Risk sentiment shaken by JOLTS report

The S&P 500 notched back-to-back losses as Wall Street navigates a bumpy start to September. It’s starting to feel like clockwork—another early-month stock plunge following closely on the heels of August’s brief but sharp correction.

Given that September historically claims the title of the worst month for stock returns—with August a close runner-up—this seasonal swoon could just be par for the course. And yet, there’s always that lingering worry that the sharp pullback from near-record highs might signal something deeper. Enter this week’s critical U.S. employment report, coupled with Job Openings and Labor Turnover Survey (JOLTS) data, which threw another wrench into the mix. The report showed job openings across the U.S. economy at their lowest since January 2021, turning up the heat on the Fed.

The 7.673 million headline JOLTS print missed the mark by a mile, falling well short of economists' 8.1 million forecast. The prior month’s downward revision made the drop even more dramatic, adding to growing evidence that the U.S. labour market is finally cooling. While that’s a positive in terms of easing wage pressures and keeping inflation in check, it also raises questions about the economy’s underlying strength.

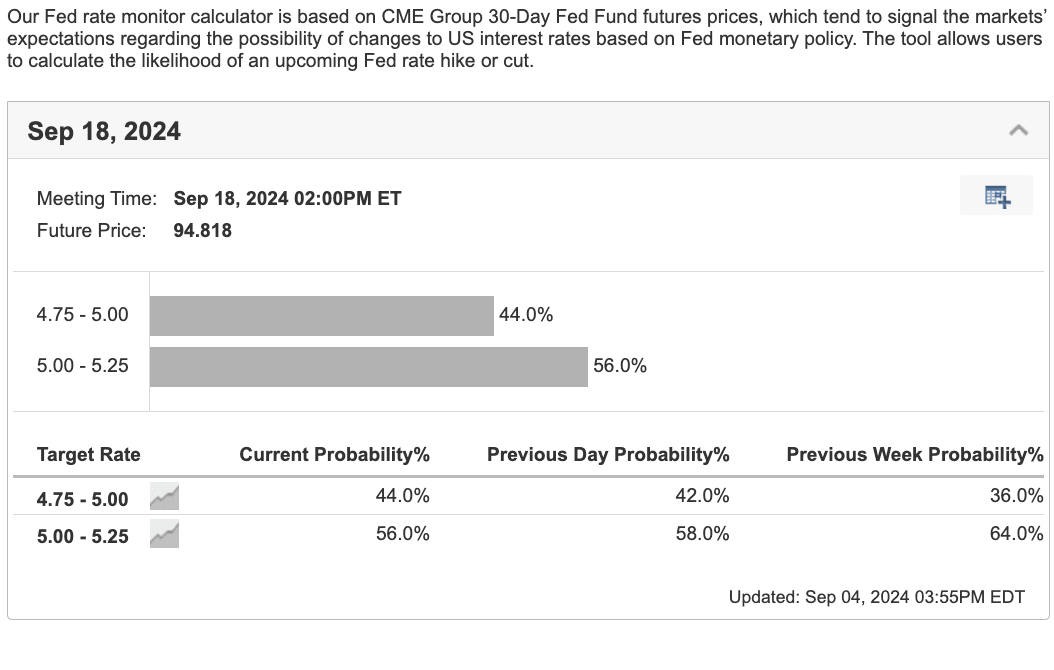

As for the September rate cut calculus, we pointed out yesterday that with just 33% odds priced in for a 50 bp cut, any hint of weaker data would send markets rushing to bet on higher probabilities—and that’s precisely what happened. The odds of a rate cut are now 40%, and the USD/JPY is dipped below 144.

If global markets remain in risk-off mode—especially with commodities like oil tanking—the Fed could be pressured to pull the trigger on a larger 50bps cut. This would be driven by easing inflation risks, which could send USD/JPY further south. (Stephen Innes)

Indeed, those odds might still be on the conservative side, with inflation on the downtrend, giving the Fed plenty of room to go bigger. In some stock market circles, a jumbo cut could be the lifeline needed to support those sky-high valuations.

However, I believe a 50 bps cut might be seen as the Fed scrambling to keep up, more Hail Mary than carefully orchestrated play. If you're unconvinced, look at the cross-asset signals: JPY is soaking up a vast safe-haven bid, and oil prices are still spilling, plumbing new depths. This points to a fair amount of instability being priced into markets, no matter what the equity bulls want to believe. Buckle up—it could be a volatile ride ahead.

Still, the fall in oil prices is a welcome relief for consumers—and likely the Fed, too. NYMEX crude oil is now flirting with a 20% drop from its year-to-date peak in April, sinking to its lowest since January. For U.S. consumers, the spotlight naturally shifts to gasoline prices, which have also seen a sharp decline. The front-month gasoline contract hit a fresh low for the year yesterday, inching ever closer to levels we haven’t witnessed since early 2021. With wholesale NYMEX prices tracking retail pump prices closely, there’s a real possibility we could soon see gas dipping below $3 per gallon—a development that would undoubtedly bring some much-needed relief to wallets across the country.

The Dealer VIX stop-in—what’s known in options parlance as a minor “VIX convexity event”—we wrote about yesterday’s FOREX report got extensive coverage overnight, which is typically once timely institutional bank reports start making their way through the media. Remembering this mini-vol event is nothing compared to what we saw in August and could be related to a seasonal swoon.

Author

Stephen Innes

SPI Asset Management

With more than 25 years of experience, Stephen has a deep-seated knowledge of G10 and Asian currency markets as well as precious metal and oil markets.