Quarter end or more

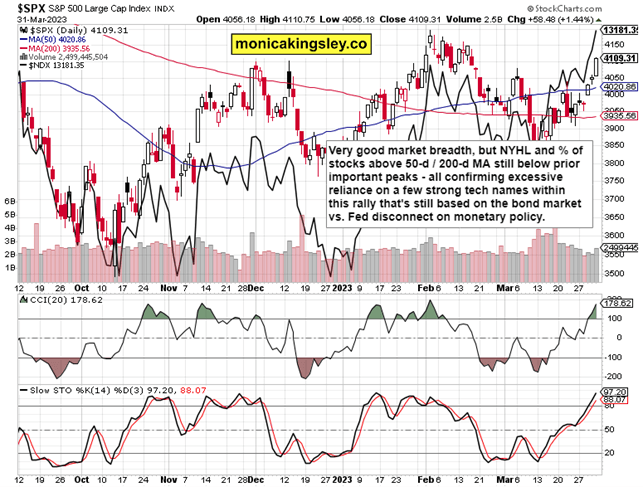

S&P 500 completed the third day of bullish calls, and didn‘t create many non-confirmations on the way to the 4,130s. While market breadth is still concerning, it had very much improved Friday, and can carry the bulls into 4,175 – 4,185 next resistance area. Not right away, but this is doable for the buyers – even if some little Monday pullback comes after the extraordinary surge that wasn‘t limited to the power hour. The improvements seen from industrials, materials and consumer discretionaries with staples as opposed to utilities, make it more than likely.

The rally is of course heavily dependent on the sectors I talked often recently – tech, semiconductors and communications. The dependance on heavyweights is all too palpable, and the flagging broader participation would come to bite, but not yet. Let NVDA, META, AMD and TSLA do the job for now. They are the generals that would be left standing while the troops at a future point refuse to participate in the upswing (not immediately on the horizon).

At the same time, financials continue limping as deposits are still leaving the banking system. Given the state of the long end of the curve and unyielding Fed attitude towards tightening, that‘s a watchout for the days ahead. Merely a watchout, because the relief that no other bank is in immediate trouble (hitting headlines), can and is winning the day.

The greatest conflict though persists - in bonds forcing the Fed to pivot, and Fed refusing to indicate so. Consider that 100bp rate cuts in 2023 are already priced in, but the Fed keeps ruling them out. Justifiably so I say – it can continue keeping rates restrictive (letting disinflation continue as best as it can) while providing liquidity through the back door so as to prop up the banking system that suffers through having taken the only route left in the quest for returns in the low rates era, which is going out on the long end (and is predictably hit when the Fed has no other choice but to keep raising thanks to inflation).

The Fed monetary policy uncertainty thus created in the markets, is obvious – the Fed has to shield the banking system from rate raising (keeping rates restrictive) consequences. At the same time, the central bank has to keep a close eye on corporate credit markets so that these don‘t seize the way they did in Dec 2018 – and fresh debt issuance and rollover ever since SVB went under, are not at all encouraging. Note that 25% of investment grade corporate debt has to be rolled over this year, and the activity review of junk corporate bonds and leveraged loan markets (private equity) doesn‘t look more optimistic.

There you go with one explanation of why financials are lagging this badly. The retreat in inflation continues, but expect goods inflation to kick in, and not only because of the rising oil prices, while services inflation would remain quite stubborn. Earnings recession is to be getting more often mentioned in the weeks ahead, while the continued Fed restrictive stance keeps carrying the risk of something new breaking somewhere else. I‘m not vocally calling for a credit event, but for a sufficiently bearish catalyst slash risk in the nearest say 2 months before either the Fed starts doing market‘s bidding, or the other way round.

S&P 500 and Nasdaq outlook

4,115 followed by 4,078 (no, 4,039 is a bridge too far) would be the support levels to start the week, but probably only the first one can be realistically reached. The short-term outlook though remains undeniably bullish as I were writing since early Wednesday. 4,175 – 4,185 is the buyers‘ objective for the nearest days / few short weeks, because chop will start appearing as the air is thinning up there.

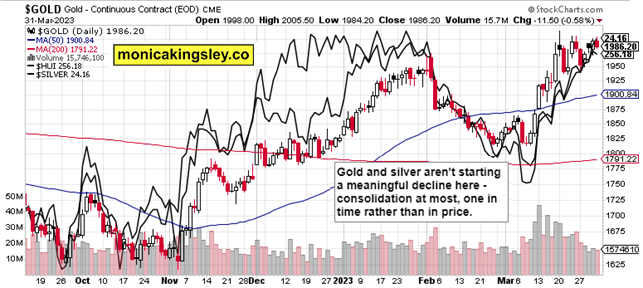

Gold, Silver and Miners

Still a clear winner, all roads are leading to precious metals. Even that daily decline on retreating inflation wasn‘t that bad as yields made up for that. And when the dollar starts weakening later this year (hello, debt ceiling Q3 2023), that will be one more engine firing.

Crude Oil

The awaited crude oil upswing is here, $73 didn‘t come into jeopardy, and once oil cuts into $79, the going gets easier. After $82.50, the bullish turn would be undeniable also on weekly chart (not that it would be looking bad already now).

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.