Rates spark: Increasing confidence about Bank of England easing

We think markets are right to price in more Bank of England easing, but the upcoming budget on 26 November can still bring both bullish and bearish surprises. Meanwhile, concerns around the US job market are offsetting the positive impact of a likely government reopening on risk sentiment.

Sterling rates should settle for 3.25% landing, but budget still brings uncertainty

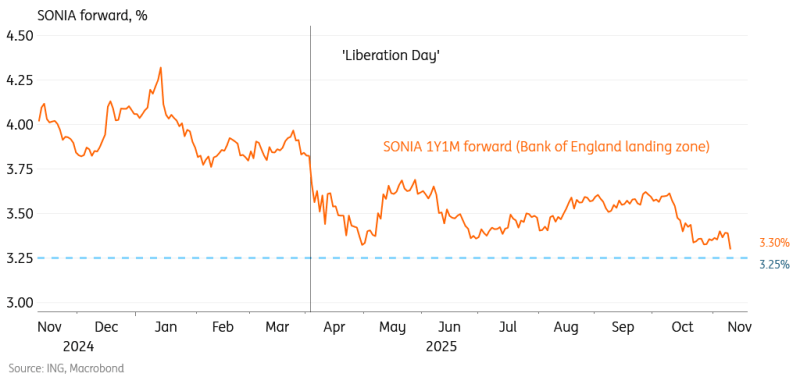

Sterling rates are still in a guessing game when it comes to the landing zone of the Bank of England, causing quite some volatility throughout the curve. Since ‘Liberation Day’ in April, markets have mostly been focused on a terminal rate around 3.5%, but that handle seems to have been broken to the downside on the back of more dovish data. Tuesday’s higher unemployment and weaker wage growth were yet another reading suggesting more room for cuts than previously thought.

Going forward, we think markets should become more confident about 3.25% as the terminal rate, but the budget announcement on 26 November does add some uncertainty to the mix. A fiscally prudent approach would involve tax hikes and spending cuts, which would support a more dovish Bank of England stance. But our risk premium estimates suggest this scenario is broadly priced in already. If, on the other hand, Chancellor Reeves fails to win markets' confidence in the UK’s fiscal discipline, then we could very well see the curve move higher again.

Markets shifting from a 3.5% Bank of England landing zone to 3.25%

Read the original analysis: Rates spark: Increasing confidence about Bank of England easing

Author

ING Global Economics Team

ING Economic and Financial Analysis

From Trump to trade, FX to Brexit, ING’s global economists have it covered. Go to ING.com/THINK to stay a step ahead.