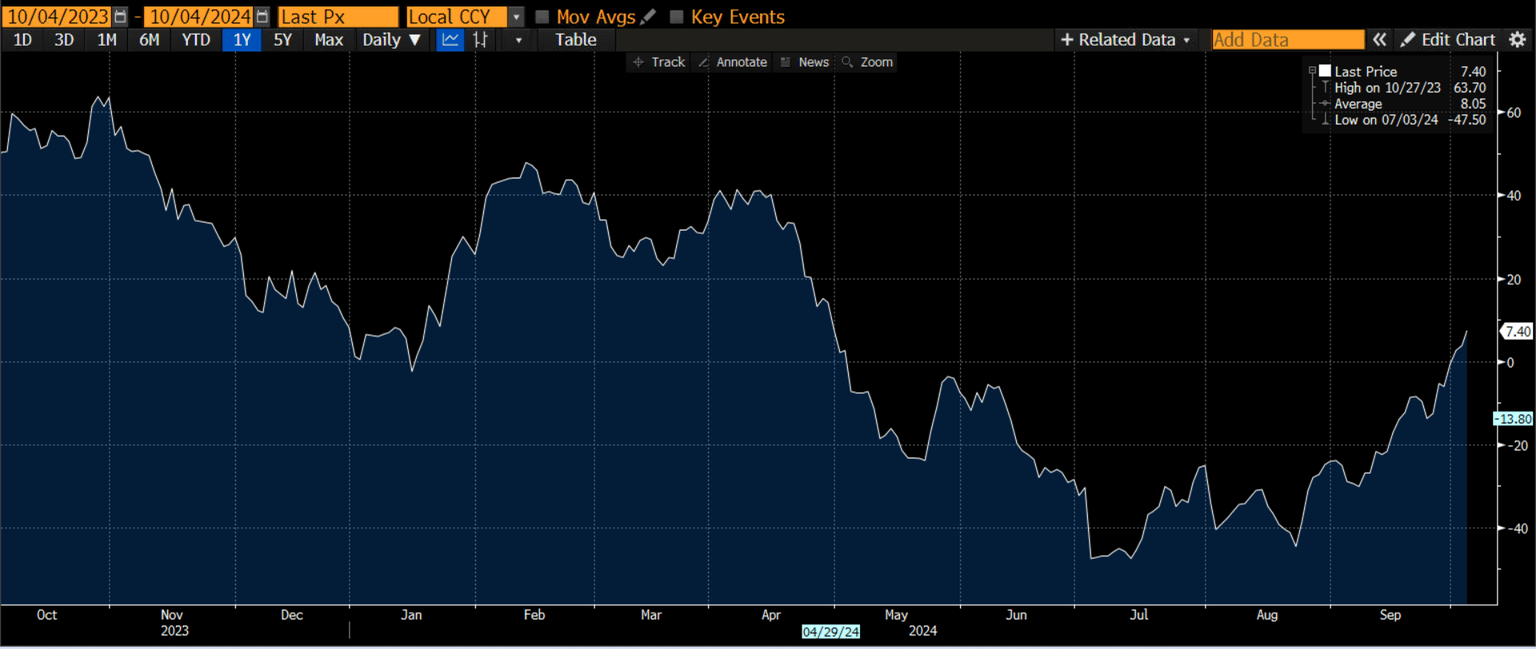

US economic data has been surprising on the upside in recent weeks. On balance, economic data is stronger than expected rather than weaker than expected, and the Citi economic surprise index is at its highest level since early May, as you can see below. This bodes well for the September payrolls report, if it follows the current trend in US economic data.

Chart 1: Citi US economic surprise index

Source: XTB and Bloomberg

The market impact of US labour market data

Payrolls data often triggers market volatility, but how much does it move US asset prices? Over the past year, the average response of the S&P 500 index to US payrolls data 30 minutes after the release has been a small increase of 0.14%. However, the largest increase was 0.43%, while downside responses have been milder, with the biggest decline in the S&P 500 30 mins after a payrolls release only - 0.14%. Overall, this suggests that the payrolls data itself has a mild impact on the main blue-chip US stock index.

The reaction in the Nasdaq 100 has been more pronounced compared to the S&P 500 over the past year. The average response to payrolls data is a 0.16% gain, however, the largest increase was nearly 0.6% in February, when payrolls were a robust 275k. The largest loss on the Nasdaq 100 in the 30 mins after a payrolls report over the past year is -0.25%. The larger upside and downside surprises to the US payroll data for the Nasdaq 100, suggests that large US tech stocks will be sensitive to this week’s data. One of the reasons for this is the impact payrolls data has on interest rate expectations and the signal they give about the strength of the world’s largest economy.

Over the past year, the dollar’s reaction to the payrolls report has been, on balance, positive. The average increase is mostly flat, however, the largest increase in the dollar index 30 minutes after the payrolls report is just over 0.5%, the biggest downside response is -0.36%. This suggests that there is the potential for the dollar to move on a broad basis on the back of this payrolls report. The dollar tends to rally when we get stronger than expected payrolls. It rallied strongly after the June payrolls report when payrolls increased by 206k. Thus, an upside payrolls surprise, could boost the dollar at the end of this week.

Overall, this is one of the most important economic releases in the US each month. The recent trend for better-than-expected US economic data, suggests that there is an increased risk of a stronger payrolls report for September, which could trigger larger than usual moves in US stocks and the dollar. It is also worth noting the backdrop to this meeting. Markets are tense due to heightened geopolitical tensions in the Middle East. This has weighed on US and European stock indices; oil is sharply higher along with the dollar and the dollar index is at its highest level since mid-August. High levels of risk aversion combined with a US payrolls report is a volatile mix.

Author

Kathleen Brooks

XTB UK

Kathleen has nearly 15 years’ experience working with some of the leading retail trading and investment companies in the City of London.