Results and update: S&P 500 made a high

Week of 10/04 Recap: - The S&P made a high late Friday, 10/01, just ahead of Venus Aphelion, over the weekend. Monday, the S&P opened down 27 handles from Friday’s high and continued 68 handles lower into mid-day Monday for the low of the week. From that low, the S&P rallied sharply 88 handles into a Tuesday afternoon high. From that high, the S&P dropped sharply 78 handles into a Wednesday AM low and into our triple whammy change in trend window. From that low, the S&P rallied sharply 140 handles into a Thursday AM high of the week. From that high, the S&P gradually eroded lower into the weekend.

10//08 - The major indices had a small down day with the following closes: The DJIA – 8.69; S&P 500 – 8.42; and the Nasdaq Composite – 74.48.

Looking ahead:

The NOW Index has moved to the BUY ALERT ZONE. This is not an outright buy signal, but rather a cautionary signal for the bears that there is a

moderate imbalance of shorts. If you are short multiple positions, you may want to reduce your position.

Coming Events:

(Stocks potentially respond to all events).

1. A. 10/01 AC – Venus Aphelion. Major change in trend Cattle, Copper, Corn, Cotton, Gold, OJ, Sugar, Wheat.

B. 10/05 AC – Jupiter Parallel Latitude Neptune. Major change in trend COMMODITY INDEX, Copper,

Oats, and OIL

C. 10/05 AC – New Moon in Libra. Major change in trend Financials, Grains, Precious Metals and especially

Sugar & Wheat.

D. 10/05 AC – Pluto in Capricorn turns Direct. Major change in trend Cocoa, Coffee, Hogs, and T-Bonds.

2. A. 10/08 AC – Saturn in Aquarius turns Direct. Major change in trend Coffee and Copper.

B. 10/08 AC – Jupiter 150 US Neptune. Moderate change in trend US Stocks, T-Bonds, US Dollar, & Oil.

C. 10/14 AC – Mercury 0 North Latitude. Major change in trend Corn, Oats, Soybeans, Wheat.

D. 10/15 AC - Neptune 90 US Mars. Major change in trend US Stocks, T-Bonds, US Dollar.

E. 10/15 AC – Jupiter in Aquarius turns Direct. Major change in trend Copper and Oats.

Stock Market Key Dates

Market Math –

10/6 – 4,597 Music Days from the 3/06/2009 major low.

Fibonacci – 10/6, 10/15, 10/18, 10/29

Astro – 10/4, 10/6, 10/11, 10/14, 10/15, 10/20, 10/25, 10/29 AC

Please see below the S&P 500 10 minute chart.

Support - 4315 Resistance – 4430

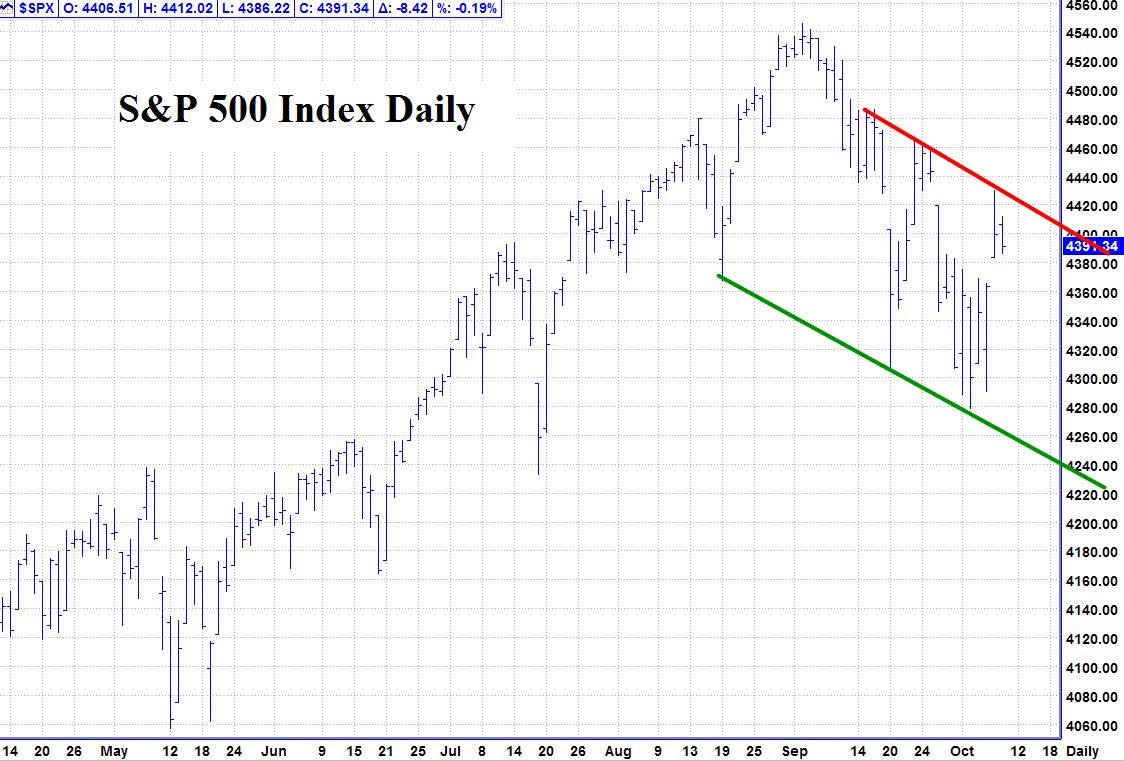

Please see below the S&P 500 Daily chart

Support - 4315, 4260, 4195 Resistance – 4430

Please see below the Planetary Index charts with S&P 500 5 minute bars for results.

Futures, Forex and Option trading involves substantial risk, and may not be suitable for everyone. Trading should only be done with true risk capital. Past performance either actual or hypothetical is not necessarily indicative of future performance.

Author

Norm Winski

Independent Analyst

www.astro-trend.com