Riding the bullish revival

S&P 500 brief pause is over – nodding to the upswing, credit markets have turned to risk- on, and VIX is going precisely nowhere, just hanging around the 15 levels. Such volatility values are conducive to the stock market upswing continuation and given no real change to the anticipated Fed taper move or the infrastructure bill birthing drama, prior market trends remain in motion.

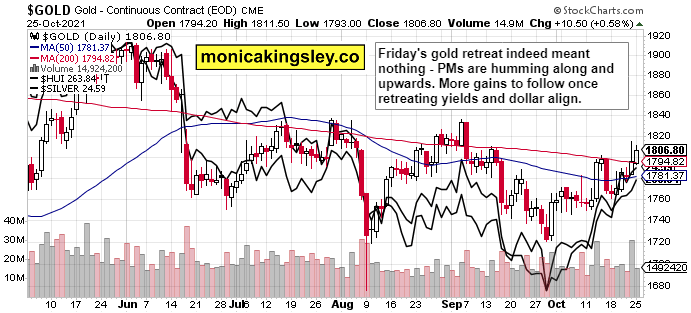

That means the stock market correction is over (saw that great Tesla move?), and our open long profits can keep growing. In precious metals, silver continues to lead gold in the countdown to the Nov taper – don‘t dare to think, PMs bears, what would unfold should the Fed not deliver. Inflation expectations wouldn‘t be as tame as they are currently – the situation on the inflation front is in my view direr than before the Jun Fed pacification talk – which turned out empty, of course, but served the key purpose of prepping the markets for the eventual taper arrival.

Here we are, the taper is baked in the cake, but inflation expectations are trending higher. And it shows in the gold to the silver ratio that‘s shifting ever more to the bullish silver side – as it should in an environment of permanently elevated inflation that I had been talking about relentlessly since early spring.

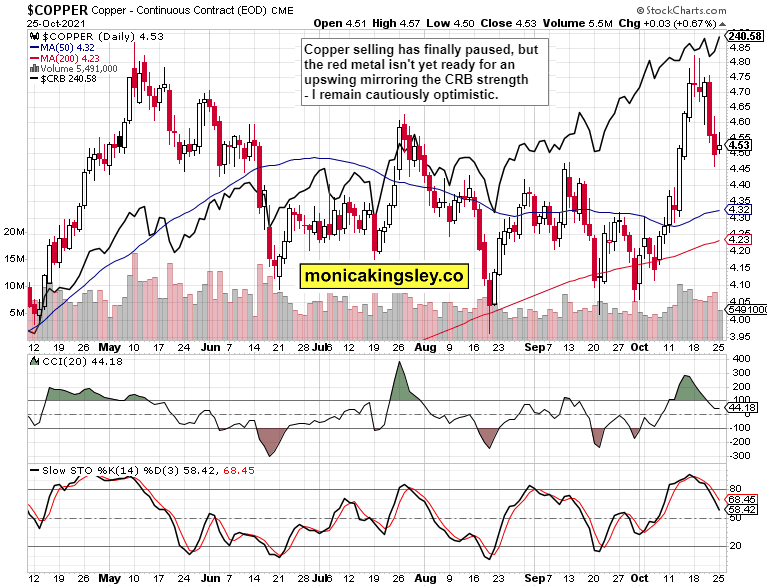

Commodities are likewise confirming, and we can look forward to more energy profits. Copper and base metals are very modestly turning up again, and the bulls have a great chance to step in at the nearest occasion of inflationary (well, still reflationary the stock market says) celebrations. That‘s what happens when fresh money doesn‘t stay on commercial banks‘ balance sheets but goes right into the financial markets.

Cryptos – the key beneficiary of the monetary largesse starting in earnest in Apr 2020 – aren‘t hesitating either, bringing fresh gains, gently confirming my bullish thesis when it comes to real assets outperformance.

Let‘s move right into the charts.

S&P 500 and Nasdaq outlook

S&P 500 didn‘t consolidate much intraday, and the credit market's non-confirmation was swiftly dealt with.

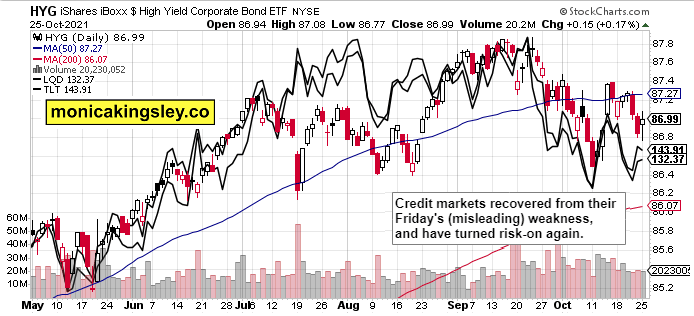

Credit markets

The risk-off posture in bonds is history now, and a fresh S&P 500 advance is being supported – namely the HYG refusal to decline intraday, is an encouraging sign.

Gold, silver and miners

Friday‘s rejection in higher gold values was indeed only temporary, and the slow grind higher can continue. It‘s two steps forwards one step backward until the Fed disappoints or the realization of more negative real rates hits hard.

Crude oil

Crude oil couldn‘t beat $85, and the intraday dip didn‘t reach really anywhere. The $83 - $84 level looks to be holding all selling for now, and higher prices remain likely once the current hesitation is overcome.

Copper

Copper attempted to rise, but couldn‘t make it in spite of the CRB Index upswing, or positive performance in base metals. The price recovery will arguably take a few days before it happens, and gives an opportunity to PMs bears to force a little temporary retreat.

Bitcoin and Ethereum

The Bitcoin and Ethereum bulls are at it again, and both leading cryptos upswing goes on, with Ethereum outperformance being a positive sign.

Summary

Stocks are once again pushing to fresh highs, blessed with credit markets confirmation and well-behaved VIX. With Fed backed into the corner and practically having to taper in Nov, the bulls can keep running for now. Real assets ascent isn‘t to be punctured, and precious metals led by silver are likely to follow behind commodities. What‘s needed, is more focus on the central bank being dismally behind the inflation curve, more recognition of inflation not being transitory. We‘re getting there, and increasingly negative real rates are paving the way ahead.

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.