Selecta Biosciences (SELB Stock): returns 14.5% on a red week

Selecta Biosciences, Inc., is a clinical-stage biopharmaceutical company, which researches and develops nanoparticle immunomodulatory drugs for the treatment and prevention of human diseases.

Market Cap: US$347.1M

One Year Return 107.7%

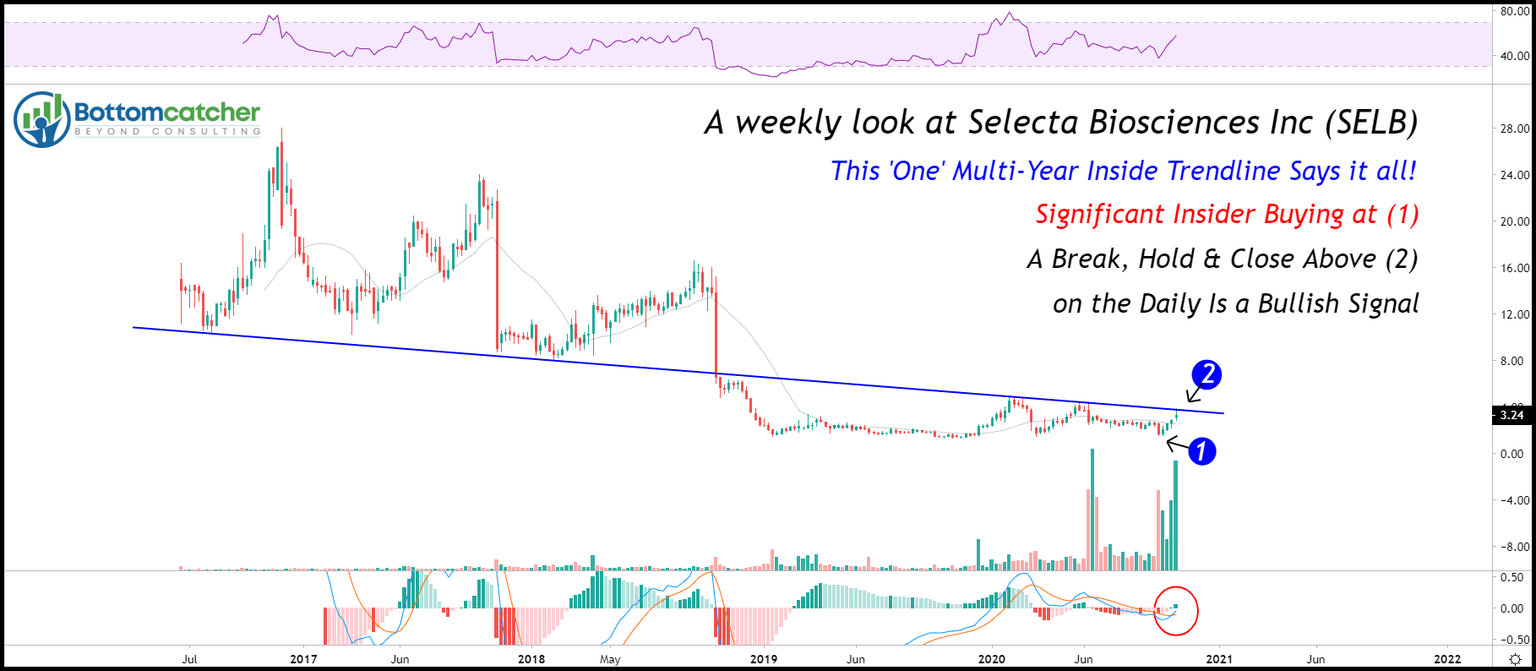

Over the past 2 weeks, we've seen significant insider buying at SELB (2) which can be construed as a positive sign for higher share prices. Since the 2018 decline, SELB's share price has ranged much throughout 2019 to present and is now testing the multi-year inside trendline at (1). It has to be said that this week the share price has held up quite well considering the sharp sell-off on the U.S. Indexes. Confirmation that SELB is finally about to break out of its long term bottoming pattern, will become apparent if we can convincingly break, hold and close above the inside trendline on the weekly time frame, preferably above the 4.70 handle, which in turn should invite more investors to the table.

Author

Steven Mylonas

Bottomcatcher.com

With more than 20 years of experience, Steven has a broad knowledge of market strategies and the markets in general, with a strong focus and understanding of data reading.