Raw and uncut

S2N observations

Warren Buffet has done it again. Mr. Wonderful has increased Berkshire’s cash holdings to a record $347 billion and completely sidestepped all the market turmoil this year and resigned at the top of his game.

The famed investor delivered more than a 5,500,000% return on Berkshire’s stock. The man is a genius and someone who has made a real difference to the world with his prodigious talent.

Just a concluding thought about the stock market.

If you make the mistake of judging your performance every time you look at the performance of your portfolio, then you are bound to second-guess your decisions.

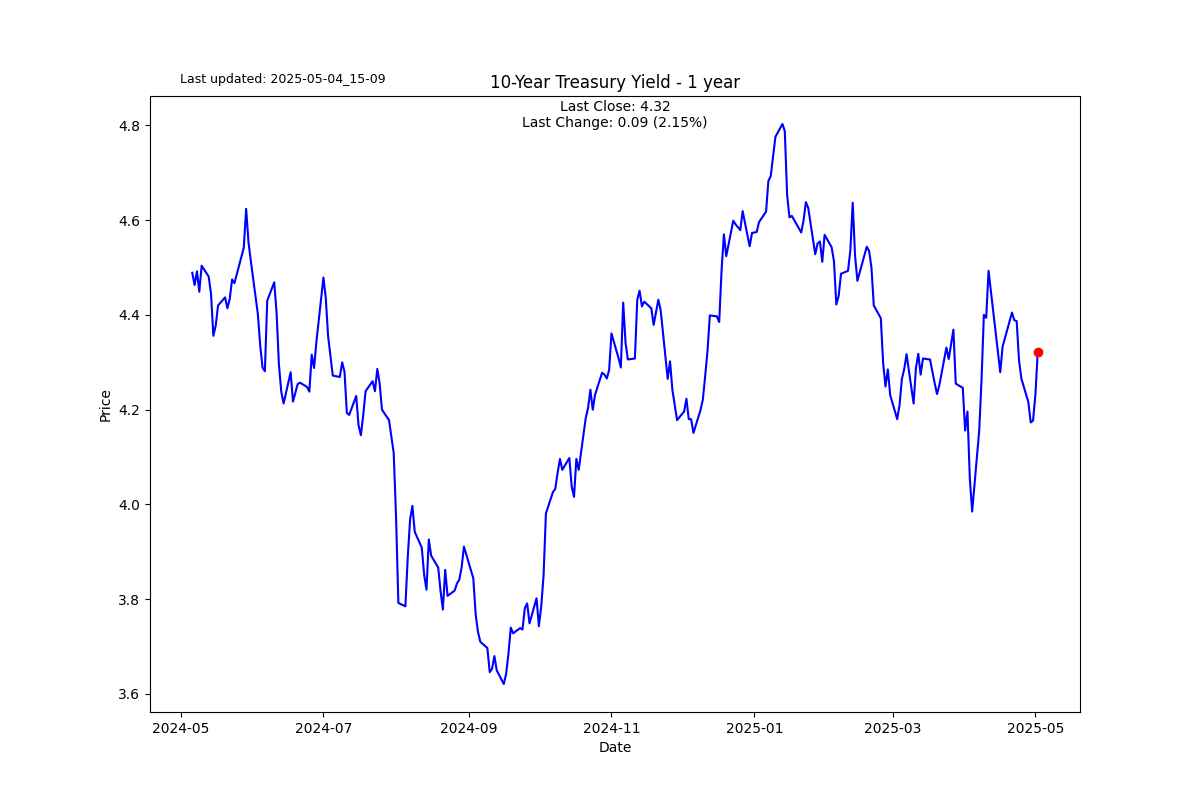

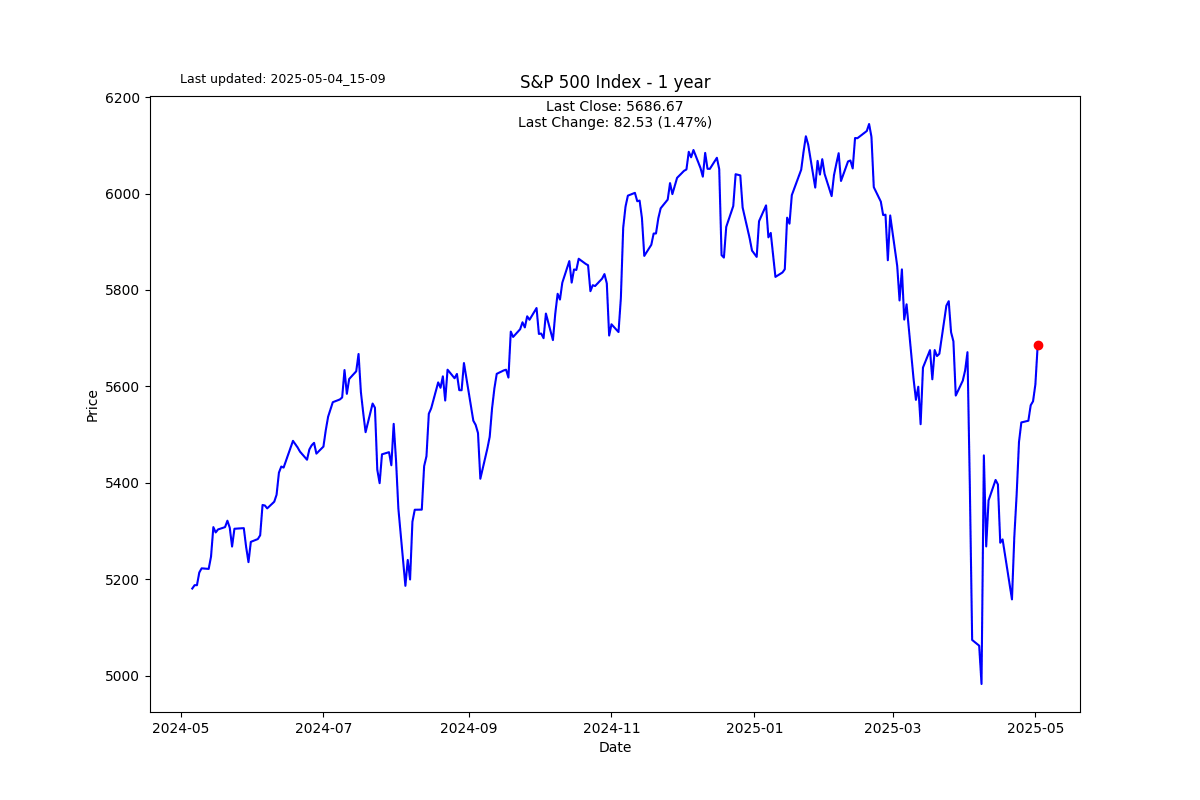

We now have many bears throwing in the towel thinking they made a mistake; this was a buy the dip moment. I disagree. Markets were very expensive prior to the tariff wrecking ball, and the reality of the situation still needs to wash through the system. Keep you on the prize and leave the day-to-day market prognosticating to the talking heads on TV and X. The S&P 500 is still in a -7% drawdown, which I believe will soon start to increase.

S2N screener alert

The S&P 500 has been up 9 days in a row, which has happened only 19 times in 50 years. The last time was in November 2004.

S2N performance review

S2N chart gallery

S2N news today

Author

Michael Berman, PhD

Signal2Noise (S2N) News

Michael has decades of experience as a professional trader, hedge fund manager and incubator of emerging traders.

-638820149050388283.jpg&w=1536&q=95)

-638820149298495188.jpg&w=1536&q=95)

-638820149528207819.jpg&w=1536&q=95)

-638820151732500059.png&w=1536&q=95)