Russia-Ukraine crisis: An analysis of oil, gold and Bitcoin

After the start of a week full of stress following the massive Western sanctions on Russia, the situation has changed almost completely with the latest news of the Russian-Ukrainian conflict helping to lift the mood of the market again. First there was the news that Ukraine will not continue the pressure to apply to join NATO, which gave hope that the conflict is starting to move on a better path, then this was followed by an official statement from Ukraine that they were ready for a more diplomatic solution. This clearly revived investor appetite, and risk on sentiment returned.

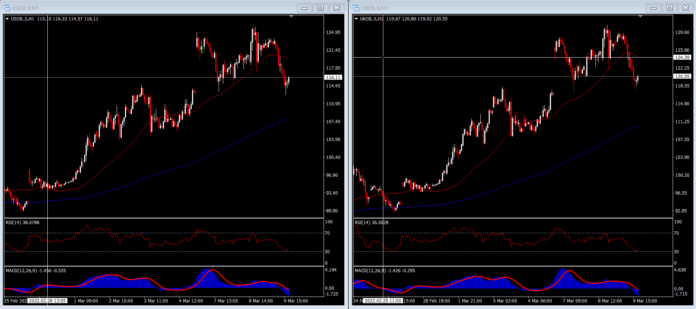

This caused instruments badly affected by geo-political issues to go back through the retracement process. USOIL, which had recorded its highest price since 2008 at $126, declined again and is now trading at $114. The next target is $108.50 if conditions continue to recover. Meanwhile, UKOIL also depreciated after hitting a record high of $131; it is now trading at $115. The next target is at the 200-period SMA (H1) level at $110 if the Bears remain in control of the market. This is clearly providing relief to investors who fear the continued rise in oil prices will put pressure on world inflation and in turn stunt post-Covid-19 economic growth.

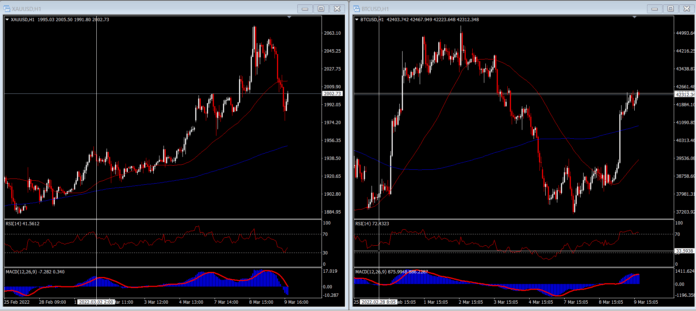

The same situation can also be seen in the instrument XAUUSD, better known as Gold. After Gold hit a $2070 high on Tuesday, slightly lower than its 2020 high of $2075, it slipped back as low as $1975 on Wednesday and is now up slightly trading at the psychological level of $2000. This leaves room for a lower decline to around $1950 if the Russia-Ukraine situation continues to recover and calm down. If things get tense again, it’s likely $2075 will be tested and broken.

In addition, the key crypto instrument BTCUSD recorded a positive recovery after reaching the March low of $37,107 on March 7. BTC rebounded and is now trading above the $42,000 level with the psychological level of $45,000 becoming the center of attention. This was backed up by an inadvertently published Statement (published on Tuesday night), citing that US Treasury Secretary Janet Yellen revealed that President Joe Biden will issue executive directives to take a constructive approach in regulating the digital assets industry. Yellen also quoted that “Under the executive order, the Treasury will work with inter-agency colleagues to produce reports on the future of money and payment systems.”. This directly helped increase investor confidence and demand in cryptocurrencies.

There are still two days left before the trading week ends on Friday, with a thousand and one possibilities that could happen in the market continuing to provide volatility and an interesting dimension to trading this week. It should be noted that the ECB will report the outcome of its monetary policy meeting on today.