Results and update: Multiple successive change in trend windows

10/18 Recap: - The S&P opened with an 8 handle gap down and then dropped another 17 handles into a 9:35 AM low of the day. From that low, the S&P rallied 36 handles into an 11:23 AM high. Please note, this was the momentum high of the day and this occurred about 16 minutes past the 11:07 AM Mercury Direct. From that high, the S&P traded into a very narrow 5 handle range, culminating with a low at 2:27 PM. From that low, the S&P rallied 8 – 9 handles into the close.

10//18 – Following a sizeable dip into the open, the major indices had a mixed to moderate up day with the following closes:

The DJIA - 36.15; S&P 500 + 15.09; and the Nasdaq Composite + 124.47.

Looking ahead – We are now in for about 2 more days of this tight series of multiple successive change in trend windows.

Usually, we when have this kind of pattern, we get multiple whipsaws with up one day and down the next. We got a sample of this with the dip on Monday’s opening. Please see the details below.

The NOW Index is in the NEUTRAL ZONE.

Coming events

(Stocks potentially respond to all events).

3. A. 10/18 AM – Mercury in Libra turns Direct. Major change in trend Corn, Oats, Soybeans, Sugar, and WHEAT.

B. 10/19 AM – Helio Saturn 90 Uranus. Major change in trend Coffee and COPPER.

C. 10/19 AC – Mercury Perihelion. Major change in trend CORN, Gold, Oats, OJ, Soybeans, Wheat.

D. 10/20 AM - Full Moon in Aries. Major Change in Trend Financials, Grains, Precious Metals and especially Sugar and Wheat.

4. A. 10/22 AC – Mercury Greatest Elongation West. Major change in trend Corn, Oats, Soybeans, Wheat.

B. 10/22 AC – Jupiter 150 US Neptune. Moderate change in trend US Stocks, T-Bonds, US Dollar, & Oil.

C. 10/22 AC – Uranus 90 US MC. Major change in trend US Stocks, T-Bonds, US Dollar.

Stock market key dates

Fibonacci – 10/18, 10/29.

Astro –10/18, 10/20, 10/25, 10/29 AC.

Please see below the S&P 500 10 minute chart.

Support - 4470, 4360, Resistance – 4490.

Please see below the S&P 500 Daily chart.

Support - 4470, 4360, Resistance – 4490, 4530.

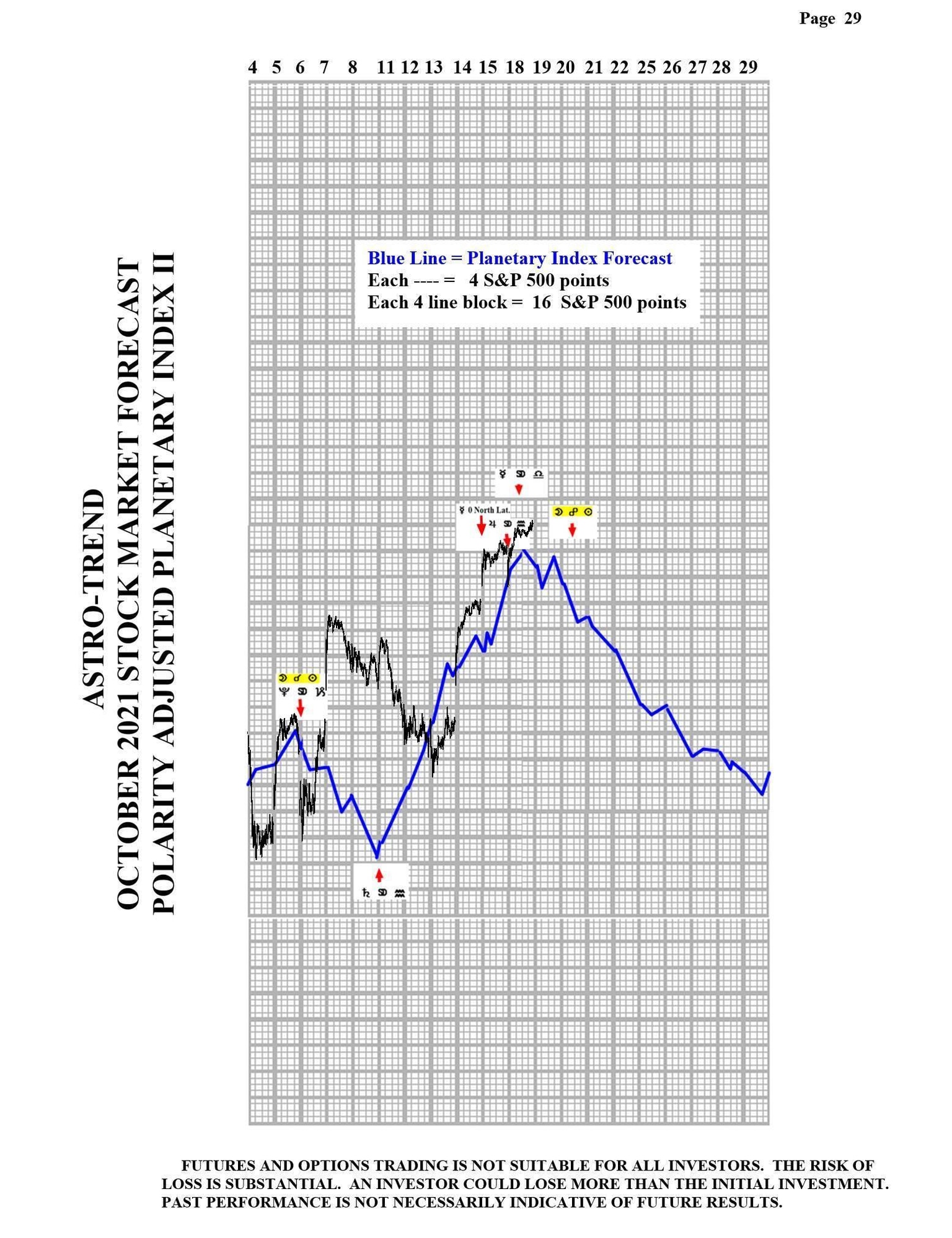

Please see below the Planetary Index charts with S&P 500 10 minute bars for results.

Author

Norm Winski

Independent Analyst

www.astro-trend.com