RUB/MXN: The "Trump Trade" to Watch

With the quadrennial US Presidential election now less than six weeks away, we've seen a notable uptick in the amount of market analysis centered around politics. It's worth noting that politicians' impact on markets is often overblown and is usually discounted into market prices in advance anyway, but this year's election offers more uncertainty than most.

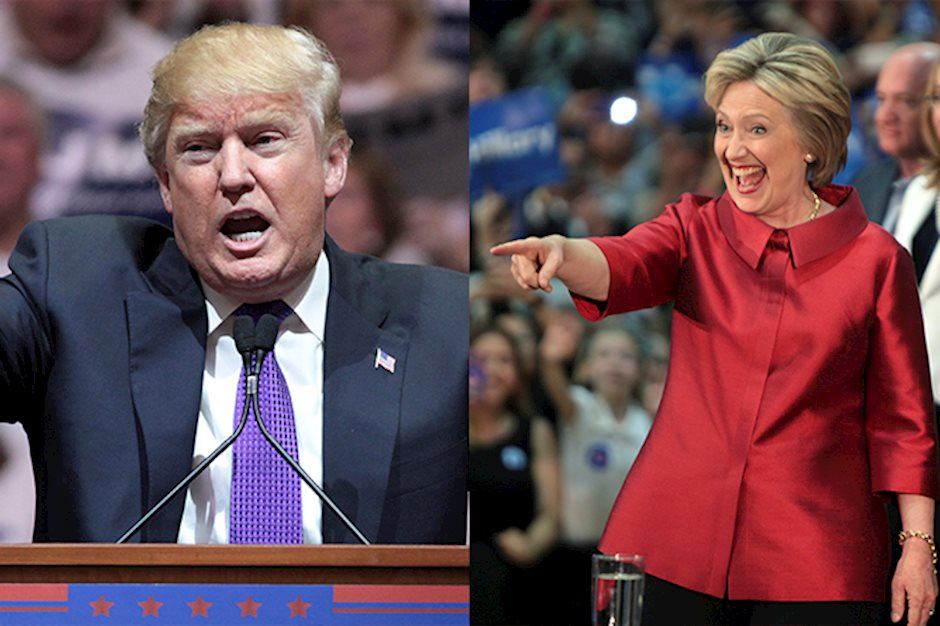

When it comes to markets, the biggest impact may be from the upheaval of traditional geopolitical alliances if Donald Trump is elected. While Hillary Clinton is generally seen as the "status quo" candidate, Trump has risen to prominence primarily on the back of a nationalist platform. As examples of his non-establishment views, Trump has called the North American Free Trade Agreement (NAFTA) the "worst trade deal that the US has ever signed", promised to build a wall along the Mexican border to limit immigration, and complimented Russian President Vladamir Putin as a "strong leader." If Trump is elected president, the above views suggest that there's potential for tension between the US and Mexico, as well closer ties with Russia.

As always, the market is a forward-looking beast, and Trump's rise to political prominence has been reflected in the ruble-peso (RUB/MXN) exchange rate. In the annotated chart below, a rising rate suggests that the Russian ruble is gaining value relative to the Mexican peso, whereas a falling rate indicates that the peso is outperforming. As you can see, RUB/MXN has rallied on events that increased the likelihood of Trump becoming the 45th US President and fallen on events that hurt his chances, such as Monday's debate:

Over the next month and a half, we expect to see much more written about this previously-obscure pair. Obviously, if readers have a strong opinion on the election, RUB/MXN may represent one of the cleanest ways to trade that view, though it's worth noting that few brokers offer the pair directly; traders may have to make a synthetic position by going short USD/RUB and long an equivalent amount of USD/MXN.

On our end, we'll be keeping a close eye on the pair as a more objective indicator of the likely election result. In the current hyper-partisan environment, it's difficult to completely remove bias from any political analysis, but by monitoring the actions of traders in the $5T per day FX market, we can at least be assured that our preferred handicapper doesn't have any inherent bias, other than the desire to make money!

Author

Matt Weller, CFA, CMT

Faraday Research

Matthew is a former Senior Market Analyst at Forex.com whose research is regularly quoted in The Wall Street Journal, Bloomberg and Reuters. Based in the US, Matthew provides live trading recommendations during US market hours, c